At present, there are various macro factors in the global consumer economy, which are changing historical purchase behaviour patterns and disrupting the traditional food industry. The growing awareness of health and wellness products, as well as the growing focus on food safety, has influenced the operations of many food industry participants. In the light of the above-mentioned scenario, letâs look at three Baby Formula stocks trading on ASX.

The a2 Milk Company (ASX:A2M)

The a2 Milk Company (ASX: A2M) is a leading infant nutrition company which is having its trading activities in Australia, China, New Zealand, US, UK and various emerging markets in Asia.

On 21st August 2019, the company unveiled its full year results for FY19. The company achieved revenue growth of 41% in FY19 as compared to FY18, reflecting strong growth across core markets and product categories. The revenue grew to NZ$1,304.5 million in FY19, while EBITDA grew to NZ$413.6 million, which is 46.1% higher than pcp. The NPAT of NZ$287.7 million in FY19 exceeded FY18 NPAT by 47%.

FY19 Results Snapshot (Source: Company Reports)

It is evident from the strong FY19 results that the company has sustained its strong growth in FY19. The FY19 results are reflecting the strength of the companyâs brand, a highly disciplined focus on growth, and the talent and commitment of its people said the company chairman while releasing the results.

The continued growth of the companyâs infant nutrition products was a strong contributor to the results with sales totalling around NZ$1.1 billion in FY19, up 46.9% on last year, driven by share gains in China and Australia.

The company also witnessed growth in its liquid milk businesses in FY19, particularly within Australia and the USA. The total fresh milk growth was 22.9% in FY19 with revenue of NZ$174.9 million across the group. During the year, the company increased the sales of its other nutritional milk products by 17.3%, resulting in total sales of NZ$65.8 million underpinned by new products launched towards the end of FY18 and in Q4FY19.

During the year, the company enhanced its approach to inventory management, enabling it to adjust more quickly to demand changes by increasing its inventory cover. By the end of FY19, the company had an inventory of $108.5 million, up 69.2% from the prior corresponding period (pcp) and 49.0% from the H1 FY19. At the end of FY19, the company had a strong balance sheet with a cash balance of NZ$464.8 million and no debt.

The companyâs growth priorities are as follows:

- To maximise the growth from existing products in core markets;

- To expand its product portfolio in core markets;

- To expand in other targeted markets.

To enable the successful delivery of these strategic priorities, the company has made significant investments In FY19. During the year, the company increased its investment in building brand value to increase the pace of brand awareness and trial in both the US and China. The companyâs investment in marketing increased by 83.7% to NZ$135.3 million in FY19, primarily as a result of increases in advertising spend in China and the US.

In Australia and New Zealand segment, the companyâs business revenue grew by 28.3% to NZ$842.7 million, and its EBITDA grew by 48.1% to NZ$388.2 million. The Australian fresh milk business remained strong during the year, with revenue growth of 10.7% and a record 11.2% market share, up from 9.8% for the same period a year ago, and 10.8% at the end of 1H19.

In China, the company revenue increased by 73.6% to NZ$405.7 million while EBITDA grew by 52.4% to NZ$123.9 million. During the year, various important regulatory changes were introduced in China with respect to e-commerce and cross border trade in general, which resulted in some orders being pulled forward into the third quarter.

US segment business revenues increased by 160.7% to NZ$34.6 million in FY19, with an EBITDA loss of NZ$44.0 million, resulting from increased investment in distribution growth and brand awareness. UK segment revenues increased by 12.7% to NZ$21.6 million in FY19 as compared to pcp, with EBITDA of NZ$4.4 million, driven by increased wholesale sales of infant formula. By the end of FY19, the companyâs Board

The company has experienced significant growth in recent years, driven predominately by the success of its liquid milk and infant formula businesses in Australia China and the US.

Exit of UK Liquid Milk Business- The company had started the UK liquid milk business in 2012. Since then, the company has evolved considerably, and the UK opportunity is not of sufficient scale when compared to the significant growth potential in Greater China and the US. Due to this, the company has decided to exit UK liquid milk operations during 1H20, to focus more on strengthening its position in its core regions.

Outlook: It is expected that the companyâs revenue will further increase across its key regions due to the increased brand and marketing investment in the US and China. It is expected that the companyâs EBITDA in FY20 as a percentage of sales will be broadly in line with 2H19 EBITDA margin (28.2%).

