Overview on Infant Productsâ Market

In this article, we have discussed three companies in detail and all the three companies â Bubs Australia Limited, A 2 Milk Company Limited and Bellamyâs Australia Limited have significant presence in infant productsâmarket related to milk products, where these companies are involved with producing and selling of infant milk formula and organic infant food.

Worldwide, China is currently the biggest player in this segment. The Chinese government in order to become more self-sufficient will support its local players from this segment and intends to have more domestic investment to boost its home-grown products. Meanwhile, due to US-China tariff war, the American Dairy industry have got significantly affected as its exports have fallen by more than 50% and it seems that China is increasing its efforts to reduce its reliance on the U.S.

Letâs go through the stocks under discussion as mentioned below:

Bubs Australia Limited

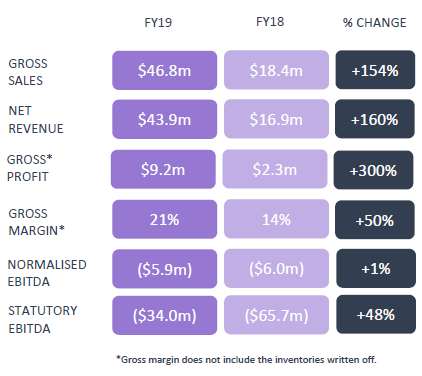

Significant Improvement in Margins in FY 19: On 30 August 2019, Bubs Australia Ltd (ASX: BUB) released full-year report closed 30 June this year. For FY 19 period, BUB has reported 160% rise in net sales at an operating level, normalised EBITDA loss of $5.9 million and the statutory net loss of $35.5 million.

The company has improved its gross margin to 21% in FY 19 from 14% in FY 18, whereby the companyâs gross margin has improved to 23% in 2H 2019 from 19% in 1H 2019. This improvement is on the back of product and channel mix optimisation, addition of new suppliers and improvements in the portfolio of the milk products.

The company expects growth in gross profit, going forward with the vertical integration of acquisition of Deloraine Dairy and full year recognition of one-step processing at Tatura. In FY 19, there has been 278% rise in the infant formula sales on the prior corresponding period and now represent 43% of net sales revenue.

During FY 19 period, there has been 133 percent rise in the sale of adult milk powder to $15.6 million and a 59 percent rise in the sales of organic baby food products. At the end of June 2019, the company had cash & cash equivalents of $23.3 million. Further during FY 19, the companyâs products grew 153% in Australia, which reflects 81% of net revenue & posted 209% growth in China, which reflects 18% of net revenue.

Moreover, during FY 19, the company received significant equity investment by C2 Capital Partners, in this Alibaba Group is an anchor investor. BUB has acquired 100% of Deloraine Dairy in 2019, which has a license from CNCA for infant formula processing facility. The company, during the period had formed the Joint Venture with Beingmate, a Chinese infant nutrition company. BUB also formed alliance with Chemist Warehouse and formed eCommerce partnership with Alibaba Tmall.

FY 19 Financial Performance (Source: Companyâs Report)

BUBâs stock last traded at A$1.185, edging up by 0.424 percent. The company has a market capitalisation of A$601.32 million with ~509.59 million shares outstanding. The stock has given a return of 159.34 percent in the YTD period.

A2 Milk Company Limited

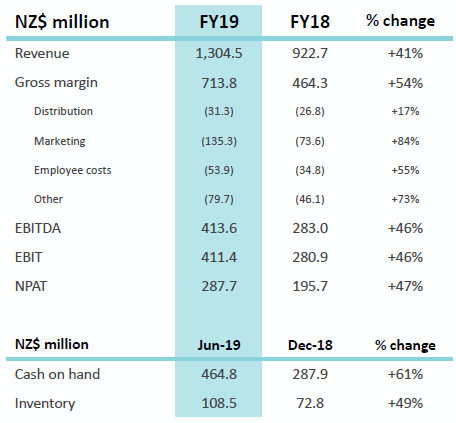

Lower than marketâs expectation of 2019 operating margin: On 21 August 2019, A2 Milk Company Limited (ASX: A2M) declared FY19 annual report closed 30 June this year.

