Australiaâs consumer staples industry includes manufacturing and distribution of food and beverages as well as the production of personal products and household goods. In addition, it also includes food & drug retailing companies, along with hypermarkets and consumer super centres. Due to the indispensable nature of these products to human lives, the S&P/ASX 200 Consumer Staples Index (XSJ) is usually not that susceptible to economic cycles.

Letâs look at the following three Australian Consumer Staple companies whose trading volumes were notably higher on 29 July 2019 on the ASX while their respective stocks have also delivered positive return yields in the last few months.

Coca-Cola Amatil Limited

Australia-based Coca-Cola Amatil Limited (ASX: CCL) is engaged in the manufacturing, distribution and sale of carbonated soft drinks, still and mineral waters, fruit drinks, ready-to-drink coffee and tea and flavoured milk drinks. In addition, the company also rents and services commercial refrigeration equipment to food/beverage manufacturers.

The company has a market capitalisation of around AUD 7.5 billion, with ~ 724 million shares outstanding. On 29 July 2019, the trading volumes in CCL were unusually high as the stock closed the market trading at AUD 10.460, edging up 0.965% with ~ 10.86 million shares traded as against its average annual volumes of ~2 million shares. Besides, CCL has generated positive return yields of 26.96% YTD and 19.63% for the last six months. On 30 July 2019, the shares were trading at AUD 10.550 up by 1.099% with 0.99 million shares traded (as at AEST: 2:53 PM). Interestingly, there were no updates from the company on 29 July 2019. Letâs have a quick look at the companyâs previous updates.

SPC Business Sale- On 1 July 2019, Coca-Cola Amatil announced that it had completed the sale of the SPC fruit and vegetable processing business (SPC) to Shepparton Partners Collective Pty Ltd and its group of companies, for a value consideration of $ 40 million payable at the time of completion on Friday 28 June 2019.

Amatil is expected to record a profit of ~ $ 14 million on sale, incorporating the estimated working capital balances, working capital adjustments to the sale price and costs of disposal. Besides, the agreement included a four-year earnout structure which, subject to business performance, could lead to around $ 15 million of additional sale proceeds at that time.

Since the takeover of SPC business in 2005, Amatil has invested ~$ 250 million including in technology, operational and energy efficiencies, and new equipment. A $ 100 million co-investment program (2014-2018) was also undertaken to revamp SPCâs tomato, and snack cup production and a new aseptic fruit processing system was introduced with a pouch line at the Shepparton site. The divestment process for the SPC fruit and vegetable processing business was started in November 2018.

Excerpts from Annual Report âThe one year ended 31 December 2018 was quite transitional for the company. While earnings were impacted by planned investments in the Accelerated Australian Growth Plan and the implementation of container deposit schemes, performance remained strong with New Zealand & Fiji delivering another year of strong EBIT growth and Alcohol & Coffee recording another year of double-digit EBIT growth. A snapshot of the Group results in as follows.

Source: Annual Results 2018

Coles Group Limited

Coles Group Limited (ASX: COL), based in Victoria, Australia, is a consumer staples sector player that owns and operates a network of supermarkets and department stores. The company provides apparels, liquor, office supplies, groceries, and household products across Australia as well as New Zealand. With a market capitalisation of around AUD 18.9 billion with ~ 1.33 billion shares outstanding, the COL stock price closed at AUD 14.230, edging up 0.423% on 29 July 2019. Around 1.81 million shares were traded in total as against annual average volume of ~2 million. On 30 July 2019, the shares of COL are trading at AUD 14.310, up by 0.562% as compared to its previous closing price (as at AEST: 2:41 PM). In addition, COL has generated positive return yields of 21.01% YTD and 13.03% for the last six months.

Recently on 16 July 2019, Coles Group announced that its full-year results for the 2019 financial year (FY19), along with the fourth quarter sales results would be disclosed on Thursday, 22 August 2019 following an analyst briefing.

Coles Groupâs Refreshed Strategy â In the month of June this year, the Group announced its refreshed strategy to deliver on its vision of becoming the most trusted retailer in Australia to grow long-term shareholder value. The strategy is essentially based on three pillars-

- Inspire Customers through best value food and drink solutions to make their lives easier.

