Highlights

- Invictus Energy (ASX:IVZ) has completed an AU$25 million placement to finance the drilling of Mukuyu-1 and Baobab-1 wells.

- The drilling at Mukuyu-1 and Baobab-1 is anticipated to complete in 45 – 60 days and four weeks, respectively.

- IVZ’s subsidiary has also received approval for an assignment agreement for exploration rights to EPOs 1848 & 1849 for Gazette.

Invictus Energy Limited (ASX:IVZ) has declared a significant capital raising plan. The company has decided to solely finance the preliminary drilling campaign in Zimbabwe’s Cabora Bassa Basin. Through the high-impact drilling campaign, the company intends to target the Mukuyu and Baobab prospects.

IVZ’s decision to solely finance the drilling came after the assessment of a variety of options, including farm-in bids from several interested parties.

However, IVZ remains open to upcoming strategic partnering opportunities as the company advances the development of the Cabora Bassa project.

Invictus raises AU$25.0 million

IVZ has secured firm commitments to raise AU$25 million through private placement to sophisticated and institutional investors. As part of the placement the company will issue 108,695,652 new fully paid ordinary shares at a price of AU$0.23 per share.

The participants in the placement will be allowed a one-for-one unlisted option for each share issued, exercisable at AU$0.40 with a five-year term.

IVZ received a strong response for the placement, and it was highly oversubscribed, with several new and present institutional investors located across countries entering the share register ahead of the drilling campaign.

Source: IVZ Announcement

The company believes that the attaching options issued through the transaction will offer further meaningful capital to IVZ’s balance sheet at a significantly higher valuation as compared to the placement, subject to the successful drilling program.

Usage of funds

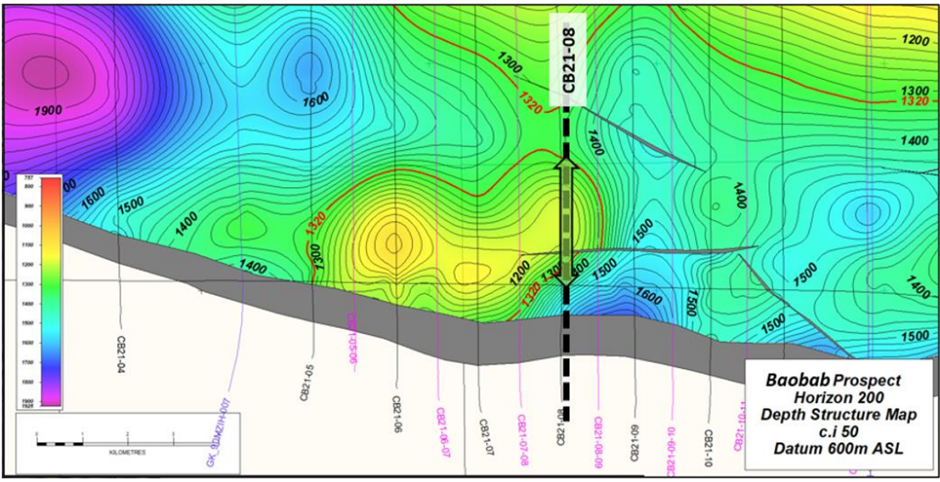

The funds raised under the placement will be deployed to finance the drilling program for the Mukuyu-1 well, wherein Central Fairway play will be tested, and Baobab-1, wherein the Basin Margin play will be tested. The company expects to make the following expenditure from the overall proceeds:

- AU$10.0 million for Mukuyu-1 Well

- AU$13.5 million for Baobab-1 Well

- AU$1.5 million in costs of the offer

Civil works at the Baobab-1 wellsite are underway to ensure drilling can follow immediately subsequent to completing Mukuyu-1. The drilling at Baobab-1 is expected to continue for around four weeks after completing the mobilisation of Exalo Rig 202 to the well site.

Baobab Prospect shown at 200 Horizon (Source: IVZ Announcement)

IVZ is currently preparing an Independent Prospective Resource estimate for the Basin Margin prospects which will be released once finalised.

Moreover, the company looks to deliver a summary of the enhanced acreage prospectivity, Basin Margin play, and the Mukuyu-1 and Baobab-1 exploration wells via a shareholder briefing to be held in due course.

Image: © 2022 Kalkine Media®

Approval received for gazette

Geo Associates (Pvt) Ltd, IVZ’s 80% owned subsidiary, has received approval from the Mining Affairs Board for the assignment agreement for the exploration rights to Exclusive Prospecting Orders (EPOs) 1848 and 1849 from the Sovereign Wealth Fund of Zimbabwe. IVZ now looks to proceed with the assignment agreement for gazette.

IVZ stock was noted at AU$0.310 on 31 August 2022.