Importance of Past Performance and Guidance:

A companyâs assets, along with the profits or losses registered in the past, are the best indicators of its overall value. The past performance of any company, along with its guidance for the next year, helps an individual to assess how the company would perform in the future (future earnings). Guidance provides an idea about the companyâs future performance. It is generally based on the sales projection, marketing conditions and expenses in the past as well as in the future. Guidance plays an important role for investors who either plan to buy, sell or hold the stock.

In this article, we would discuss three technology stocks and unfold their past performance and browse through the guidance.

Data#3 Limited

Data#3 Limited (ASX:DTL) ranks amongst the foremost Australian IT service and solution providers, which helps customers to solve difficult business problems through innovative technology solutions.

Past Performance:

The consolidated business of the company delivered a record result in FY2019, with the total revenue of the company up by 19.8% to $1,415.6 million. The revenue generated through the products increased by 21.3% to $1,167.4 million and service revenue increased by 13.3% to $246.9 million. The company reported a 35.3% growth in public cloud-based revenue ($362.2 million in FY2019).

During FY2019, DTL entered into partnerships with world-leading technology vendors and considered the development and management of these partnerships to be a central focus for the team.

The company made significant progress on its three strategic objectives:

- increasing services margins,

- enhancing overall customer experience and

- helping customers to thrive amid digital transformation.

Financial Highlights:

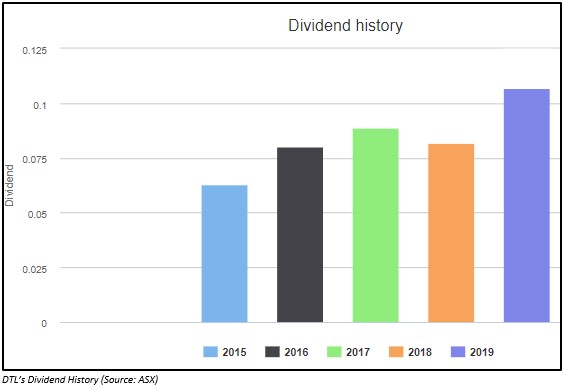

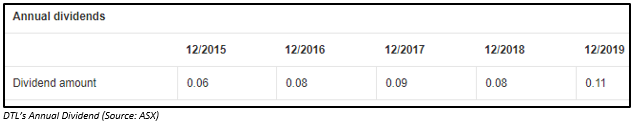

- DTL made a net profit of $18.1 million;

- The company declared a final dividend of 7.10 cents per share;

- Net assets of the company increased by ~ 5.07% to $47.445 million.

- Net cash inflow from operating activities was $11.676 million.

- Net cash outflow from investing activities was $2.943 million and $15.883 million through the financing activities.

- Net cash and cash equivalents by the FY2019 ending 30 June 2019 were $121.198 million.

Guidance:

DTL remains confident about the delivery of its long-term strategy based on strong business, with no material debt, supported by the strong long-term relationships along with the supplier partnership and an extremely qualified and productive team.

The company foresees a growth scope in the Australian IT market and has positioned itself well to capitalise on opportunities.

Developments in early FY2020:

DTL announced the appointment of Mark Esler as Non-Executive Director to the Board, with the term effective from 30 August 2019.

Stock Performance

The DTL shares have generated a YTD return of 102.62%. On 03 October 2019, they opened at $2.950. At 1:10 PM AEST, the stock quoted $3.140, trading up by 1.61% with a market capitalisation of $475.78 million and approximately 153.97 million outstanding shares. The PE ratio of the stock is 26.28x and the annual dividend yield is 3.46%.

Audinate Group Limited

Audinate Group Limited (ASX: AD8) is a provider of professional digital audio networking technologies around the world.

Past Performance:

For Audinate Group, FY2019 was another exciting year during which the company achieved all the financial and operational objectives of FY2019 set at the beginning of the year.

