According to Global Industry Classification Standards; Consumer Discretionary & Consumer Staples are two broad sectors which include a couple of sub-industries. Consumer Discretionary sector includes Automobiles & Components, Consumer Durables & Apparel, Consumer Services and Retailing. Consumer Staples sector includes Food & Staples Retailing, Food, Beverage & Tobacco and Household & Personal Products. As per ASX, Wesfarmers Limited (ASX:WES) is assigned to the Consumer Discretionary sector while Woolworths Group Limited (ASX:WOW) is assigned to the Consumer Staples sector. After looking at some recent developments in these two consumer heavyweights in Australia, it appears that both of these companies are trying to penetrate their respective market share in the surging e-commerce platforms due to ever-evolving consumer taste, market dynamics and trends.

Wesfarmers Limited (ASX:WES) is a large-cap stock which is part of ASX 20 Index and considered as highly liquid and bluechip stock. Yesterday, the group released an announcement pertaining to trading update for Kmart.

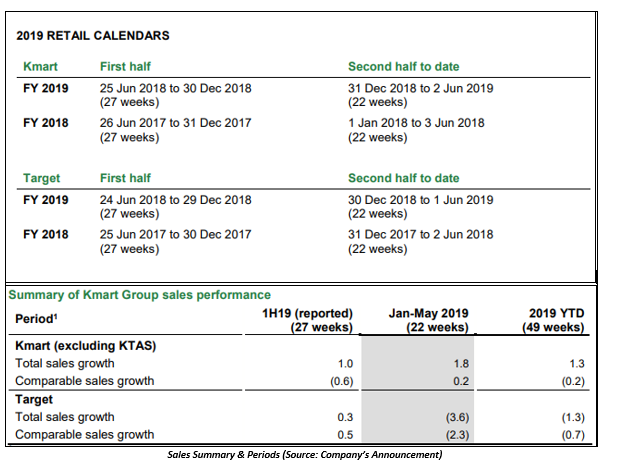

Previously in half-year end 31 December 2018, it had been reported that the sales growth was sluggish against the growth prevailed in the prior corresponding period; also, the group is expecting a lower level of sales growth in the current period (second half year FY19) as well. Additionally, optimisation of store network has impacted the sales of Target.

WES asserted that the market environment remained competitive for Kmart and Target in the second half of the FY19 to date with a higher level of promotional activity and increased price investment; also the price pressure continues to increase on many industry participants on the back of prevailing pricing level and cautious consumer sentiment. As per the release, total sales during the second half to date increased by 1.8% while comparable sales increased by 0.2% in Kmart, which is in line with the first half of the year and Kmart would annualise the exit of the DVD category.

Also, WES implemented a number of initiatives to optimise store flow & store processes for supporting the future growth in the current financial year; these initiatives resulted in a temporary reduction in on-shelf availability, and temporary reduction would be resolved by the end of the financial year.

WES reported that the ongoing optimisation of the store network caused the total sales to decrease by 3.6% of Target during the second half to date period, and Targetâs current offerings would require ongoing repositioning as reflected by the 2.3% decrease in comparable sales during the second half to date period. In accordance with the release, margins have been impacted in Kmart & Target due to heightened price competition. Importantly, the group is expecting the earnings before interest and tax from Kmart Group through continuing operating to be between $515 million and $565 million for FY19; notably, the estimate excludes earnings from Kmart Tyre and Auto (KTAS).

On 13 June 2019, Wesfarmers also released 2019 Strategy Briefing Day Presentation. WES intends to focus on three key areas, which were People, Suppliers and Environment to create value in the future. It intends to make a difference in the communities where the group operates and progress towards gender balance & Indigenous employment â People. For suppliers, the group aims to reinforce its market-leading ethical sourcing program and extend it to goods, not for resale and services. Environment, the group intends to develop proactive strategies to improve resilience to climate change.

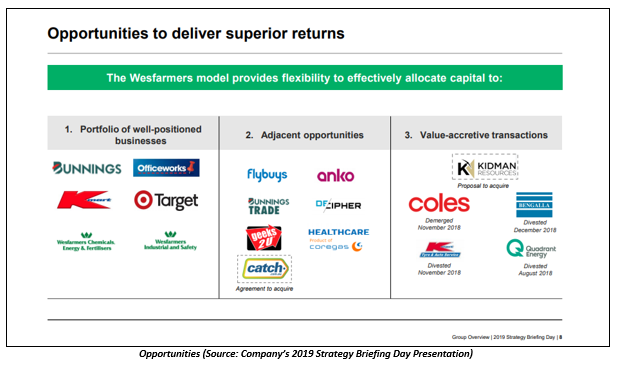

WES asserted that the group is focused for the long-term business growth through continued investment, it intends to execute this by operating a portfolio of well-positioned businesses, tapping Adjacent opportunities and improved focus on value-accretive transactions.

As per the presentation, portfolio of well-positioned business would be executed through price investment to reinforce value proposition for customers, technology penetration to support efficiency initiatives and continued investment in e-commerce capabilities while also recruitment & development of talent. Also, the group intends to capitalise on adjacent opportunities available from expanding businesses, new channels and investments like the ongoing Catch group. Lastly, WES believe value accretive transactions would leverage its long-term objectives, and the group remains active in divesting or acquiring new businesses, such as ongoing transaction with Kidman Resources.

At around 2:14 PM AEST on 14 June 2019, WES was trading at A$35.815, down by 1.282% from the previous close. Its year-to-date return is +24.78%, and in the past one year, the return is +17.36%. WES also recorded +25.62%, +11.35% and +4.45% in the past six-month, three month and one-month periods, respectively.

Woolworths Group Limited (ASX: WOW)

Woolworths Group Limited (ASX:WOW) is large-cap stock and constitutes to ASX 20 Index. On 13 June 2019, WOW announced a strategic partnership with Marley Spoon AG (ASX:MMM).

In accordance with the release, the group had injected A$30 million in MMM via debt & equity; subsequently, MMM issued the senior secured convertible notes worth A$23 million along with the issue of MMM shares worth $7 million, which (equity) takes the interest of Woolworths in Marley Spoon to 9%. Also, the debt funding is structured to allow WOW to participate in the growth attributed by the Australian business. Importantly, the partnership entails an initial term of five years while aims to achieve operational synergies through collaboration and focus on the growth of Marley Spoon and Dinnerly brands in Australia.

Woolworths is expecting to benefit in terms of valuable insights from Marley Spoonâs experience and provide its consumers with a new range of meal kits service through the partnership with Marley Spoon. Meanwhile, WOW also believes that Marley Spoon would have similar benefits from the partnership in terms of the consumer base, and the supply chain & sourcing capabilities of the consumer heavyweight.

Brad Banducci, CEO of Woolworths Group, stated that the partnership is in line with the groups objective to meet customersâ needs for meal kits solutions while it also exposes Woolworths to the high-growth market segment of ready-to-cook meal kits. He also acknowledged the demonstrated customer-based approach of Marley Spoon along with innovative and entrepreneurial capabilities.

Fabian Siegel, CEO of Marley Spoon, mentioned the gradual shift of grocery shopping to online platforms while meal kits with home delivery would add value to the consumers with their weeknight meals, and expects to that both parties would be incentivised to grow Marley Spoonâs business in Australia. He also accredited the mentality of the Woolworths group, understanding of business needs and the offer to Marley Spoon to empower its business in Australia.

At around 2:13 PM AEST on 14 June 2019, WOW is trading at A$32.27, down by 0.401% from the previous close. The performance of the stock in the past one-year period is +11.57%, and in the six-month return is +13.72%, and its year-to-date return is +11.15%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.