Growth Stocks: Things to Know

Growth stocks belong to those companies that are fast growing or expected to grow at a rate that is a lot above the market average in the foreseeable future. Generally, these companies tend to be young and flourishing through their growth phase with a potential to offer great returns to the shareholders. The companies under this category tend to plough back their excess earnings and profits into the business to drive expansion projects, R&D and innovation, thus driving further growth in the short term.

In addition, growth stocks are usually associated with sustainable positive cash flow, high revenues and gross margins, high price-to-earnings (P/E) ratios and high price-to-book ratios. Examples of global growth stocks include Netflix, Invidia, Dropbox, Amazon, Spotify etc.

Since there are no dividends, investors planning to add these gems to their portfolios must be on top of their investments and earn money through capital gains, encashing rapid price appreciations by selling their shares whenever the opportunity arises. The advocates of Growth investing believe that although growth investing is capable delivering impressive profits, this aggressive strategy may not be suitable for everyone.

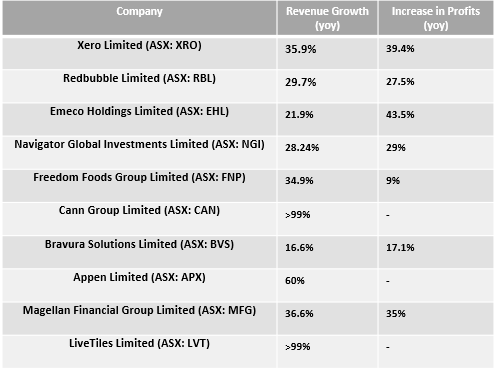

Moreover, every stock has the potential to be a growth stock in a booming economy when the GDP is growing, unemployment rate is low, consumer confidence is high and interest rates are low. Some of the ASX-listed companies that may be considered as growth stocks are listed below:

YOY- Year on year % change from FY18 to FY19

Letâs discuss Xero Limited, Appen Limited, Magellan Financial Group Limited, LiveTiles Limited and Freedom Foods Group Limited in detail.

Xero Limited

Global software services company, Xero Limited (ASX:XRO) is based in Wellington, New Zealand and offers a cloud-based accounting platform, Xero, which connects small businesses to advisors in different sectors such as hospitality, non-profit, construction, legal and many others.

Xeroâs market cap is ~ $ 9.19 billion with ~141.37 million shares outstanding. On 6 September 2019, the XRO stock price closed the trading at $ 66.500, up 2.29%. Also, the stock has delivered a positive return of 54.97% Year-to-date. It is a popular growth stock amongst investors in Australia.

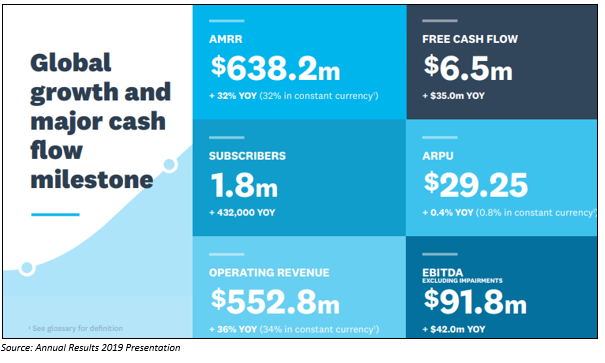

FY19 Resultsâ For the year ended 31 March 2019, Xero reported a 32% year-on-year increase in annualised monthly recurring revenue to $ 638.18 million and 36% year-on-year improvement in operating revenue to $ 552.82 million. The total number of subscribers also increased by 432,000 over the year and the total subscriber lifetime value increased 36% year-on-year to $ 4.4 billion. The gross margin percentage edged up two percentage points to 84%. The EBITDA, excluding impairments, also increased by $ 42 million year-on-year to $ 91.8 million.

In addition, the companyâs free cash flow also improved year-on-year to $ 35 million.

Appen Limited

New South Wales, Australia-based Appen Ltd (ASX: APX) collects and labels image, text, speech, audio, and video data used to build and continuously improve the worldâs most innovative artificial intelligence systems. Appen has a market capitalisation of around $ 3.08 billion and ~ 120.98 million shares outstanding. On 6 September 2019, the APX stock settled the dayâs trading at $ 26.120, up 2.55%, with ~ 1.97 million shares traded. In addition, the APX stock has delivered a YTD return of 98.98% and 4.3% in the last six months.