Stock Performance: In the last six months, A2Mâs stock has provided a return of 17.30% as on 20 August 2019. The stock has a 52 weeks high price of A$17.300 and 52 weeks low price of A$8.140 with an average volume of $2,948,245. At the time of writing i.e., 21 August 2019 (2:17 PM), the stock was trading at a price of A$14.060, down by 12.125% intraday, with a market capitalisation of circa A$11.76 billion.

Bellamyâs Australia Limited (ASX:BAL)

Australiaâs leading Infant nutrition company, Bellamyâs Australia Limited (ASX: BAL) is progressing to build out a tiered-product portfolio and penetrate the China offline channel. Recently, three of Bellamyâs branded formulation-series were approved by SAMR (State Administration for Market Regulation). These series will be produced at the ViPlus Dairy (ViPlus) facility in Toora and will target the premium segment of the offline channel and initially focus on Tier 3 and 4 cities.

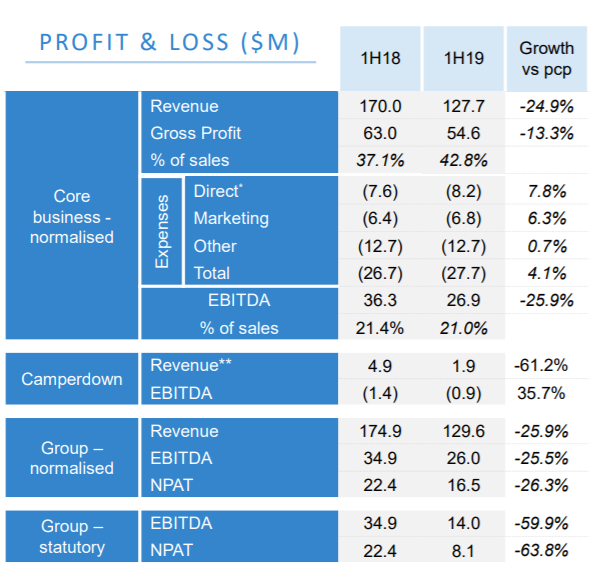

In the first half of FY19, the company witnessed a decline of around 25% to A$127.7 million as compared to pcp, due to SAMR delay and reduced trade inventory.

H1FY19 Results Snapshot (Source: Company Reports)

The companyâs gross margin improved by 5.7% in H1FY19 as compared to pcp. At the end of half year period, the company had a cash balance of A$95 million.

Recently, Fort Canning Investments Pte Ltd became a substantial holder of the company by holding 7,871,732 ordinary shares of the company.

Stock Performance: In the last six months, BALâs stock has provided a return of 5.73%. The stock has a 52 weeks high price of A$12.570 and 52 weeks low price of A$6.710 with an average volume of $1,052,896. At the time of writing i.e., 21 August 2019 (2:17 PM), the stock was trading at a price of A$8.460, down by 2.422% intraday, with a market capitalisation of circa A$982.9 million.

Wattle Health Australia Limited (ASX:WHA)

Wattle Health Australia Limited (ASX: WHA) is progressing to complete the 75% acquisition of Blend & Pack (B&P). At the recently held Extraordinary General Meeting (EGM), the shareholders greenlighted the acquisition and gave their approval.

The company believes that the acquisition of Blend and Pack is in line with its vertical integration strategy and also strengthens its position to sell product into China.

The company has also made a significant commitment in funding a dedicated organic spray drying facility at Corio Bay Geelong. The companyâs partners in CBDG are Organic Dairy Farmers of Australia and Niche Dairy Pty Ltd (5%) owned by Andrew Grant.

The company is of the view that both Blend and Pack and CBDG will add significant value and additional revenue streams to the company. In parallel to this, the company is also executing a strategic marketing program for Uganic aimed at driving sales for the business.

In the first half of FY19, the company reported a loss of $4.3 million, improvement of 66.8% compared to the loss of $13.08 million in pcp.

Stock Performance: In the last six months, WHAâs stock has provided a negative return of 53.63% as on 20 August 2019. At the time of writing i.e., 21 August 2019 (AEST: 108 PM), the stock was trading at a price of $0.400 with a market capitalisation of circa $80.72 million. It is to be noted that, the stock is trading close to its 52 weeks low of $0.397.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.