The company did not meet the market analystsâ expectations on 2019 operating margin, despite, the fact that A2M met its full-year guidance for 2019. For FY 19, the company has reported more than 41% increase in revenue to NZ$1.3 billion ($1.2 billion), 46.1% increase in EBITDA to NZ$413.6 million and 47% rise in the net profit to NZ$287.7 million. At the end of FY 19 period, the company had cash balance of ~NZ$465 million. The balance sheet remained strong with no debt.

China momentum continues to build: The company has improved its infant nutrition market share in China to 6.4% and expanded its distribution by 2 folds to around 16,400 mother and baby stores in China. A2M has invested for the expansion of Kantar market share so that city tiers B, C and D can be also included. The China label grew by more than 100% on the back of Mother Baby Stores (MBS) and modern trade.

US building scale: In the US, the company has posted 160.7% growth in the revenue to NZ$34.6 million in 2019 and has expanded its distribution network to 13,100 stores. There has been 10.7% growth in the Australian fresh milk revenue and 35.3% increase in a2 Platinum® formula revenue.

FY20 Outlook: Moreover, for fiscal 2020, the company expects the earnings before interest, tax, depreciation and amortisation (EBITDA) margin to be in line, with the EBITDA margin of the second half of FY 19 of 28.2%. The company expects marketing spend to rise to approximately 12% of sales in 2020, up, from 10.4% in 2019. Also, 2020 gross margin is expected to be flat versus FY 19 period.

FY 19 Financial Performance (Source: Companyâs Report)

A2Mâs stock last traded at A$13.66, moving up by 1.94 percent. The company has a market capitalization of A$9.85 billion, with 735.17 million hares outstanding. The stock has given a return of 28.85 percent during the YTD period.

Bellamy's Australia Ltd

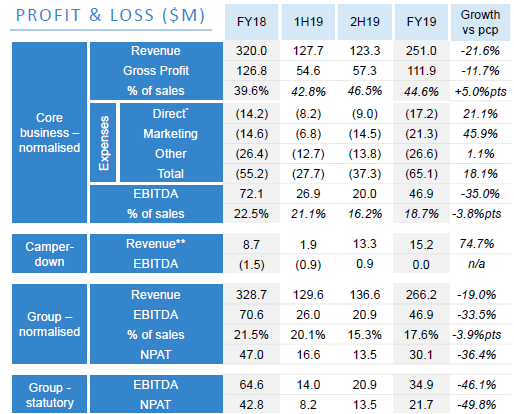

Subdued Performance in FY19: On 28 August 2019, Bellamy's Australia Limited (ASX: BAL) declared FY 19 results closed 30 June this year.

For the FY19 period, the company has reported 19% fall in the net revenue to $266m, 46% decrease in the statutory EBITDA to $34.9 million and 49.3% fall in the statutory net profit after tax to $21.7 million. This financial performance is on the back of subdued demand from China due to regulatory change, low rate of birth and cut-throat competition.

The 2019 results have been also affected due to one-off write-down of legacy-label inventory and the destocking in the third quarter, as well as due to the trade change compared to the original expectation. During 2019, the companyâs gross margins expanded to 43.5% from 39.2% in FY 18.

FY20 outlook: Bellamyâs Australia anticipates posting lower than the sales target of A$500 million for fiscal 2021. The company at the end of FY 19 had the cash balance of $112m. Meanwhile, BAL has been waiting to get a nod from the SAMR or State Administration for Market Regulation for shipment of the formula to China from a facility, the company had earlier bought during 2017.

Moreover, for FY20, the company is anticipating the growth of 10-15% in group net revenue growth and the 2020 EBITDA margin is expected to be in line with FY 19. The company further expects the revenue to grow during the second half of 2020 with the launch of new products, strong gross margin and with the investment in marketing and China capability.

FY 19 Financial Performance (Source: Companyâs Report)

BALâs stock last traded at A$8.200, edging up by 5.534 percent. The company has a market capitalisation of A$880.74 million and ~113.37 million shares outstanding. The YTD return of the stock is 2.37 percent.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.