The answer to the above question is simple- itâs the reporting season. The ASX-listed companies are gearing up to release their respective earnings report, as the market experts and investors await the performances and future momentums that companies would undertake. Quite a lot of investing decisions occur, based on the recent updates provided by the companies.

Adhering to this trend, we have picked the two stocks from the fascinating Metals and Mining sector of the Australian trade market, which have recent updates that might be of interest in this season of stock indulgence.

Before diving into the stocks, let us get a gist of the Australian metals and mining sector:

Metals and Mining in Australia:

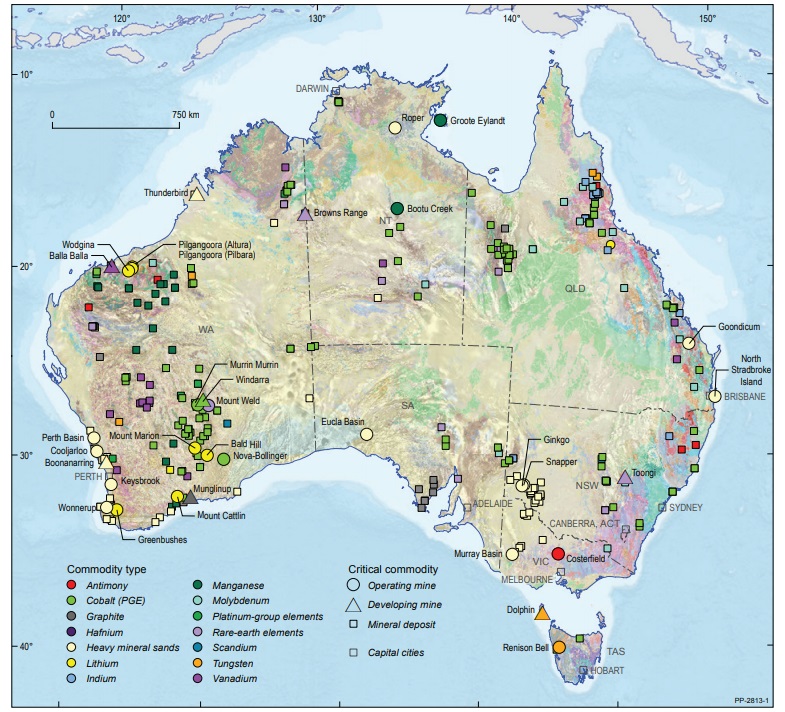

Known as âThe Lucky Countryâ for all the right reasons, Australia has privileged wealth as its soil is home to a hoard of raw materials. The Australian mining industry is amongst the countryâs most well-established sectors, with its history dating back to the gold rushes of the 1850âs. A major contributor to the Aussie GDP (~7 per cent), Australia is the fourth largest mining country in the world, after China, the US and Russia). Mining is export-oriented in the country. Australia features amid the top 5 international producers of minerals like lead, zinc gold, iron ore and nickel and possesses the largest uranium and the fourth largest black coal resources worldwide, respectively. The country is home to some of the worldâs largest and most ambitious mining projects.

Optimistic Outlook of Metals and Mining:

Besides being an attractive destination for investors, Australia has world-leading expertise in resource extraction and processing, high-tech engineering and renewables research. The Global demand for Australian resources has increased in the recent years and includes minerals which are used in a range of emerging high-tech applications across a variety of sectors like renewable energy, aerospace, defence, automotive (given the EV Revolution), telecommunications and agri-tech. In 2018-19, the resource and energy commodity exports are anticipated to generate over $264 billion, which would be more than two thirds of the goods exports.

By 2019â20, Australia could account for around 80 per cent of the global lithium supply from hard rock deposits. There is an anticipation of a zooming 68 per cent increment in the cobalt consumption of the world forecast between 2015 and 2025. In 2017, Australia produced ~4,970 tonnes, which was the worldâs second largest economic demonstrated resource of cobalt.

