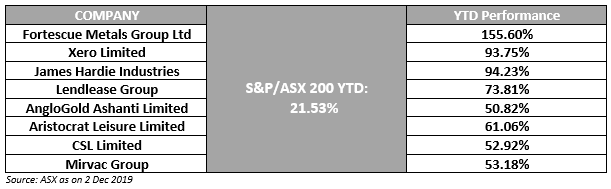

A stock is said to outperform if it delivers a return higher than that of an index, another stock or the overall market. This superior performance indicates that the stock is a profitable addition to oneâs portfolio. Most analysts give such stock a strong buy rating. In this article, we are discussing eight stocks from different sectors listed on the ASX, that have outperformed the market (S&P/ASX 200) as demonstrated in the table below.

Best ASX 200 Stocks

Fortescue Metals Group Ltd (ASX: FMG)

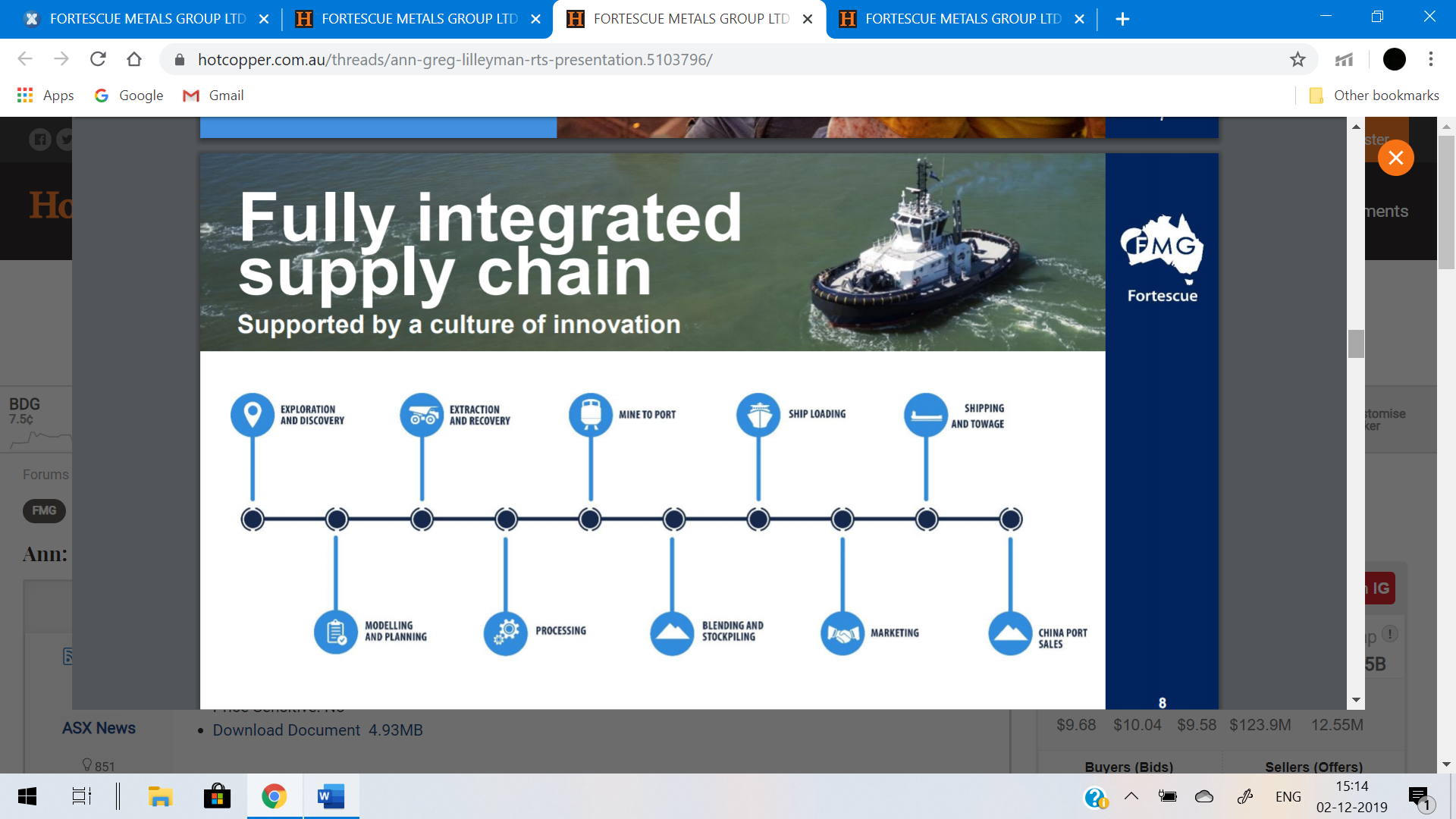

Australia-based Fortescue Metals Group Ltd is engaged in the exploration and production of iron-ore with a wholly-owned fully-integrated supply chain.

