The Australian economy is the 14th largest economy in the world and is being awarded a AAA rating by all the three global rating agencies around the world. Since 1992 till 2018, Australia has seen a continuous annual economic growth. Robust policy structures, strong institutions, an attractive investment atmosphere along with the deep trade links with the Asian region are some of the major factors for a strong economy.

In industries like energy and resources, agribusiness, education, tourism and financial services, Australian businesses have made significant strides. The country is also growing as well as commercialising new disruptive technologies in various other sectors like education, agriculture, healthcare and financial services.

Australia is known for its resources sector. Many of the countries in Asia still rely on Australiaâs resources sector to meet their needs. The premium foods and agricultural products produced in Australia is in high demand around the world.

In this article, we would look at various ASX listed companies from different sectors and cover their recent update.

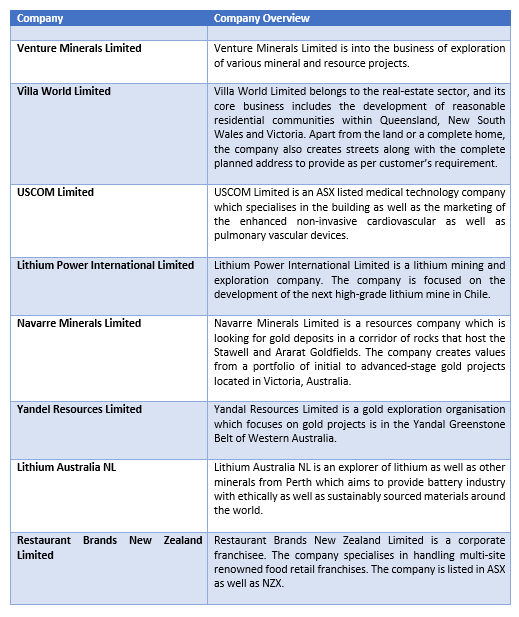

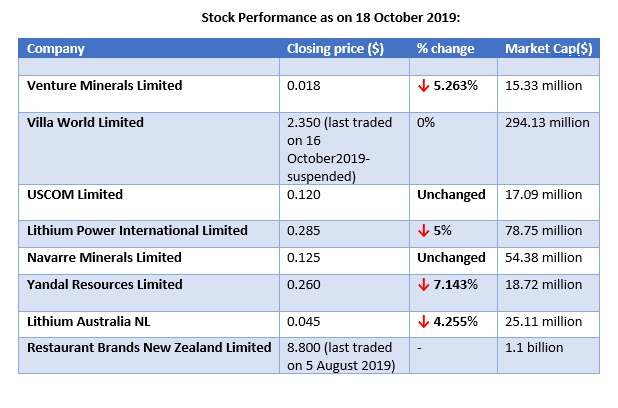

Venture Minerals Limited (ASX: VMS)

Venture Minerals Limited (ASX: VMS) on 16 October 2019 released its Brisbane Resources Roundup Presentation. Below are some of the important points discussed by the company in the presentation.

- The company completed the study of Riley Iron Ore Mine and noted a strong return with respect to Post-Tax Cash generation, IRR, operating cost, pre-production capital estimate, post-tax NPV.

- The Post-Tax Cash generation of $31 million, IRR was 303%, operating cost was $56/t fob.

- The company expects a pre-production capital estimate of $3.6 million, which is fully funded.

- Based on two years of production, the company estimates Post-Tax NPV8 of $27 million.

- The company has targeted its first ore shipment during Q2 FY2020.

- A more cost-effective ore transport solutions are being finalised by the company.

- Appointed an experienced General Manager of operations.

- Signed a full off-take agreement with Tier 1 Global Iron Ore trader.

- Focusing on moving from an explorer to producer.

- The company is uniquely positioned as its Mount Lindsay project remains one of the largest underdeveloped projects in the world which has more than 80,000 tonnes of tin metal.

- The first drill program at Thor Prospect came across huge sulphides verified that Copper-Lead-Zinc target is a 20 km elongated Volcanogenic Massive Sulfide style system in Western Australia.

Villa World Limited (ASX: VLW)

Dividend / Distribution Update:

Villa World Limited (ASX: VLW) provided an update on its dividend/distribution, related to the approval of the scheme of arrangement by the Supreme Court of New South Wales with respect to the proposed acquisition of Villa World by AVID Property Group Australia Pty Limited. The scheme of arrangement is legally effective now and the shareholders would be entitled to a dividend of $2.035 with the record date of 23 October 2019 and would be payable on 30 October 2019.

Redemption of Villa World Bonds:

On 16 October 2019, the company revealed that it aims to redeem entire Villa World Bonds on 30 October 2019.

