Dietary management of infants is given utmost importance across the world. One of the commonalities of every culture include child-care and the inclusion of paediatrician advice, while bringing up the youngest members of the families. The primary need of every infant, besides proper care, is effective and efficient nutrition, which if compromised might lead to disorders and malnutrition. The essence of this thought gave rise to the businesses of infant formulas and baby foods, and Australia has a number of companies catering to this business opportunity.

What is Infant Formula?

Interchangeably referred to as Baby Formula, Infant Milk, First Milk, Infant Formula are specialised products that are specifically designed for the dietary management of infants, aged 0-12 particularly. These Formula are designed in a way that it substitutes the nutrition that would be achieved through breast milk, and includes requisite amount of water, carbohydrate, protein, fat, vitamins, and other important minerals that would be required by the infant to achieve and maintain normal health and growth.

What are the Pros and Cons of Infant Formula?

Infant formula has been widely used across economies but has been subject to a fair share of criticism as well. On the good side, it is a power package of nutrients that the infant needs to grow healthy. Secondly, it is guided by safety standards from food corporations and government health units. Thirdly, these are apt substitutes in cases where breastfeeding ceases to take place, for various medical/personal reasons.

On the flip side, digestion of the Formula has been subject to several discussions. Secondly, the formula fed babies feed less often than the ones who breastfeed. Thirdly, the formula might fail to serve the purpose if the infant shows signs of allergy towards any ingredient of the composition.

What caused the recent collapse of Infant Formula Industry in Australia?

Australian manufactures of Infant Baby Formula have been the recent vulnerable victims of the US-China Trade War. With Chinaâs population at over 1.3 billion, the market demand has been on a rise, and has gone beyond domestic production. Moreover, a decade ago, the local Infant Formula products in China were subject to grave criticism after they were questioned on grounds of quality and possible contamination, which opened doors for exporters, including Australia. The US and Europe are the biggest exporters of Infant Formula to the Chinese economy, which is a growth-land for the ANZ region as well. SAMR approvals are posing another threat to the domestic players.

In the recent times, investors have undertaken a dicey approach towards the Australian Infant Formula stocks, which have lost significant percentages recently, after China declared that its local manufactures would capture a bigger share of the market, shunning down the addressable market of the Aussie infant business. In this situation, regulations on inter-country e-commerce sales and quality checks are expected to pace up.

In the light of this context, let us look at 6 infant formula stocks, trading on the Australian Securities Exchange and decode if they are on a path of revival in the present time:

Wattle Health Australia Limited (ASX: WHA)

Company Profile and Stock Performance: Sourcing locally grown ingredients and creating organic dairy products and infant foods, WHA is an Australian F&B company that was listed on ASX in 2017. On 31 July 2019, WHA ended the dayâs session at A$0.480, up by 4.35 per cent, with a market capitalisation of A$89.47 million. The YTD return of the stock has been a negative 49.45 per cent.

EGM Presentation: On 31 July 2019, the company released an EGM presentation as well as quarterly results, stating that it had been a victim of the macro level challenge posed by the focus to make sales in China, fights for the SAMR approvals and delays in construction of Corio Bay Dairy Groupâs facility.

Total milk production in Australia for FY19 was ~7.9 billion litres of milk, driven by the Exclusive supply agreement with Organic Dairy Farmers of Australia. Corio Bay Dairy Group, with nationâs first organic nutritional milk spray dryer, is a JV of WHA, OFDA and Niche Dairy. It was reported to be capable of converting up to 60 million litres of liquid to powder annually (capacities to increase to 120 million litres). The project, running behind schedule, would be completed in 1H2020. Further, WHA took ownership to 51 per cent in Blend and Pack, an OEM Nutritional Blending and Canning facility, earlier this year. The facility is accredited in both China and Australia market. The company has signed a term sheet with Gramercy to fund the acquisition of Blend and Pack.

On the Infant Formula side, Uganic infant formula range (fresh organic milk and organic A2 fresh milk) is due to launch in August 2019.

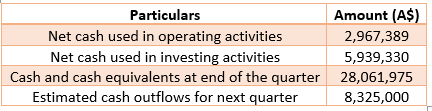

The below table outlines WHAâs cash flow statement for June 2019 quarter:

The A2 Milk Company Limited (ASX: A2M)

Company Profile and Stock Performance: Producer, marketer and seller of branded dairy and infant formula products in targeted global markets, A2M was listed on ASX in 2015 and is a dual-listing company, trading on NZX as well. By the end of the market trading on 31 July 2019, A2M was trading at A$17.230, down by 0.058 per cent, with a market capitalisation of A$12.59 billion. The YTD return of the stock has been 64.71 per cent.

