Iron ore prices have shown a significant uprise since December 2018 amid supply shortage and high steel demand in the Chinese domestic market. The prices of most actively traded September series of Dalian Commodity Exchange iron ore 62% grade futures (DCIOU9) rose from the level of RMB 448.00 (low in December 2018) to the level of RMB 774.50 (Dayâs high on 28th May 2019).

Likewise, the prices of June series iron ore 62% grade futures (TIOM19) on the Chicago Mercantile Exchange surged from the level of US$61.54 (low in December 2018) to the level of US$102.50 (High in May 2019).

The factor which supported the iron ore prices was the shortage supply in the global market, created from the production loss of mammoth iron ore miners such as Vale, Rio Tinto (ASX: RIO), BHP Billiton (ASX: BHP), Fortescue Metals (ASX: FMG), etc.

After the ban on its Brucutu Mine, Vale lost an ample amount of production, and soon the Australian miners experienced a production loss due to the impact from the Tropical Cyclone Veronica. The overall scenario caused a large gap between the supply and demand, which in turn, supported the iron ore prices.

On the demand front, the steel prices have marked a consistent rally in the past, which in turn, prompted mills to engage in higher procurement of iron ore; thus, increasing the demand and supporting the raw material prices.

SHFE Steel Rebar Price Curve (October Series) (Source: SHFE)

Status Quo:

In the status quo, the iron ore prices dropped from its Mayâs multi-year high of RMB 774.50 to the level of A$721.50 (Dayâs low on 6th June 2019), and are recovering to the top again.

DCIOU9 Daily Chart (Source: Thomson Reuters)

With iron ore prices again moving up, the share price of the behemoth iron ore miners is also taking a U-turn; however, the small-cap miners are pulling up their socks in the environment of rising commodity prices, and it would be worthwhile looking these miners from tip to toe.

Centaurus Metals Limited (ASX: CTM)

CTM is an Australian Securities Exchange listed exploration and evaluation activities related company in the mineral space. The significant prospects of the company include Mombuca Gold project, Conquista Direct Ship Ore project, which is an iron ore project, and Jambreiro Iron Ore project. Centaurus holds copper-based projects including- Aurora Copper Project and Pebas Copper-Gold Project in the State of Ceara, Brazil.

The iron ore-based project of the company is also in Brazil, a country with substantial iron ore deposits, which could give CTM an advantage over the long run.

CTMâs Iron Ore Prospects:

Jambreiro Iron Ore Project:

CTM conducted a Feasibility Study of the prospect in December 2013, which suggested low operating costs and durable economics related to the project.

As per the Feasibility Study the dual Ps (Proven and Probable) Ore Reserves of the prospect stands at 48.5 million tonnes with an average grade of 28.1 per cent Fe, and the production rate is at 1 million tonnes per annum, which is comparatively less as compared to the giant miners of Australia such as Rio Tinto (ASX: RIO), BHP Billiton (ASX: BHP), Fortescue Metals (ASX: FMG), and the Brazilian mammoth- Vale.

CTM is licensed for a shovel-ready production of 3 million tonnes per annum, which if we compare to the size of the company, is relatively significant.

The current mine of life is estimated to be 18 years by the company with a total revenue consideration of A$750 million and an EBITDA of A$350 million with a capital cost of A$53 million.

The annual average operating cash flow is estimated to be at A$19.4 million. In the Feasibility study, the company estimated the average sales price during the life of mine to be at A$41.3 per dry metric tonne, with an operating cash cost during the life of mine of A$22.0 per dry metric tonnes.

However, strengthening iron ore prices have prompted the company to update the previous Feasibility test, which, in turn, provided the company with a strategic view.

Jambreiro now stands as a high-quality (28.1 per cent Fe) iron ore asset, which could take advantage of the shortfall in the iron ore supply chain. Though the giants with high production capacity could take advantage as well, but the iron ore price momentum could benefit CTMas well, and investors may wish to keep such stocks under radar.

Financial Profile:

The company inched up its exploration expense in the financial year 2018, which stood at $2,463,216 for the year ended 31st December 2018, which marked an increase of 16.14 per cent annually, as compared to $2,120,845 in the year ended 2017.

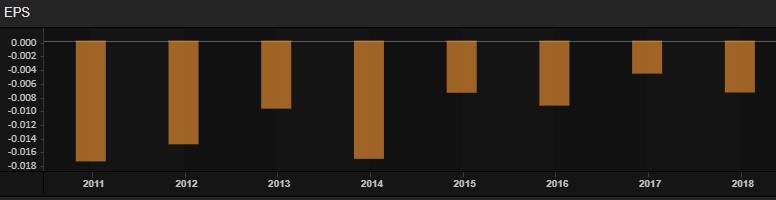

However, the loss for the period also inched up from $3,632,809 to $4,197,361, and earnings per share declined to 0.19 cents from 0.26 cents a share for the period ended 31st December 2018.

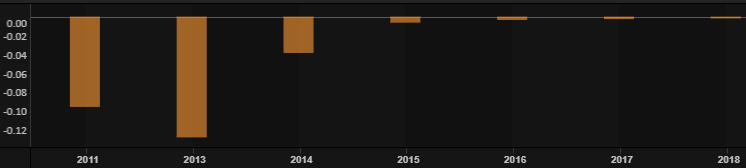

The EPS is, however, improvising year-on-year from the year 2013.

