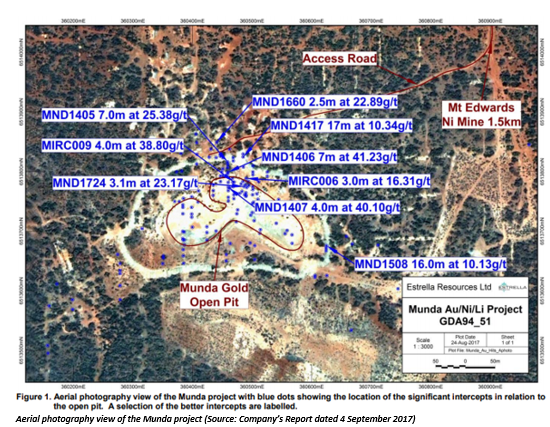

Estrella Resources Limited (ASX:ESR) is a company from the metals and mining sector, based in Perth, Australia. On 14 May 2019, ESR announced that it has received Programme of Work (POW) approvals for the drilling of high-grade gold structures at Munda Gold Mine.

ESR initially reported the acquisition of Munda Gold and Spargoville Nickel Projects back in September 2017. In February 2019, ESR had notified that a review was underway to re-activate Munda Gold Mine, to maximise the opportunity the company had for Munda Gold Asset, considering the strength in the A$ gold price. Also, in 1999, Munda, a pre-existing open-pit gold mine was operated by Resolute Gold Mines.

Previous high-grade gold results from the Munda project are as follows:

- MIRC004 1m at 321g/t Au from 51m.

- MND1406 7m at 41.23g/t Au from 53m including 1.0m at 195 g/t Au from 58m.

- MND1407 4m at 40.10g/t Au from 70m.

- MND1508 16m at 10.13g/t Au from 98m.

- MND1724 3.1m at 23.17 g/t Au from 94.1m.

- MND1405 7m at 25.38g/t Au from 76m including 2m at 82.5g/t Au from 76m.

Project Update & Road Ahead

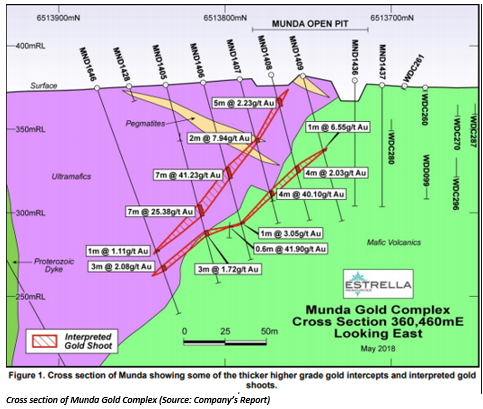

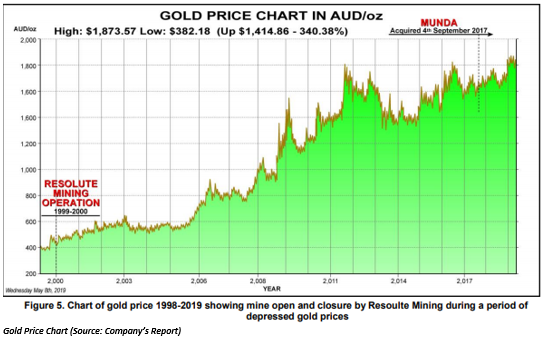

ESR has received Programme of Work (POW) approvals to initiate the drilling of high-grade gold structures in the mine. A dramatic fall in gold prices in 1999/2000 led to premature closure of the mine resulting in inaccessibility to the bulk of the gold resources. Resolute had then planned to recover gold from a depth of 60 metres below the surface. However, fall in gold prices saw the mine only reach a depth of 15 metres below the surface.

Munda project is in the proximity of several gold toll milling facilities within the distance of Munda Projectâs economic trucking. In April 2019, a letter of Intent containing Alliance with Blue Cap Mining Pty Ltd (BCM) was released by the company. BCM has reviewed the Munda Project and recommended that it was worth pursuing due to the reasons as follows:

- Its proximity to gold ore processing solutions and infrastructure.

- Gold ore grade is enough to lower project sensitivities.

- Drilling has the potential to increase ore reserves.

- Identified high-grade ore near surface capable of generating early revenue.

- Munda sits within a granted mining lease with previous mining history.

The alliance will benefit from the distinctive resources of both entities. It will also help bring the Munda Gold Mine towards production. BCM would utilise its existing working capital facility and open pit services to fund the opening phase of a mining operation at Munda. The drilling contracts are currently being negotiated, and ESR plans to test new âplunging shootâ structural interpretation to the high-grade gold mineralisation.

The existing JORC2012 Mineral Resource of 511,000t @ 2.82g/t Au for 46,337 ounces Au will be updated once drilling information is available.

Gold Market

ESR reported the trend of gold markets and concluded with an interesting opportunity to revive the Munda Gold Mine. As per the chart above, reflecting the price of gold for the period between 1998-2019 depicts its upside movement of 340.38%.

The company also mentioned that planning was underway to begin site preparations and diamond drilling campaign.

Also, on 9 May 2019, ESR had notified about obtaining DMIRSâ approval for drilling work at Target 5 EM anomaly.

The stock of the company closed flat, by the end of the trading session, at a price of A$0.013 (as on 14 May 2019). The 52-week high and low are A$0.033 and A$ 0.012 respectively with circa 530.38 million shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.