Financial Highlights:

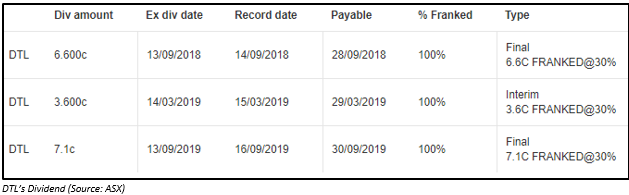

During FY2019, the company reported a 33.6% revenue growth to US$20.3 million. AD8 bills its clients in USD and the strengthening of USD resulted in revenue growth in the Australia dollar by 44% to $28.3 million. The EBITDA improved by 249% to $2.8 million, supported by the revenue growth during the period. The operating cashflow increased from $1.0 million in FY2018 to $3.6 million in FY2019. The company spent $6.7 million during FY2019 into research and development.

The balance sheet of the company strengthened post completion of an over-subscribed institutional placement of $20 million on 6 June 2019. The company raised another $4 million through the share purchase plan.

Operational Highlights:

The revenue of AD8 was generated through its core audio networking business, the companyâs entry within the existing OEM customers and the number of OEMs which adopted Dante for the period.

Product Development:

During the period, the company made its successful entry into the video market and released Dante AV module along with introducing the Dante AV Product Design Suite in June 2019. For the AV module, AD8 follows the same module as its present audio networking business.

The company, in the InfoComm tradeshow that was held on June 2019, released two new software products - Dante Application Library⢠(DAL) and Dante Embedded Platformâ¢.

Dante is a software that runs on operating systems like Linux for Intel and ARM processors.

Outlook:

The company expects that there would be growth in the USD revenue consistent with a long-term historic performance. However, there are possibilities that the results in the near term may get impacted due to the US tariffs and prevailing economic conditions.

Developments in early FY2020:

On 16 July 2019, the company announced the commercial availability of Dante AV Module⢠and the Dante AV Product Design Suite⢠products for order by manufacturers.

Stock Performance

The shares of AD8 have generated a YTD return of 117.98%. On 03 October 2019, the shares opened at a price of $7.730 and at 1:25 PM AEST, they quoted $7.670, trading down by 1.16% with a market capitalisation of $519.32 million and approximately 66.92 million outstanding shares. The PE ratio of the stock is 718.520x.

ELMO Software Limited

ELMO Software Limited (ASX:ELO) is a provider of Software-as-a-Service (SaaS), cloud-based human resources and payroll solutions used by various companies, made available through a single user interface.

Past Performance:

The companyâs revenue from the operating activities increased by 51% to $40.053 million. The company made a loss of $13.180 million, up by 341% as compared to FY2018, an outcome of the increased employee expenses from further hires to support business expansion.

The statutory revenue of the company increased from $31.8 million in FY2018 to $42.6 million in FY2019. The pro forma loss before income tax, finance expenses, depreciation and amortisation was $0.8 million. The growth in the pro forma revenue was driven by revenues through a strong subscription of 95.4% of total revenue along with the high customer retention of over 92%. The customer base expanded by 30.1% as compared to pcp.

For FY2019, ELO reported an increase in the pro forma operating expenses, excluding depreciation and amortisation, driven by continued investment in resources to support the future growth of the company.

The net cash by the end of FY2019 declined as a result of $13.2 million of acquisition related payments. The position of net cash by FY2019 end on 30 June 2019 was $27.698 million.

FY2020 Guidance:

For FY2020, ELO has a positive outlook for the organic development of the business. The company expects a growth in multi-module sales with an expanded product set. It would focus on increased traction in the new market segment and offer an exclusive integrated offering covering HR, payroll, and rostering / time & attendance, investing to achieve sustainable growth.

Developments in early FY2020:

- ELO entered into a partnership with the University of Technology Sydney for the development of the AI-driven Predictive Analytics solution. Through this partnership, the company would be able to improve its comprehensive HR, Payroll and Rostering / Time & Attendance platform.

- ELO completed a $55 million underwritten placement and the secondary sell-down.

Stock Performance

The shares of ELO have generated a YTD return of 20.66%. On 03 October 2019, they opened at $6.700, and quoted $6.650 at 1:41 PM AEST, trading up by 0.75%, with a market capitalisation of $477.94 million and approximately 72.4 million outstanding shares.

After screening through the past performance, FY2020 guidance and the recent developments in these stocks, it can be said that all these players are on the right track of achieving their targets.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.