Source: Greg Lilleyman RTS Presentation

JV Agreement with Reward: On 13 November 2019, advanced stage sulphate of potash exploration and development company, Reward Minerals Ltd announced to have executed a farm-in and joint venture agreement with Fortescue Metals Group Ltd in the McKay Range, located in north-western Western Australia. The McKay Range Farm-in and JV Agreement between Holocene Pty Ltd, a wholly owned subsidiary of Reward and FMG Resources Pty Ltd, a wholly owned subsidiary of FMG, is over Holoceneâs tenements E45/3285 and E45/4090.

Stock Performance: On 2 December 2019, the FMG stock closed the trading at AUD 10.020, up 2.98% by AUD 0.290. FMG has a market capitalisation of ~ AUD 29.96 billion with ~ 3.08 billion shares outstanding.

Xero Limited (ASX: XRO)

Information technology company, Xero Limited offers an online accounting system that is easy-to-use for small businesses and their advisors around the world.

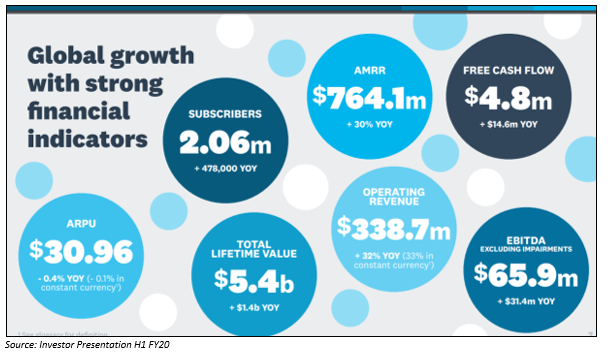

Business Update: On 7 November 2019, Xero announced its half year earnings for the period ended 30 September 2019 (H1 FY20), wherein the company recorded a robust top-line growth along with higher gross margin and free cash flow. An increase of 32% in operating revenue was recorded ($ 338.7 million) and around 30% growth was recorded in annualised monthly recurring revenue to $ 764.1 million. Xeroâs total subscriber base expanded to 2.057 million, up 30% over the prior corresponding period.

Stock Performance: Xero Limited has a market capitalisation of ~ AUD 11.5 billion with ~ 141.45 million shares outstanding. On 2 December 2019, the XRO stock settled the dayâs trade at AUD 82.360, up 1.33% by AUD 1.080.

James Hardie Industries plc (ASX: JHX)

James Hardie Industries plc develops and manufactures fibre-cement siding products such as lap and vertical siding, trim, panels, weather barriers, and cement boards for customers, globally.

Q2 FY2020 Results: On 7 November 2019, James Hardie announced results for the second quarter of the fiscal year 2020 and half year ended 30 September 2019 posting:

- Group adjusted net operating profit of USD 98.6 million for Q2 and USD 188.8 million for the half year, up 22% and 17%, respectively, relative to prior corresponding period (pcp).

- Group adjusted EBIT of USD 134.2 million for Q2 and USD 258.6 million for the half year, up 26% and 21%, respectively, on pcp.

- Group net sales of USD 660.1 million for Q2 and USD 1,316.9 million for the half year, an increase of 2% on pcp.

Stock Performance: James Hardie has a market capitalisation of around AUD 12.96 billion with ~ 447.52 million shares outstanding. On 2 December 2019, the JHX stock price settled the session lower at AUD 28.950, down 0.035% by AUD 0.010.

Lendlease Group (ASX: LLC)

Sydney, Australia-based Lendlease Group is a multinational construction, property and infrastructure company.

New Board Appointment: The company announced, on 29 October 2019, the appointment of Baroness Margaret Ford OBE to the Board as an independent Non-Executive Director, effective from 1 March 2020. Baroness Ford, based in London, UK, is a highly experienced Chairman and Non-Executive Director with a wealth of experience in development and construction, and infrastructure financing.

On-Market Purchase: Lendlease Group advised on 23 August 2019 that the company intends to purchase ~ 2,600,000 Lendlease securities on market for the purpose of funding employee incentive awards and retention awards. The purchase commenced on 23 August 2019 and was expected to be concluded once the aggregate value was achieved, around 10 September 2019. These securities were to be placed into an employee share plan trust until vesting.