Bondholders whose name are on the register on Friday 25 October 2019 at 7 pm Sydney time, would be eligible to be paid $100 face value of every VLWâs bond held by them along with any unpaid interest on that bond up to 9 January 2020.

On 17 October 2019, the company released an announcement that shares of VLW would be suspended from quotation. The company also stated that ASX has notified from 17 October 2019, VLW bonds will also be suspended from trading.

USCOM Limited (ASX: UCM)

USCOM Limited (ASX:UCM) on 16 October 2019 released its AGM presentation where it highlighted its FY2019 results for the period ended 30 June 2019.

- Total income increased by 27% to $3.64 million

- Sales increased by 31%.

- Cash consumption decreased by 28% to $1.21 million.

- The company has zero debt.

- In 6 years, the total income of the company increased by 260% and sales by 358%.

- China is the major market for the company. USCOM 1A is the lead product in this region. 62% of the total sales is from China/Asia.

- In 2019, the USCOM 1A contributed 75%, SpiroSonic contributed 20%, and BP+ contributed 5%.

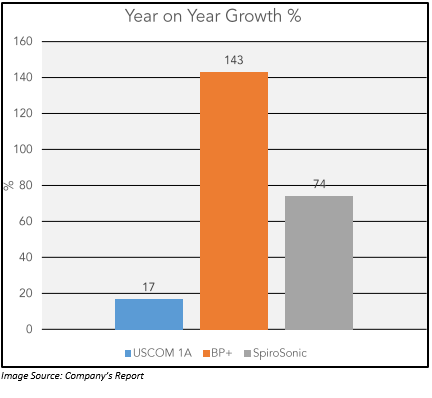

- Q4 FY2019 for the company was a record quarter with respect to increasing in the manufacturing of USCOM 1A by 17%, BP+ by 143% and SpiroSonic by 74% year on year.

Lithium Power International Limited (ASX: LPI)

Environmental Impact Assessment (EIA) Update:

On 16 October 2019, Minera Salar Blanco S.A., the joint venture company of Lithium Power International Limited (ASX:LPI) was notified that the Chilean Environmental Service extended the EIA assessment procedure for 60 days.

Generally Chilean regulations sets 120 days period for evaluating any project that is submitted in the country. However, it can grant the one-time extension to the Environmental Service in case there is a need to complete the evaluation process.

LPI expects a resolution from environmental services in Q1 FY2020.

Navarre Minerals Limited (ASX: NML)

Placement of 43.2 million shares to raise $4.75 million:

Navarre Minerals Limited (ASX:NML) on 16 October 2019 announced that it had received subscriptions for the placement of 43.2 million shares to raise $4.75 million at $0.11 per share. The placement received huge support and had strong demand from the new as well as the existing shareholders.

The funds raised by the company would help in strengthening its working capital position and to take up exploration programs at several prospects in the emerging Stavely Arc mineral province. The funds would also provide flexibility in expanding the scale of the drilling activities at the Stawell Corridor Gold Project.

Yandal Resources Limited (ASX: YRL)

Preliminary Metallurgical Test Work completed:

Yandal Resources Limited (ASX: YRL) on 16 October 2019 announced the conclusion of the preliminary metallurgical test work on oxide as well as transitional rock samples from the Flushing Meadows gold deposit which is a part of the companyâs 100% owned Ironstone Well gold project located near Wiluna in the Yandal Greenstone Belt of WA.

- Around 96% of gold was recovered from conventional gravity and cyanide leach processing on oxide RC drill samples that was of more than 80 m vertical depth.

- A transitional Reverse Circulation (RC) drill sample in the range of 89 m to 94 m vertical depth returned 84% recovery with gold, linked with 4% pyrite along with small arsenopyrite.

- There would be follow-up test work utilizing representative diamond core samples which are scheduled upon the closure of the present RC drilling program in the March Quarter 2020.

Lithium Australia NL (ASX:LIT)

On 16 October 2019, Lithium Australia NL (ASX: LIT) released an announcement where it highlighted that, it invested an additional $100,000 in Envirostream Australia Pty Ltd ('EA'). As a result, now its equity in EA has increased from 18.9% to 23.9%.

The companyâs exposure to the procedure of gathering as well as separating spent lithium-ion batteries got increased post this.

Restaurant Brands New Zealand Limited (ASX: RBD)

1H FY2020:

Restaurant Brands New Zealand Limited (ASX: RBD) on 16 October 2019 released its 1H FY2020 results for 28 weeks ended 9 September 2019.

- The total group sales increased by 2.7% to NZ$442.6 million.

- The net profit after tax of the group decreased by 2% to NZ$20 million due to the adoption of new lease accounting standard NZ IFRS 16.

- New Zealand operating revenue increased by 0.8%to $246.8 million as compared to the previous corresponding year.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_01_09_2025_07_01_12_631371.jpg)