Summary

- Cleanaway Waste Management announced an increase of 8.7 per cent in FY20 underlying NPAT. It incurred acquisition and integration related expenses, principally concerning the acquisitions of Toxfree and the SKM recycling business.

- CWY declared a final dividend of 2.1cps, taking the total dividend to 4.1cps, up by 15.5 per cent.

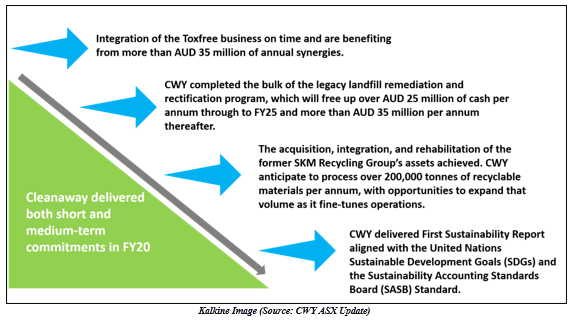

- Delivering both short and medium-term commitments in FY20, Cleanaway reached the halfway mark in the Footprint 2025 journey and created solid foundations for the future growth of the business.

Great Virus Crisis (GVC) has been pretty hard on several businesses; however, some companies responded by adapting their lives and work practices to continue catering to their customer base.

With this backdrop, we will discuss Cleanaway Waste Management Limited (ASX:CWY), which posted impressive FY20 results. CWY strengthened its position as the country's leading integrated waste management business during the year. The company continued providing safe, reliable and efficient services to its customers despite the disruption led by pandemic.

Good Read: Less Water, More Resources: A Guide Through Australia’s Waste Policy

In its financial results update for FY20 on 26 August 2020, the company highlighted that it remained the market leader in every sector in which CWY operates while its network of prized waste infrastructure assets continues to grow across the country.

Chief Executive Officer and Managing Director, Vik Bansal, stated that FY20 performance reflects the defensive characteristics of revenue streams. Despite the COVID-19 impact, all segments - Solid Waste Services, Industrial & Waste Services, and Liquid Waste & Health Services - performed well in FY20.

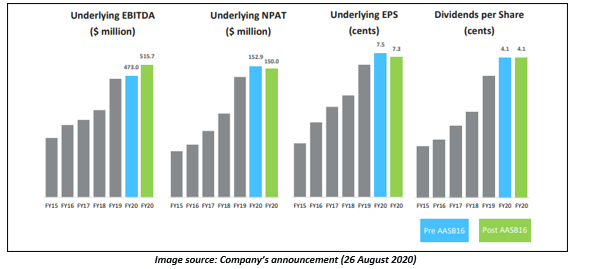

Key financial highlights for the year ended 30 June 2020 as compared to the previous year included

- Revenue from ordinary activities increased by 2.1 per cent to AUD 2,332.1 million

- Underlying net profit after tax (NPAT) grew by 8.7 per cent to AUD 152.9 million.

- Statutory NPAT stood at AUD 112.6 million, down by 6.6 per cent, including underlying adjustments totalling AUD 37.4 million after-tax mostly comprising acquisitions and integration costs and net costs associated with the Perth Material Recycling Facility fire.

- Underlying EBIT was AUD 251.9 million, representing an increase of 4.6 per cent with 60 bps margin expansion to record 12.0 per cent

- Underlying EBITDA stood at AUD 473.0 million, up by 2.5 per cent with 60 bps margin expansion to record 22.5 per cent

- Free Cash Flow was AUD 230.1 million, grew by 11.5 per cent

Operating cash flows increased by 14.5 per cent to AUD 401.5 million. At 30 June 2020, the Group had AUD 421 million of headroom under existing banking facilities and cash on hand was AUD 79.8 million

Dividend Report

CWY declared a final dividend of 2.1 cents per share (cps), compared with 1.9cps in the same period a year ago, bringing the total dividend for the year to 4.1cps, up from 3.55cps in FY19.

The final dividend will be fully franked dividend and is scheduled to be paid on 6 October 2020 to shareholders on the register as at 14 September 2020. The Dividend Reinvestment Plan (DRP) will be in operation for this dividend. Shareholders living in Australia or New Zealand may elect to participate in the DRP, which has an election date of 15 September 2020.

As per the DRP, CWY shares will be issued at average of the daily volume weighted average price of all shares sold on ASX from 16 to 22 September 2020.

Do Read: Recycling market: Cleanaway Waste Management

Way Forward

Cleanaway Waste Management intends to pursue several critical projects in the future that are strategically significant for its business, according to Mr Bansal.

The proposed energy-from-waste facility in Western Sydney gives a more environmentally friendly solution to the growing waste disposal requirements in Sydney. In a joint venture with Pact Group Holdings Ltd and Asahi Beverages, Cleanaway has announced a plastic pelletising plant in Albury, New South Wales. The company plans to use the facility to process plastics that it recovers via collections network into an excellent closed-loop recycling solution.

Footprint 2025 Progress

Cleanaway reached the halfway mark in the Footprint 2025 journey and has built solid foundations for the future growth of the business.

Main highlights included:

- Completion of integration of Toxfree and SKM businesses

- Committed to proceeding with a PET Plastic Pelletising facility

- Advancing Energy-from-Waste project in Sydney, with EIS submitted

FY21 Outlook

Due to variable trading conditions amid the COVID-19 pandemic, Cleanaway has not provided any guidance for the year. The trading conditions so far have been mixed across the country with more pronounced impact seen in the Victoria state. CWY witnessed some recovery in June over April and May while July enterprise performance has been in line with the FY20 average monthly performance.

The company is scheduled to hold its annual general meeting on 14 October 2020.

Stock Performance: On 27 August 2020 (AEST: 01:09 PM), CWY stock was trading at AUD 2.500, up by 2.881 per cent. The company has a market capitalisation of AUD 4.99 billion and its stock has delivered a return of more than 21 per cent in the last three months. It has an annual dividend yield of 1.69 per cent.

Must Read: Three Unique Investment Tips to Build Recession-Proof Portfolio in COVID-19 Crisis