Stock Performance: Lendlease Group has a market capitalisation of around AUD 10.9 billion with ~ 564.48 million shares outstanding. On 2 December 2019, the LLC stock settled the dayâs trade at AUD 19.260, down 0.259% by AUD 0.050.

AngloGold Ashanti Limited (ASX: AGG)

AngloGold Ashanti Limited is a holding company for a group of companies engaged in the exploration and mining of gold in different regions internationally. The Group has operations in the Vaal River and West Witwatersrand areas of South Africa as well as Namibia, Mali, Brazil, Argentina, Australia, Tanzania and the United States.

On 3 December 2019, the company announced the appointment of Ms Nelisiwe Magubane as an independent non-executive director to its board of directors, effective 1 January 2020. Additionally, AGG unveiled the appointment of Mr Rhidwaan Gasant as lead independent director, effective 27 November 2019.

Market Update: On 28 October 2019, AngloGold announced an operational update for the quarter ended 30 September 2019, posting:

- A 12% increase in free cash flow to $ 87 million in Q3 2019, a 156% improvement on Q3 2018.

- Increase in production by 3% to 825koz in Q3 2019, supporting expected production improvements in Q4 2019.

- All-in sustaining costs (AISC) increased 12% year-on-year to $ 1,031/oz, primarily due to increase in total cash costs.

- Guidance maintained - production at lower half of the range, costs at upper end of range.

- Adjusted net debt declined by 6% in Q3 2019 to $ 1.646 billion from Q3 2018; adjusted net debt to adjusted EBITDA ratio at 1.06 times.

- All-injury frequency rate at 3.23 injuries per million hours worked in Q3 2019, a 24% improvement on Q3 2018.

Stock performance: With a market capitalisation of around AUD 10.63 billion and ~ 1.91 billion shares outstanding, AGG settled the dayâs trade on 2 December 2019 at AUD 5.510, down 0.72%.

Aristocrat Leisure Limited (ASX: ALL)

Aristocrat Leisure Limited is a leading gaming provider and games publisher, with more than 6,400 employees located in offices around the world.

FY19 Results: For the full year ended 30 September 2019, Aristocrat Leisure announced normalised profit after tax and before amortisation of acquired intangibles (NPATA) of $894.4 million, representing growth of 22.6% in reported terms and 13.9% in constant currency. The company also announced an ordinary fully paid dividend of AUD 0.34 (Record Date: 29 November 2019; Payment Date: 17 December 2019) for the six-month period ended 30 September 2019.

Stock Performance: Aristocrat Leisure has a market cap of ~ AUD 21.66 billion with ~ 638.54 million shares outstanding. On 2 December 2019, the ALL stock settled the dayâs trading at AUD 34, up 0.236% by AUD 0.080.

CSL Limited (ASX: CSL)

CSL Limited is a global specialty biotechnology company, engaged in research, development, manufacturing, and marketing of products to treat and prevent serious human medical conditions.

FY19 Results: For the 12 months ended 30 June 2019, CSL announced a reported net profit after tax of $1,919 million, up 11% or 17% on a constant currency (CC) basis, reflecting-

- Continued strong growth in immunoglobulin and albumin therapies.

- High demand from patients for specialty products - Haegarda and Kcentra.

- Successful evolution of the portfolio containing haemophilia therapies.

- Strong profit growth with Seqirus delivering on strategy.

Stock Performance: CSL has a market cap of ~ AUD 128.6 billion with ~ 453.87 million shares outstanding. On 2 December 2019, the CSL stock settled the dayâs trade at AUD 286.100, edging up 0.92% by AUD 2.60.

Mirvac Group (ASX: MGR)

Mirvac Group is an integrated, diversified Australian property group, comprising an investment portfolio and a development business.

Leadership Changes: Mirvac Group, announced on 19 November 2019, the appointment of Alan Robert (Rob) Sindel as Non-Executive Director on the Mirvac Board, effective 5 August 2020.

1Q20 Operational Update: For the first quarter of financial year 2020 (FY20), the Group maintained its business momentum from FY19, building on the solid metrics reported at the full year and setting the foundations for another strong year ahead.

The Group maintained a high occupancy of 98.4% and completed ~17,700 square metres of leasing activity; and also increased WALE to 6.9 years (6.4 years at 30 June 2019), strengthening the security of future income.

Stock Performance: Mirvac Groupâs market cap stands at around AUD 13.26 billion with ~ 3.93 billion shares outstanding. On 2 December 2019, the MGR stock settled the dayâs trade at AUD 3.390, up 0.593% by AUD 0.020.

Thank you for Reading Best ASX 200 Stock that Outperformed.Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.