Highlights

- Wooboard Technologies has put forth its report for the September quarter of FY23 with all major developments

- During Q1 FY23, Wooboard continued to advance the trials and roll-out of new features of its Sixty platform

- Wooboard and Slik signed a reseller and licence agreement during the quarter, allowing integration and cross-selling of both companies’ product suites

Wooboard Technologies Limited (ASX:WOO), an employee engagement and well-being platform developer, has released its quarterly report for the three months ended 30 September 2022. It has brought forth all the important financial and operational updates from the first quarter of the ongoing fiscal year 2023 (Q1 FY23).

Significant developments during September quarter

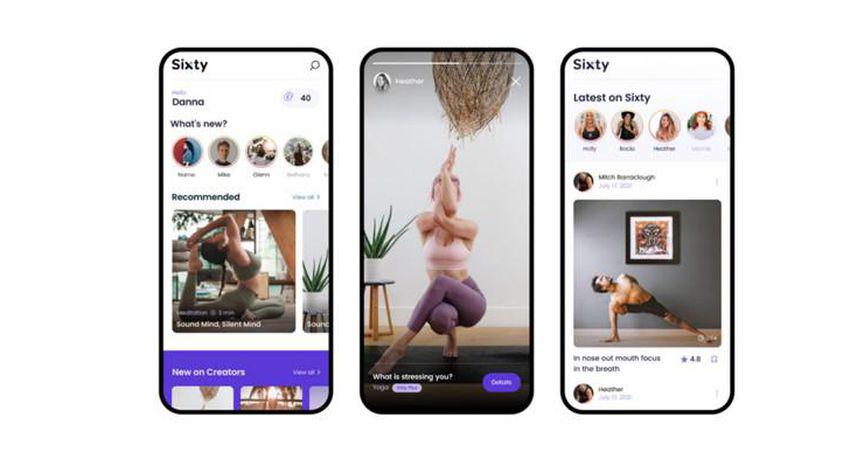

During the quarter, the company concluded the initial trials of its in-house developed health and wellness-related Sixty platform, which brought valuable feedback. This feedback included video content from well-being content creators from South America.

Wooboard has also moved forward creating multiple novel designs and features, such as a payment gateway, a manager’s dashboard for the business market segment, and live streaming.

The company is planning to roll out new features to diverse departments soon. In the next round of trials, it will engage more employees. With recent advancements in development work, Wooboard believes it is well-positioned to begin the trials of the Sixty product suite with more firms in November 2022.

Key enhancements made to the Sixty platform

- The initial beta trial plus compilation and the analysis of trial feedback have been completed.

- A metrics dashboard for managers has been created.

- Spanish content from well-being creators in South America has been incorporated.

- The Live stream feature has been added.

- Content creator dashboards have been further improved to offer significant analytical insights.

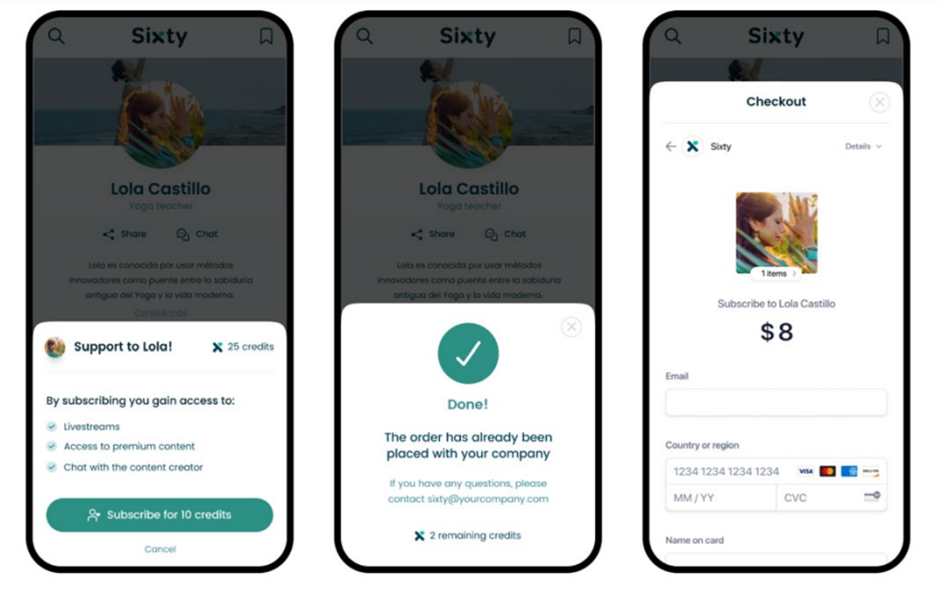

- Stripe payment integration has also been concluded, letting users access premium pay-per-view content.

- Updated UI/UX designs have been included to increase engagement and enhance upcoming increased trials.

Visual demonstration of recent upgrades and enhancements made to the Sixty platform

Dashboard for content providers (Image Source: Company Announcement)

Stripe Payment Method (Image Source: Company Announcement)

Live Streaming using Vimeo (Image Source: Company Announcement)

Slik licence agreement executed

Wooboard and Slik Pro Corp signed a five-year-long reseller and licence agreement during the quarter. The deal will allow the integration and cross-selling of both companies’ product suites.

As per the agreement, Wooboard needs to give Slik a royalty of 50% of the net profit (ex GST) derived from the sale of the Slik Pro platform. Wooboard has paid the first of the three tranches of US$266,666.67 per tranche from its existing cash reserves of the September quarter.

Also, if the Licence Conditions Precedent is fulfilled two months prior to the end of the five-year agreement, it will be renewed automatically for an additional 30 years.

To know about Wooboard Technologies’ reseller agreement with Slik Pro Corp, click here.

Image Source: ©2022 Kalkine Media®

Image Source: ©2022 Kalkine Media®

WOO’s outlook for the road forward…

The company plans to achieve increased product sales by leveraging the new features. WOO believes that this Slik-created module with advanced features will help the firm to exploit its Asia-Pacific rights.

WOO is looking forward to enhancing its ability to deliver increased brand recognition and lead generation over the coming quarters. This is being taken care of through its series of "People Experience Talks" programs, which help participating prospective clients understand how to design a captivating organisational experience. Also, eBooks have been published on Slik’s YouTube and Spotify channels leading to increased traction. Also, during Q2 FY23, Slik may launch an "International People Experience Certification" to strengthen its inbound strategy.

The company is putting in continued efforts to develop Sixty and introduce progressive initiatives to leverage a strong commercial relationship with Slik.

WOO’s shares last traded at AU$0.001 with market capitalisation of AU$4.39 million.