- Smarter Selling through efficiency and pace of change.

- Win Together with team members, suppliers and communities.

The Groupâs CEO Steven Cain also added that the business has certain strategic differentiators such as an optimised store and supply chain network contributing to wins in online food and drink, being a great value Own Brand Powerhouse and destination for health, creating Australiaâs most sustainable supermarket, delivering via an engaged team and pace in execution, and lastly achieving long-term structural cost advantage via automation and technology partners.

The Group also highlighted its key financial objectives for the next four yearsâ

- The revenue growth is expected to be at least in line with market growth over the long term.

- The Group is targeting ~ $ 1 billion of cumulative cost savings by the financial year 2023.

- Maintaining an attractive dividend payout ratio.

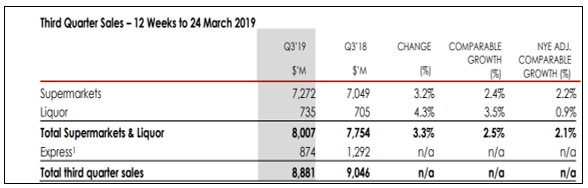

Third Quarter 2019 Sales Result â On 29 April 2019, Coles Group released its Third Quarter Sales Results for the 12 weeks to 24 March 2019, demonstrating 46th consecutive quarter of comparable sales growth by the supermarkets, which stood at 3.2% supported by a successful âFresh Stikeezâ promotional campaign. Besides, the Groupâs Online growth was recorded at 27%, with sales of over $ 1 billion on a rolling 12-month basis and the Liquor comparable sales adjusted for New Yearâs Eve (NYE) timing increased by 0.9%.

Source: 2019 Third Quarter Sales Results

The A2 Milk Company Limited

The A2 Milk Company Limited (ASX:A2M) is engaged in the production of cow milk, which is free of a protein called beta casein A1 and distributes its products internationally. With a market capitalisation of around AUD 12.57 billion and around 735.05 million shares outstanding, the A2M stock price settled the dayâs trading on 29 July 2019 at AUD 17.100, edging up 3.26% by AUD 0.540 with ~ 2.76 million shares traded as against average annual volumes of ~ 2.6 million. On 30 July 2019, the shares of the company were trading at AUD 17.095, marginally down by 0.029% as compared to its previous closing price, with around 0.9 million in trade (as at AEST: 2:47 PM).

In addition, A2M has generated positive and high return yields of 64.42% YTD and 47.67% in the last six months.

On 21 June 2019, the company announced that it would comply with the NZX Listing Rules dated 1 January 2019 from 30 June 2019.

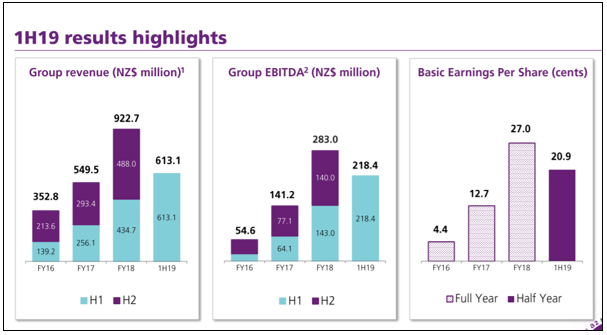

In May 2019, the company presented at the Macquarie Australia Conference held in Sydney touching upon various aspects of the business. As per the interim results for the six months to 31 December 2019, the company reported revenues of $ 613.1 million, up 41% on the prior corresponding period (pcp) and an EBITDA of $ 218.4 million, also up 52.7% demonstrating continued strong momentum. The net profit after tax amounted to $ 152.7 million for the period.

Source: Presentation to Macquarie Australia Conference 2019

Subsequently, the company updated that for the nine months to 31 March 2019, the Group revenue had increased to NZD 938 million, up 42% on pcp with a continued sales growth in nutritional products and liquid milk.

In the second half of FY19, the company primarily focused on accelerating strategic investment in consumer insights, brand and organisational capability, and launch of the a2 Smart NutritionTM in Australia and China cross border e-commerce (CBEC) in 4Q FY19, which is a fortified nutritional powdered milk drink targeting children in the age group of 4-12 years.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.