Major Critical Mineral Operating and Developing Mines in Australia (Source: Government Report)

Given this profound and promising backdrop of the Metals and Minerals Space of Australia, let us look at the two stocks- POS and ESR:

Poseidon Nickel Limited (ASX: POS)

Company Profile: A nickel sulphide development and exploration company, POS has 3 operational projects in Western Australia. The companyâs strategy is on the recommencement and exploration of its established nickel operations, with acquisition as a critical element of this strategy. POS owns the Windarra Nickel Project, the Black Swan Nickel Operations and the Lake Johnston Nickel Operations.

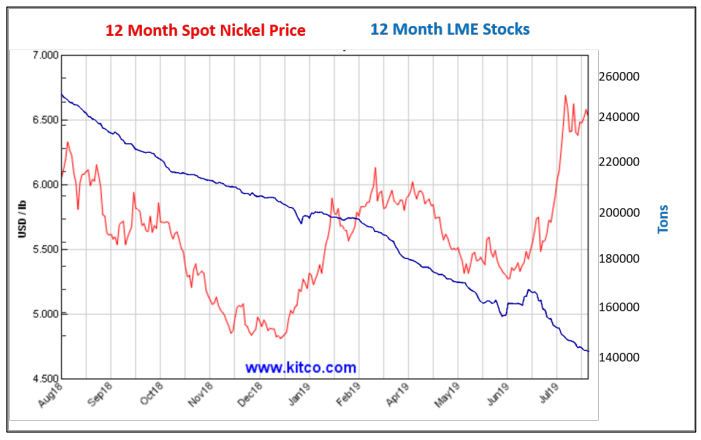

Diggers and Dealers Site Tours Presentation: On 5 August 2019, POS conducted a Site Tours Presentation, stating that the Black Swan Operations were ready to restart in less than 9 months at nearly 8,000t nickel p.a. The nickel price environment was supportive in the EV soared demand era, with stocks at five year lows and market into deficit, with the nickel price up by 34 per cent on a YTD basis.

At the Lake Johnston, New discovery was made at Abi Rose and significant exploration upside. At the Windarra Project, Cerebrus deposit of 69,000t Ni with mine plan was found, with exploration being upside.

Nickel Prices (Source: POSâs Report)

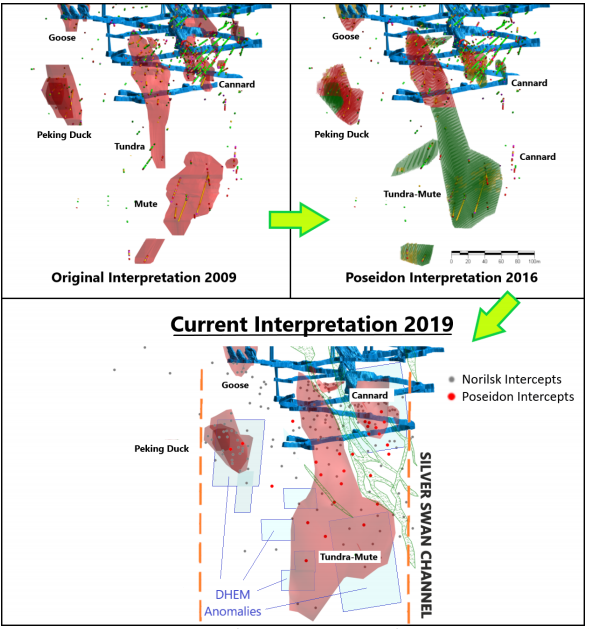

Silver Swan Resource Upgrade and RC Drilling: On 5 August 2019, POS released an update on the Silver Swan Restart Resource, indicating 10,130 tonnes of nickel metal at a grade of 9.4 per cent Ni. The indicated and inferred Resource increases was up by 30 per cent, to 16,030 tonnes of nickel metal at a grade of 9.5 per cent Ni. Besides this, the underground RC drilling had begun, after awarding a 2,500m trial Underground RC drilling program to MDU, below the Black Swan Open Pit to assess potential underground resource.

