Appen Limited (ASX:APX) is a publicly-traded, ASX-listed company that gathers as well as labels data that is used to build and continuously enhance the most innovative artificial intelligence systems in the world. It is a global leader in the development of high-quality, human-annotated datasets for machine learning and artificial intelligence. Appen carries the experience of more than 20 years in collecting as well as improving a wide array of data types like speech, text, image & video.

During 2019, the shares of Appen Limited delivered a return of more than 75%. The shares which traded at $12.80 on 2 January 2019 reached $22.46 on 31 December 2019. Appen has provided a YTD return of 16.68% in 2020 while the S&P/ ASX Information Technology Sector has delivered a YTD growth of 7.84%.

However, on 22 January 2020, the shares of Appen closed at $26.320, 1.7% above its previous closing price. APX has a market cap of $3.13 billion and 121.11 million outstanding shares.

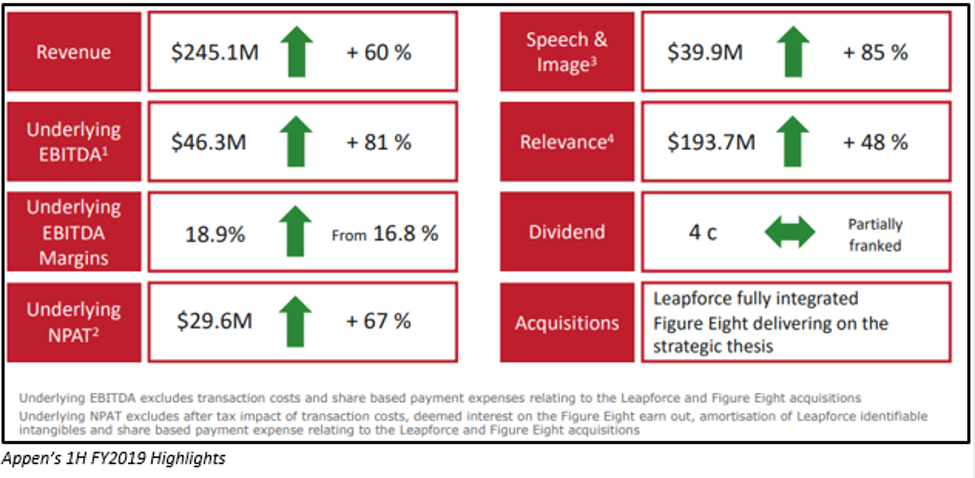

Let’s look at Appen’s 1H FY2019 results for the period ended 30 June 2019.

1H FY2019 Results; Revenue up by 60%

Appen’s core business performed strongly during 1H FY2019.

- Revenue increased by 60% to reach $245.1 million.

- Underlying EBITDA went up by 81% to reach $46.3 million.

- Underlying EBITDA margins increased from 16.8% to 18.9%.

- Underlying NPAT increased by 67% to reach $29.6 million, while statutory NPAT grew by 33% to reach $18.6 million.

- Revenue from organic growth was up by 85% and stood $39.9 million.

- Relevance revenue for 1H FY2019 was $193.7 million.

- Leapforce got fully integrated.

Figure Eight business, acquired by the company during April 2019, is delivering on its strategic thesis.

Chris Vonwiller, the Chairman of Appen, expressed his happiness because of the strong 1H FY2019 results and stated that the high growth in the Artificial Intelligence market would continue to drive the need for quality training data. As per the estimates by Gartner, the number of Artificial Intelligent projects per company is increasing at the rate of 106% per annum.

APX’s ongoing investment in technology would position the company where it can meet the demand for high volumes of quality data in the market at speed across various data types for an increasing number of used cases.

The board for 1H FY2019 declared an interim dividend of 4 cents per share.

Appen’s FY2019 Guidance:

For FY2019, Appen expects its underlying EBITDA to be in between $96 million to $99 million. In 1H FY2019 result announcement, the company expected the EBITDA to be in the range of $85 million to $90 million. The company stated that the improvement in EBITDA is the outcome of an increase in the relevance revenues and margins, majorly from the existing projects with the existing customers.