China e-Commerce Announcement: On 21 June 2019, A2M welcomed the measures of Chinaâs SAMR and other bureaus regarding the e-commerce legislation of goods and services transacted via e-commerce platforms, which had been effective from April 2019.

Bellamyâs Australia Limited (ASX: BAL)

Company Profile and Stock Performance: Producer and distributor of branded organic formula and food products, BAL was listed on ASX in 2014. By the close of trading session on 31 July 2019, BALâs stock was valued at A$10.100, down by 2.42 per cent, with a market capitalisation of ~A$1.17 billion. The YTD return of the stock has been 36.36 per cent.

SAMR Approval: On 1 May 2019, BAL notified that SAMR had approved a label and artwork change to the existing registered ViPlus Dairyâs bovine formula-series, which would be manufactured at the ViPlus Dairy facility in Toora and sold and marketed by the company and its distributors. ViPlus was awaiting final certification of all artwork changes from SAMR. Besides this, WHAâs organic formula-series application is awaiting SAMRâs approval and would be produced at the Camperdown Powder facility in Melbourne.

Synlait Milk Limited (ASX: SM1)

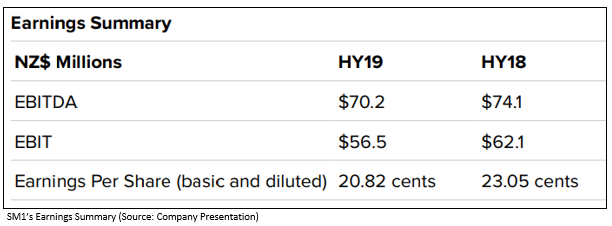

Company Profile and Stock Performance: NZ based dairy manufacturer supplying dairy products to leading milk-based health and nutrition companies, SM1 was listed on ASX in 2016. By the close of market on 31 July 2019, SM1âs stock was valued at A$9.680 with a market capitalisation of A$1.73 billion. The YTD return of the stock has been 13.35 per cent.

2019 Investor Day Presentation: On 1 May 2019, SM1 conducted its Investorâs day, stating that it achieved a 22.7 per cent pre-tax net return on capital employed in FY18 and it was currently investing over $400 million in growth projects. The plans to simplify logistics networks are underway in FY19 and would yield cost benefits in FY21, with focus on inventory management in FY20.

Considering the China market, SM1âs regulatory team in China was working through the registrations of Akara and Pure Canterbury brands with SAMR, expected to be approved in 2019.

Bubs Australia Limited (ASX: BUB)

Company Profile and Stock Performance: Manufacturer of infant milk formula and a consumer staple player, BUB was listed on ASX in 1993. By the close of market trading on 31 July 2019, BUB was trading at A$1.350, trading down by 2.17 per cent, with a market capitalisation of A$703.23 billion. The YTD return of the stock has been 203.30 per cent.

FY19 Q4 Activities Report: A great phase for BUB, the fourth quarter of FY19 marked sales exceeding that of the full year in 2018. The company recorded the highest quarterly revenue of $18.46 million. FY19 finished at $51.3 million revenue, a 179 per cent increase on pcp. As on 30 June 2019, BUB had cash reserves of $23.3 million.

BUB had entered into a JV with Beingmate, a Chinese infant nutrition brand and entered into association with Chemist Warehouse in a strategic equity-linked alliance. It had a Major equity investment by C2 Capital Partners, of which Alibaba Group is an anchor investor, and the quarter also saw an eCommerce partnership with Alibaba Tmall for Bubs® products. Enhancing the China end was the Channel partnership with Kidswant.

Keytone Dairy Corporation Limited (ASX: KTD)

Company Profile and Stock Performance: Manufacturer, packer and exporter of dairy and nutrition products, KTD was listed on ASX in 2018. By the close of market trading on 31 July 2019, KTDâs stock was valued at A$0.480, down by 1.03 per cent, with a market capitalisation of A$72.75 million. The YTD return of the stock has been 25.97 per cent.

AGM and Corporate Update: On 26 July 2019, KTD notified that it is building its second purpose-built powder manufacturing facility in New Zealand, increasing capacity 3,500tpa on current operations, to 5,000tpa. In FY19, the company had acquired Omniblend, from the health and wellness sector. The Sales for FY19 increased to $2.5 million, up by 23.9 per cent over FY18. The first quarter for the FY20 year recorded sales of $1.5 million, up by 366 per cent on pcp.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.