The progressive development of the Silver Swan resource (Source: POSâs Report)

Stock Performance on ASX: After the end of the trading hours, on 5 August 2019, POSâ stock was valued at A$0.040, down by 4.762 per cent relative to its last close. With a market capitalisation of A$110.99 million, the stock had 2.64 billion outstanding shares. In the last six months, POSâ stock has generated a return of 7.69 per cent and the YTD return stands at -2.33 per cent.

Estrella Resources Limited (ASX: ESR)

Company Profile: A metals exploration company based in Perth, ESR holds Lithium exploration and mining rights agreements with Apollo Phoenix Resources. Its prime project is the Mt Edwards Lithium Project. The company was listed on the ASX in 2012.

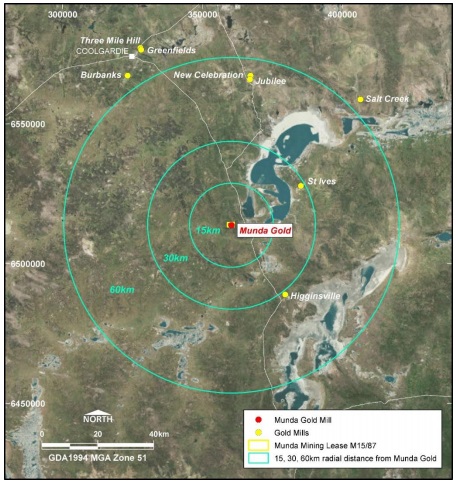

Update on the Munda Gold Project: On 5 August 2019, ESR pleasingly notified that the diamond core drilling had been concluded at its 100 per cent owned Munda Gold Project at Widgiemooltha, by the Topdrive Drilling Australia. Two holes totalling 321.2m of HQ3 diamond core drilling were conducted to the north of the gold mine and the Drilling intersected potential gold bearing quartz veins, within the upper weathered supergene zone. Nickel sulphides were intersected in the fresh rock on the basal contact of the host ultramafic.

Matrix and semi-massive nickel sulphides intersected in EMD002 from 99.0m-101.0m (Source: ESRâs Report)

The Munda Gold Project is located within the nickel rich Widgiemooltha region and south of the historical Mt Edwards underground nickel mine, on the basal contact of an ultramafic unit which has a history of returning high-grade nickel intersections. ESR would update shareholders with the results being presently scrutinised post completion, which are delayed due to the current upswing in the mining sector.

Location of Munda Project and other major gold project (Source: ESRâs Report)

Quarterly Report for June 2019: On 31 July 2019, ESR released its quarterly activities report for the quarter ending 30 June 2019, stating that the Carr Boyd Layered Complex and the Munda Gold Project were the limelight of the period. At both the prospects, ESR was granted a POW approval and drill testing of the T5 EM target was completed at Carr Boyd. At the Munda prospect, diamond drilling commenced at the Mineral Resource with results expected in the September 2019 quarter. Besides this, Metallurgical test work continued on nickel sulphide material from the 5A drilling program which was completed in the December 2018 Quarter.

The below table provides the cash flow statement highlights of ESR, for the quarter ending 30 June 2019:

| Particulars | Amount (A$â000) |

| Net cash used in operating activities | 212 |

| Net cash used in financing activities | 13 |

| Cash and cash equivalents at end of period | 279 |

| Estimated cash outflows for next quarter | 255 |

Stock Performance on ASX: After the closure of the trading hours, on 5 August 2019, ESRâs stock was valued at A$0.010, up by 11.111 per cent relative to its last close. With a market capitalisation of A$4.77 million, the company had ~530.38 million outstanding shares. In the last six months, POSâ stock has generated a return of -43.75 per cent and the YTD return stands at -35.71 per cent.

Globally, political tensions have been impacting the commodity market, with a cause of concern throughout 2018 and 2019. Given that metals and mining is regarded as the industry sector with the best prospects in Australia, it would be interesting to await the unveiling of events and trade in this promising space.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.