Source: kamui29, Shutterstock

Summary

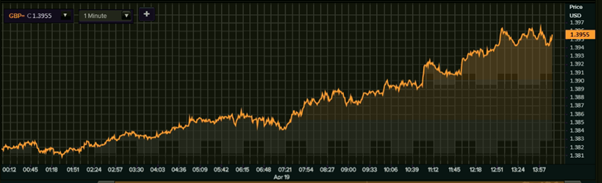

- GBP strengthened sharply against the USD and the euro in late afternoon deals

- The GBP vs USD pair touched a high of 1.3969, up 1 per cent from the previous close

- BoE had fixed a reference exchange rate of 1.3817 USD on 16 April

The Great Britain pound (GBP) strengthened sharply against the United States dollar (USD) and the euro in the late afternoon deals on Monday, 19 April, after the US dollar index witnessed meaningful correction. With the recent appreciation in the pound’s value against the greenback, the GBP has inched the gap from the crucial mark of 1.40.

According to the latest foreign exchange data available, the GBP to USD pair was trading at 1.3956, up 0.91 per cent from the previous close of 1.3830. During the session today, the currency pair touched a high and low of 1.3969, up 1 per cent from the previous closing, and 1.3810, respectively, at the interbank foreign exchange market.

GBP vs USD chart (19 April)

(Source: Refinitiv, Thomson Reuters)

The domestic forex traders are keenly awaiting to rejig their respective trade set-ups according to the upcoming macroeconomic releases. The Office for National Statistics (ONS) is scheduled to release the unemployment rate, Claimant Count change, CPI-based inflation rate in the present week.

Meanwhile, the GBP’s extent of appreciation with regard to the euro remained slightly lower. The GBP to EUR pair was trading at 1.1604, up 0.54 per cent from the previous mark of 1.1542. In the intraday deals so far, the currency pair hovered between a high and low of 1.1615 and 1.1531, respectively.

The Bank of England had fixed a reference exchange rate of 1.3817 USD and 1.1534 EUR against a unit of pound sterling on 16 April. The Andrew Bailey-led nine-member Monetary Policy Committee will be meeting again in the first week of May and is slated to announce the policy action on 6 May.

.jpg)