Resource Profile:

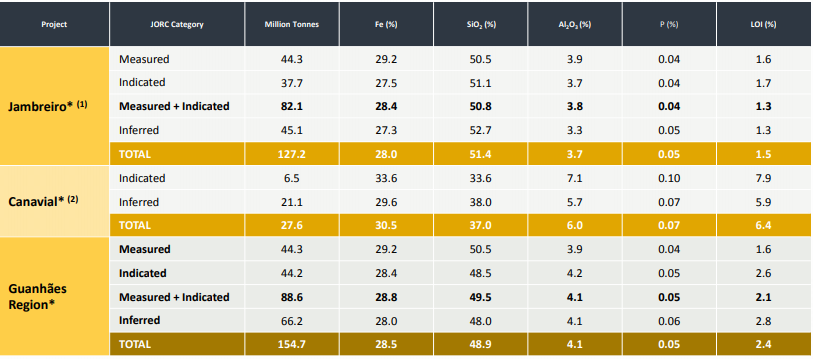

CTM holds a vast line of mineral and ore resources, the total Mineral Resources at Jambreiro is at 127.2 million tonnes. The Mineral Resources at other prospect and classification of the resources are as follows:

Source: Companyâs Report

Price Actions:

CTMâs shares moved in a downtrend from the level of A$0.018 (High in May 2018) to the level of A$0.005 (Low in April 2019). Post reaching the level of A$0.005, the share price of the company demonstrated a sharp upside and made a high of A$0.009 in May 2019 and dropped by 2 cents to A$0.007 in June, where are prices are currently hovering.

Venture Minerals Limited (ASX: VMS)

VMS is an Australian Securities Exchange listed mineral explorer who operates in Australia and Thailand. The business portfolio of the company contains multi-commodity prospects, as the company hosts projects of copper, gold, and iron ore. Venture Minerals hold many prospects, including Pak Yang and Thali in the Loei Belt. The iron ore prospect of the company goes by the name of Riley DSO, which is a hematite-rich pisolitic and cemented laterite. Apart from Riley DSO, VMS also hosts one ore deposit- Livingstone deposit.

With iron ore prices showing the upside momentum again, Venture Minerals is reviewing its Riley Iron Ore Mine on a priority basis for a potential restart.

VMSâ Iron Ore Prospects:

Riley DSO:

VMS wholly owns the deposit and defined Maiden Resource of 2 million tonnes with an average grade of 57 per cent in 2012, which in turn, inched up by Direct Shipment Ore (DSO) deposit Maiden Resources to 4.4 million tonnes. As per a mining study conducted by Rock Team, an independent mining engineer, the conversion rate of the deposit from resource to reserves stand at 90 per cent.

The presence of such a high conversion rate along with high-grade makes the prospect a potential iron ore project; however, some appeals to the projectâs approval and weaker prices in the international market prompted the company to the shut the project in 2014.

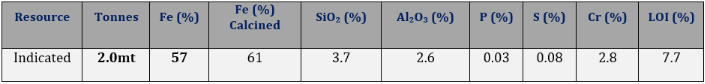

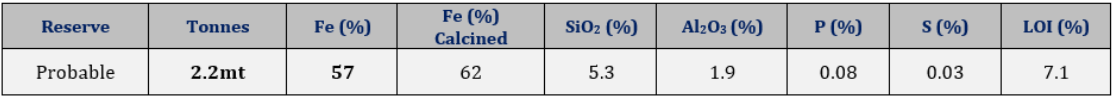

Venture Minerals received news regarding the Federal Court dismissal of appeals against the project in 2015; and the high price environment is providing the company with an impetus to restart the project, which VMS kept on a priority to review during the quarter ended 31st March 2019. The resource profile of the deposit is as follows:

Resources and Reserves of Riley Ore (last updated in 2012) (Source: Companyâs Website)

Livingstone DSO Deposit:

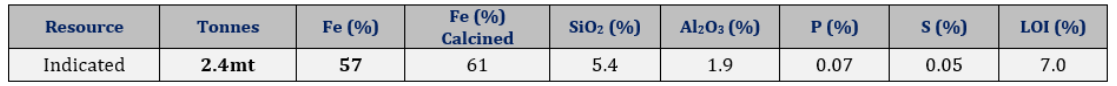

VMS wholly owns the deposit and defined Maiden Resource of 2.2 million tonnes with an average grade of 58 per cent as in 2011. The company completed the resource upgrade in 2012, which in turn, converted the entire inferred resource into indicated.

The resource profile of the deposit is as follows:

Resources and Reserves of Livingstone DSO (last updated in 2012) (Source: Companyâs Website)

With such high-grades in hand, the company is now underway to develop and commence the production from both the prospects amid a high price environment, and the company recently completed an Institutional Entitlement Offer.

Financial Profile:

During the quarter ended 31st March, VMS marked a cash outflow of A$318K for the exploration activities; total outflow of A$1,694K in the past nine months (in March).

The overall loss of the company before tax stood at $3,511,165 for the year ended 30th June 2018, which was 96 per cent up as compared to a loss of $1,782,967 in the previous corresponding period. The Earnings per share (EPS) also declined for the financial year ended 30th June 2018 as compared to the EPS in 2017.

However, the EPS is improving from the financial year 2014.

Price Actions:

VMSâ shares declined from the level of A$0.074 (High in November 2017) to the level of A$0.023 (low in April 2019), and recovered slightly to A$0.029 (high in May) from where it again declined to hover around A$0.020 (as on 12th June 2019 AEST 2:24 PM).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_07_04_2025_07_17_24_352003.jpg)