The company also clarified that the full-year earnings are sensitive to upside or downside aspects which include the timing of work from major clients as well as fluctuations in the Australian dollar.

Appen, a Trusted Company:

Appen is known for providing high-quality training data for machine learning. The company helps its customers improve their best-in-class products & services around the world, which includes search engines, social media platforms, voice recognition systems, sentiment analysis, and eCommerce sites.

Appen is trusted by eight out of the top 10 tech companies. The skilled project managers of the company use various quality control methods as well as a mechanism to meet and exceed the quality standards for training data.

More than one million skilled contractors operate in more than 130 nations & use over 180 languages and dialects.

The platform and solutions are built to manage large scale data collection as well as annotation projects, on-demand. Appen has in-depth skill planning & recruiting to meet multiple use cases for its clients. They quickly ramp up new assignments in new markets.

Appen offers multiple secure service offerings, which comprise of safe remote contractors, on-site contractors, on-premise solutions, and ISO 27001 / ISO 9001 accredited secure services.

Need for High-quality training data:

Training data or training dataset are those materials which help Artificial Intelligence and Machine Learning models learn the way to process the information and derive the required output. Machine learning uses neural network algorithms that replicate the potential of the human brain to take in various inputs and weigh them, to generate neural activations, in individual neurons. These training data offers a highly detailed model of the human thought process.

While developing training datasets for AI & ML, there is a need for a considerable volume of data to help these models to make the optimum decision. Machine learning helps the computer systems to tackle the complex problems as well as deal with basic changes of multiple variables.

The success of any model is directly proportional to the quality of the dataset.

Recent Achievements of Appen:

- Appen recognised in Deloitte’s Technology Fast 50 & 500 companies: For Appen, it is the sixth year the company was recognised in Deloitte’s Technology Fast 50 Australia Awards and second year where the company was recognised in the leadership category.

- During December 2019, the company launched a secure workspace solution to safeguard sensitive data for annotation in facilities or at-home settings. The Appen Secure Workspace Solution provides the right blend of technology, people, and processes to confirm that the projects, including sensitive data, can be annotated by a global crowd in a secure way.

Appen’s 2020 Prediction in AI to consider when Operationalising AI Developments:

Moving AI from proof of concept to Programs still a challenge: Most organisation experiment with the AI technology but they fail to make faster progress because there are still major hurdles to overcome before operationalising AI at scale. A similar challenge is expected in 2020. Now, IT leaders would require putting an extra effort to develop the right framework to move projects from POC to production as well as deliver business value.

Focus shifts to optimising data and analytics investments: It is expected that the business leaders would be focusing on the return on investment of data & analytics investments as the strategies mature.

Responsible AI becomes a key element of the future of workBroad adoption of AI for Customer Service

Machine Learning Tools & Artificial intelligence for IT operations (AIOps) gain more traction in the enterprise

AI Initiatives Will Need to Embrace Secure Data Practices

Scope of Appen:

Appen has an enormous scope in the upcoming period. Probable reasons include:

- AI market is still in a nascent stage and is growing continuously.

- Appen is uniquely positioned to win. It has a track record of growing customers.

- It is an established provider that was founded in 1996.

- The strategic acquisitions over the past three years have placed the company to help in meeting client needs for high levels of data security & large volumes of superior text, speech, image & video data.

- Global presence with offices in Seattle, San Francisco, Detroit, Exeter, Beijing, Wuxi, Shanghai, Manila, Davao and Sydney.

- Appen also has scalable operations. It has 662 full-time staff worldwide with more than 1 million on-demand skilled annotators on a global scale. It provides data for a growing range of AI applications.

AI in 2020

In 2019, government interest in artificial intelligence technology was seen increasing. On a global scale, AI is expected to add trillions of dollars in the coming decades, which was highlighted in the report published by the Australian government on ‘Australia’s Tech Future’. Significant steps were also taken during this period on this front by the government. One of them was the introduction of 8 AI Ethics Principles.