Requirement for consumer staples marks one of the essential requisites of any individual, irrespective of the financial situation. Examples of these products include food and beverage, hygiene products and household commodities. Considering that the demand for these products is constant and prevails across the year, they are non-cyclical.

Major global firms dealing with consumer staple products include Procter & Gamble (P&G), Johnson & Johnson, Kellogg Co., Altria Group and Walgreens Boots Alliance.

Let us take a look at few consumer staple products which are listed on the Australian Securities Exchange:

- Freedom Foods Group Limited (ASX:FNP)

- Costa Group Holdings Limited (ASX: CGC)

- Bega Cheese Limited (ASX:BGA)

- Bellamy's Australia Limited (ASX: BAL)

- Tassal Group Limited (ASX:TGR)

More on the top 10 consumer staple stocks (based on market capitalization) on ASX can be READ here.

With this backdrop, let us now look at the recent updates and present stock performances of two consumer staple stocks, on ASX- WHA and BKL:

Wattle Health Australia Limited (ASX: WHA)

Company Profile: A provider of health and wellness products, WHA sources locally grown ingredients and creates formulations and organic products with scientific and nutritional benefits. Adhering to international standards, the company aims to protect the earthâs natural resources. With its registered office in Abbotsford, the company was listed on ASX in 2017. The company has offices in China, Vietnam and India. WHA has three product ranges- The nutritional infant formula dairy range, Nutritional range dairy and WattleBaby natural baby food.

Company products (Source: Company website)

Stock Performance: The companyâs stock was voluntarily suspended from trade on ASX, awaiting an acquisition announcement which came in today, on 2 July 2019 (related to Blend & Pack, discussed below). The stock last traded on 24 June 2019, at A$0.520, 2.97 per cent up relative to its last trade, which was re-instated to official quotation today. It closed the dayâs session at A$0.520, up by 2.97% (As on 2 July 2019). The EPS of the stock is a negative A$0.051 and it has generated negative returns of 28.87 per cent, 39.16 per cent and 44.51 per cent in the last one, three and six months, respectively. The YTD of the stock is a negative 44.51 per cent.

Acquisition of Blend & Pack: On 2 July 2019, the company announced that it had signed a revised debt facility term sheet for net cash funding with Gramercy, which now amounts to $85 million. This funding was $75 million, before the revision. With a coupon rate of 9 per cent per annum and OID of 13 per cent, the debt facility is valid for a term of four years.

The revision of this debt facility term sheet would aid the company to receive additional working capital and increase the proposed purchase of B&P shares. Blend & Pack is Australiaâs largest CNCA certified manufacturing facility. The company is aiming to increase its shareholding interest in Blend & Pack to 93. 5 per cent, which would facilitate the construction of Australiaâs first dedicated organic nutritional spray dryer. Post the acquisition, the company would be amongst the first fully vertically integrated organic nutritional dairy players in the country.

Other updates: The company would be conducting its Extraordinary General Meeting and Explanatory Memorandum on 31 July 2019.

On 23 May 2019, the company notified that construction at the Corio Bay Dairy Group was continuing and steel works for the dryer and evaporator building were being installed. Installation of the concrete panels of the dryer and the evaporator building would commence shortly.

Construction work at CBDG (Source: Companyâs report)

Blackmores Limited (ASX: BKL)

Company Profile: Pertaining to the group of household and personal products, BKL provides natural health solutions to its users. The company was listed on ASX in 1985 and has its registered office in Warriewood, New South Wales.

BKLâs Stock Performance: After the close of trading session on 2 July 2019, the companyâs stock was valued at A$91.900, 2.1 per cent up relative to its last trade, with approximately 17.36 million outstanding shares. The EPS of the stock was A$4.069 with an annual dividend yield of 3.39%. BKLâs stock has generated negative returns of 0.98 per cent, 3.29 per cent and 28.14 per cent in the last one, three and six months, respectively. The YTD of the stock is a negative 28.14 per cent.

New on Board: On 2 July 2019, the company announced that it had appointed a new Chief Executive Officer and Managing Director, Mr Alastair Symington. His term would be effective from 1 October 2019. Based in Dubai and hailing from Melbourne, Mr Alastair is currently serving as a senior VP of Consumer Beauty, leading the ALMEA region for Coty. He holds 23 years of experience and has worked in firms like P&G, Nestle and Gillette. Before the effective term, Executive Director Marcus Blackmore is serving as the companyâs Interim CEO.

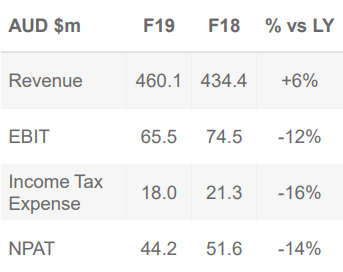

Shareholder Briefing: On 28 May 2019, the company conducted a Shareholders Briefing (Lead the Wellness Revolution). It presented its third quarter YTD update for FY19. The company had recorded a revenue of A$460.1 million, which was up by 6 per cent on the prior corresponding period of FY18 (A$434.4 million).

Financial update (Source: Companyâs report)

Segment-wise, the revenue in all regions was up, except for in China. Considering this result, the company is focussed on reduction of excess stock in channels to China, as an outlook for FY19. The company is also targeting savings worth $60 million over three years.

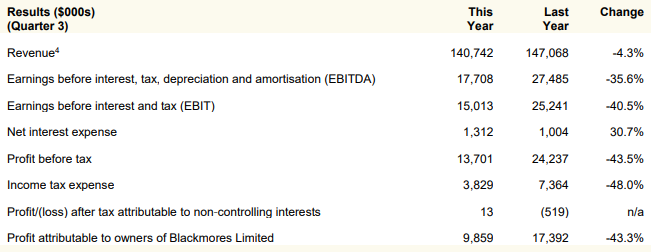

Third Quarter Financial Results: On 16 April 2019, the company announced its Q3 results for the period ending 31 March 2019. In the first nine months of the year, the company had recorded a profit of $44 million, which was down by 14 per cent on its prior corresponding period and a revenue of $460 million, which was up by 6 per cent on pcp. In Q319, the profit was $10 million, down by 43 per cent. The revenue was $141 million for the quarter, which was down by 4 per cent on pcp.

Q3 results (Source: Companyâs report)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.