Highlights

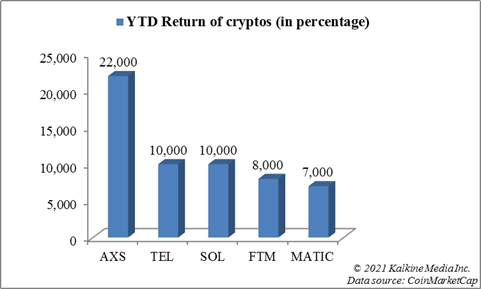

- Five billion-dollar market cap cryptocurrencies have a whopping YTD return of over 7,000 per cent

- Token of a blockchain game has skyrocketed by 22000 per cent YTD

- One crypto, which ranks among top ten cryptos by market cap, has an eye-popping YTD return 10,000 per cent

Is it even possible to make hundreds of dollars in less than a year with just one-dollar investment?

What was virtually always unlikely is becoming likely, thanks to the strange world of crypto investment. No, it is not just Bitcoin that remains a preferred investment choice of crypto enthusiasts. Investors have understood that different crypto assets come with distinct features. This distinction can even make them more profitable than their popular counterparts like Bitcoin or Ether.

The last quarter of calendar year has begun. This may be the best time to take note of what happened in all previous quarters in the crypto world. It can be the guiding light for year-end investment decisions.

Today, let’s find out the top five billion-dollar market cap crypto assets that have returned over a thousand per cent since the beginning of 2021.

1. Axie Infinity (AXS)

Tech enthusiasts usually love gaming. So when blockchain admirers found its use in the gaming industry, the impact was phenomenal. Axie Infinity is a blockchain-powered game. Like other decentralized things, it is also owned and operated by players, and not by any central authority.

Forget about Pokémon, this blockchain game allows users to breed and collect creatures with crypto tokens underpinning them. These creatures, also called Axies, have distinct features and a non-fungible token (NFT) linked to each.

AXS acts as the governance token of Axie Infinity. It can be used by gamers to take collective decisions on any changes within the platform. Decisions are put to vote and AXS holders have a say.

The Axie craze has been unbelievable. The AXS token was trading at under-1 dollar at the beginning of the year. At the time of writing, it was trading at nearly US$123. By this count, the year-to-date (YTD) return of AXS is over 22,000 per cent.

The market cap of AXS at the time of writing was US$7.5 billion.

Also read: What are DeFi games & which are the most popular DeFi games?

2. Telcoin (TEL)

Telcoin is a blockchain-based financial services provider. It competes with traditional banks by providing mobile users access to fast and cheaper transaction services.

Telcoin joins forces with telecom players to give more powers in the hands of users. The platform makes transactions automated by weeding out the role of intermediaries or any centralized authority. It is said to be regulated in Singapore by the Monetary Authority of Singapore (MAS). It also claims to fall under the purview of regulators in Canada.

TEL is an Ethereum-based ERC-20 token. It was trading at US$0.018 at the time of writing. It started the year with a price tag of nearly US$0.00017. The YTD return is over 10,000 per cent.

The market cap of TEL is over US$1 billion.

Also read: 10 little known cryptocurrencies investors must explore

3. Solana (SOL)

Solana is a relatively new entrant in the field of decentralized finance (DeFi) that is dominated by Ether.

Solana’s blockchain can be used to create decentralized apps or DApps. The platform combines the proof-of-stake consensus with its proof-of-history protocol. The latter consensus protocol makes its scalability easier. Solana’s attraction lies in lesser time for validation of transactions. Fees and other costs are also on the lower side.

At the time of writing, SOL was trading at nearly US$156. SOL started the first day of 2021 with a price tag of nearly US$1.5. The YTD return of this altcoin is more than 10,000 per cent.

The market cap of SOL at the time of writing was a whopping US$46.4 billion. It ranks among top ten crypto assets by market cap in the list compiled by CoinMarketCap.

4. Fantom (FTM)

Fantom has a unique consensus algorithm for execution of smart contracts on blockchain. This bespoke consensus protocol reduces the time for effecting a transaction. Fantom claims to have brought the time for execution to two seconds. It also claims to have superiority over the proof-of-stake consensus.

Fantom remains a competitor to Ethereum’s blockchain. Both allow users to build DApps. FTM remains the native crypto token of Fantom’s blockchain. Fantom also claims that its team has presence across the world, which matches with the idea of decentralization that underpins the entire crypto industry.

At the time of writing, FTM was trading at nearly US$1.38 apiece. FTM started the year with a price tag of nearly US$0.017. The YTD return of FTM is over 8,000 per cent.

The market cap of FTM is nearly US$3.5 billion. It ranks among top 50 cryptos by market cap.

Also read: Top 5 cryptocurrencies available for under $1

5. Polygon (MATIC)

Polygon takes Ethereum network a notch up in the multi-chain platform category. Several other multi-chains like Polkadot and Avalanche have emerged as Ethereum’s competitor. Polygon claims to infuse attributes in the Ethereum’s blockchain without compromising on security and transparency.

Polygon uses ‘Plasma’ framework, which enhances scalability of the platform. This framework works in tandem with proof-of-stake consensus algorithm. Polygon claims to achieve up to 65,000 transactions in a matter of just one second.

MATIC is an ERC-20 and the native token of Polygon. It can be used to pay fees on the platform. At the time of writing, MATIC was trading at nearly US$1.26. It was trading at nearly US$0.018 on January 1, 2021. The YTD return is approx. 7,000 per cent.

MATIC’s market cap is nearly US$8.4 billion.

Also read: Adventure Gold (AGLD) rises on Binance listing: Know price prediction

Bottom line

Cryptocurrencies like Bitcoin and Dogecoin grab a lion’s share of news headlines. Nevertheless, the five crypto assets with best YTD returns listed above did not fail to create wealth for backers who invested at the most opportune time. The five cryptos also have very high market cap running in billions of dollars. Now that Bitcoin has reclaimed the US$50,000-mark after some hiccups due to regulatory crackdown, the entire crypto world likely presents an opportunity to investors.