The London Stock Exchange has been struggling since the start of February 2020 to date due to the novel coronavirus. Fears of recession are looming as several nations have come under massive economic crunch. However, investing in physical gold or gold stocks has always been attractive to investors in times of crisis. There are many advantages to invest in gold stocks such as quick gains if these mining stocks do well and opportunity for faster return. When investors spend in gold stock, that person is not purchasing a position in the gold coins or physical gold or gold bullion. Physical gold is healthier suitable for extended and protected investments. In other words, you are capitalizing in stocks and participating in specific businesses. Gold stocks have a propensity on the gold price to be leveraged, which means that when gold is stirring higher and they can produce the best profit. However, in Britain, there are numerous gold stocks quoted on the LSE. The three most prominent players in mining sector listed on the London Stock Exchange which trade under FTSE 100 index are Polymetal International Plc, Petropavlovsk Plc and Fresnillo Plc. Other UK’s gold stocks with relatively smaller capitalisation include SolGold, an Australian copper and gold excavating company, Pan African Resources, a mid-tier Africa-concentrated manufacturer, Greatland Gold, which is concentrated on gold excavating in Australia, and Chaarat Gold Holdings, which functions in the Kyrgyz Republic.

Let’s talk about the performance of Polymetal International Plc, Petropavlovsk Plc and Fresnillo Plc in the last one year.

Overview of Polymetal International Plc

Polymetal International Plc (LON:POLY) is one of the prominent international gold manufacturer and global silver manufacturer. The company has its assets in Kazakhstan and Russia, and is quoted on Astana International Exchange, Moscow Stock Exchange, London Stock Exchange.

(Source: Thomson Reuters)

As on 8 June 2020, POLY shares are trading at GBX 1,408, down 0.50 per cent as at 12:28 PM GMT, as compared to previous day closed price. Last year, at around the same time on June 10, the stock price of the company was trading at GBX 870.80. The above graph shows that stock price is continuously increasing with share volume in a positive way. However, the company faced some headwinds during the lockdown period in the recent past months in 2020.

At the time of writing, the company’s market capitalization reported to be at GBP 6.64 billion and P/E ratio has been reported to be at (TTM) 17.64. The Average Dividend Yield and Annual Dividend of the company reported to be at 3.54 per cent and GBX 50.15.

Overview of Fresnillo Plc

Fresnillo (LON:FRES) is one of the prominent valuable metals group, which is situated in Mexico. The company’s pit has been in process for over five hundred years. Its employee proficiency and plan for development is stated to support the company’s success for years to come.

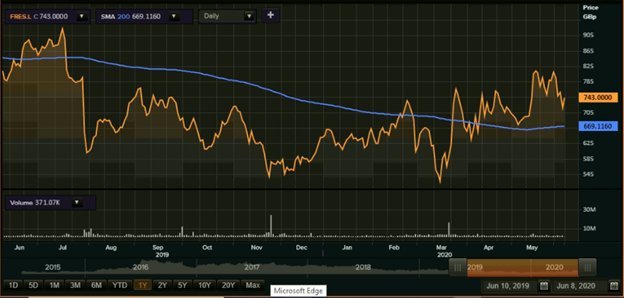

(Source: Thomson Reuters)

On 10th June 2019, the stock price of the company was trading at GBX 789.80 which have now decreased to GBX 743.0 points on 8 June 2020. The above graph shows that stock price has experienced many up and downs during the one year. It happened because the stock price of the company faced some headwind during the lockdown period following some downfalls recorded in July and November 2019.

As on 08th June 2020, at around 10:21 AM GMT, the stock price of the company increased by 3.60 per cent as compared to previous day closed price. The company current stock price is 19.32 per cent below of its one-year high price i.e. 921.20, set on 16th July 2020. As on 08th June 2020, the company’s Market Capitalization reported to be at GBP 5.26 billion and P/E ratio has been reported to be at (TTM) 32.64. The Average Dividend Yield and Annual Dividend of the company reported to be at 1.64 per cent and GBX 11.74.

Overview of Petropavlovsk Plc

Petropavlovsk Plc (LON:POG) is one of the leading primary gold mining businesses, with regards to reserves & resources and production in Russia. The company concentrates on generating value for its investors, staffs and other participants by securely and correctly discovering, mining and producing at a steady production of low-cost gold.

(Source: Thomson Reuters)

On 10th June 2019, the stock price of the company was trading at GBX 8.16 which have now increased to GBX 24.55 as on 8 June 2020, which shows around 300 per cent upsurge in the last one year. The share price of the company has been increasing since November 2019 with a slight headwind in March 2020 due to lockdown in the United Kingdom. From January 2019 to November 2019, the share price of the company was quite similar without many upsurges in the price.

As on 08th June 2020, at around 11:34 AM GMT, the stock price of the company increased by 1.66 per cent as compared to previous day closed price. The company current stock price is 15.64 per cent below of its one-year high price i.e. 29.10, set on 18th May 2020. As on 08th June 2020, the company’s market capitalization reported to be at GBP 795.06 million.

_(1).jpg)

_05_16_2023_17_11_27_393572.jpg)