Highlights

- Reabold invests in underdeveloped oil and gas assets and intends to monetise them in the near term.

- The company’s monetisation strategy entails progressing them to production and selling the assets or stake in those assets.

- The current oil and gas market trend bodes well for the company’s asset value.

LSE-listed oil and gas exploration and production investment company Reabold Resources PLC (LON: RBD) is committed to monetising undercapitalised oil and gas assets.

Thanks to the Russia-Ukraine war, the demand for undeveloped oil and gas assets has heated up significantly. There are plans in motion to decrease Europe’s reliance on Russian gas, which is most likely to keep the oil and gas prices firm, as per many research reports.

The Russian invasion of Ukraine has dramatically impacted commodity markets, escalating prices which were already at high levels. High levels of unpredictability and volatility define the oil and gas market, and these characteristics are expected to persist.

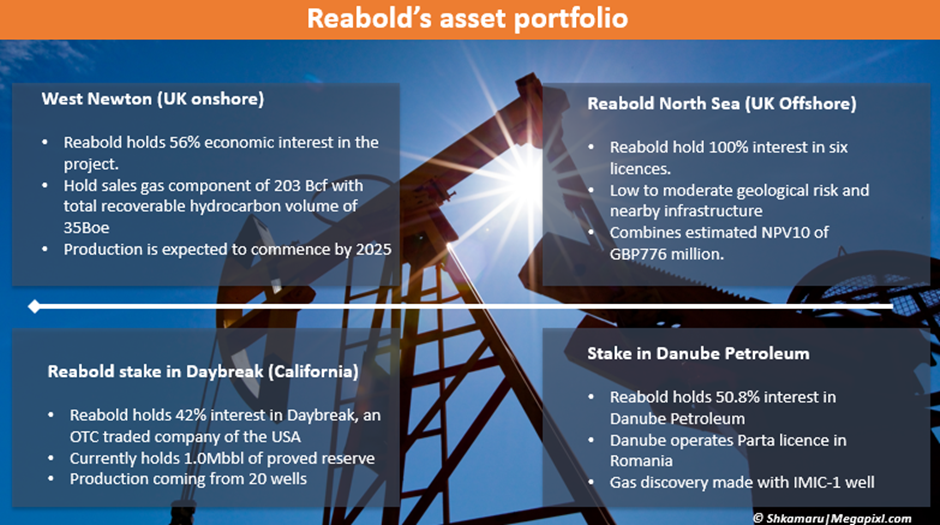

The European sources of energy supply are likely to become more significant given the continent is striving to cut down its dependence on Russia. Against this backdrop, it becomes important to look at the projects like Reabold's UK onshore West Newton project, which has the potential to play a significant role in the UK’s energy security in future. RBD has a number of portfolio assets that are in or close to the monetisation stage.

To know more about the company’s operation, click here.

How is the conflict in Eastern Europe unfolding?

The European Union has expressed its intention to considerably reduce its dependency on Russian gas, but this will take some time. This suggests there will be a fierce rivalry for the limited supply.

Companies are increasingly moving toward self-sanctioning, and some governments have also started to impose sanctions on Russian oil and gas. In response to these penalties, Russia has threatened to stop supplying gas through the Nord Stream 1 project.

This will result in local energy supply sources gaining more strategic prominence. It is also expected to accelerate Europe's energy transformation. To lessen the dependency on Russia, the investment in Europe's energy infrastructure, including generation and storage, is likely to increase much more quickly.

Thanks to geopolitical issues, gas and electricity prices in Europe are expected to stay high. This will be primarily due to the supply concerns due to embargoes and restrictions on Russian oil and gas imports. Also, market participants believe that if EU nations start to replenish their oil and gas inventory for the winter, demand will climb, pushing the prices higher.

Reabold continues to move assets in its portfolio through the appraisal, development and production stages. It has production in its California asset from 20 wells at present and continues to progress its assets in the UK through the appraisal and development planning stages. The perceptions of future oil and gas prices, particularly those for European gas, have a clear impact on how effectively the asset base is monetised.

Image: © 2022 Kalkine Media ®, Data source: Company update

Reabold's approach is to acquire stake in those oil and gas projects that are not well funded and add value to those assets through appraisal and development planning, and then monetise its investments. The strategy increases value by decreasing the risk profile of the project facilitating the monetisation of the project, particularly when long-term commodity price expectations are greater.