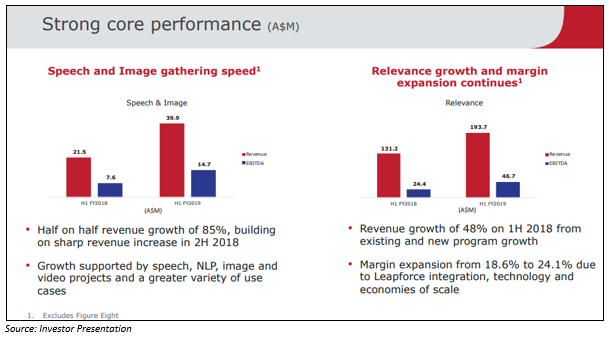

H1 FY19 Results- According to the companyâs financial results for the half year to 30 June 2019, the revenue increased by 60% to $ 245.1 million, the underlying EBITDA by 81% to $ 46.3 million, underlying EBITDA margin expanded from 16.8% to 18.9% and the underlying NPAT also improved significantly by 67% to $ 29.6 million.

The company has a robust balance sheet with Net Assets of $ 458.7 million including cash of $ 70.8 million. The cash flow from operations also increased by 98% during the year and remains strong.

Magellan Financial Group Limited

Sydney, Australia-based Magellan Financial Group Limited (ASX:MFG) is a specialist funds management company established in 2006. Magellanâs core subsidiary, Magellan Asset Management Limited, has ~$ 92.092 billion of funds under management (FUM) as at 30 August 2019.

Magellan Financial Groupâs market capitalisation stands at around $ 9.63 billion with ~ 182.07 million shares outstanding. On 6 September 2019, the MFG stock price settled the dayâs trading at $ 54.320, edging up 2.7%, with ~ 651,050 shares traded.

In addition, the MFG stock has delivered positive returns of 126.32% Year-to-date and 46.84% in the last six months.

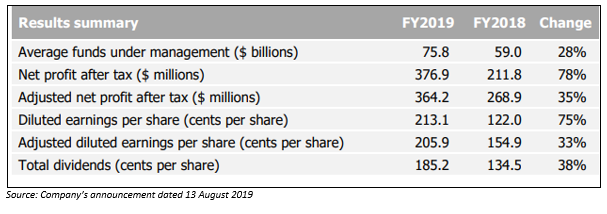

FY19 Results â According to Magellan Financial Groupâs financial results for the year ended 30 June 2019 (FY19), the net profit after tax (NPAT) increased by 78% to $ 376.9 million while the adjusted net profit after tax grew by 35% to $ 364.2 million.

The total dividends for the year increased 38% to 185.2 cps. The effective tax rate stood at 23.6% for the year.

LiveTiles Limited

Global software company, LiveTiles Limited (ASX:LVT) is headquartered in New York, US, and provides intelligent workplace software to the government, commercial and education marketplaces, and is an accoladed Microsoft Partner. Few of its products include LiveTiles Intelligence, LiveTiles Design, LiveTiles Bots, LiveTiles Intelligent Workplace etc. Itâs operations are spread across the UK and US, Europe, the Middle East belt and APAC region.

LiveTilesâ market capitalisation stands at around $ 270.87 million with ~ 660.67 million shares outstanding. On 6 September 2019, the LVT stock price settled the dayâs trading at $ 0.400, down 2.43% with ~ 1.9 million shares traded.

The stock has also delivered positive return of 20.59% Year-to-date.

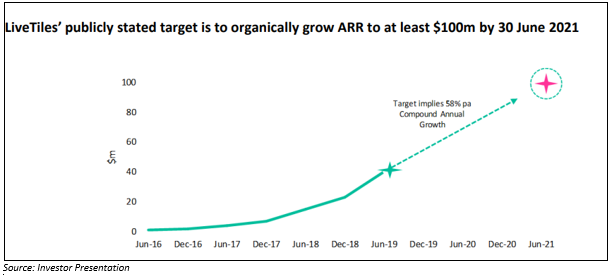

FY19 Results- On 27 August 2019, LVT released its financial results for the financial year ended 30 June 2019, posting a staggering increase of 218% in the revenue from ordinary activities to $ 18.09 million. The company had $ 40.1 million of annualised recurring revenue (ARR) as at 30 June 2019 with a stated target of achieving $ 100 million of ARR by June 2021.

Freedom Foods Group Limited

Freedom Foods Group Limited (ASX: FNP) is engaged in the production and sale of soy yogurts, beverages, dips and vegetarian soy-based foods. Besides, the company also manufactures, distributes and markets natural foods and distributes and markets canned seafood. Freedom Foods Group has a market capitalisation of around $ 1.58 billion with ~ 272.9 million outstanding shares. On 6 September 2019, the FNP stock settled the dayâs trading at $ 5.680, down 2.06%, with ~ 1 million shares traded.

Besides, FNP has delivered positive returns of 19.59% in the last six months, 25.27% YTD, and 12.62% in the last three months.

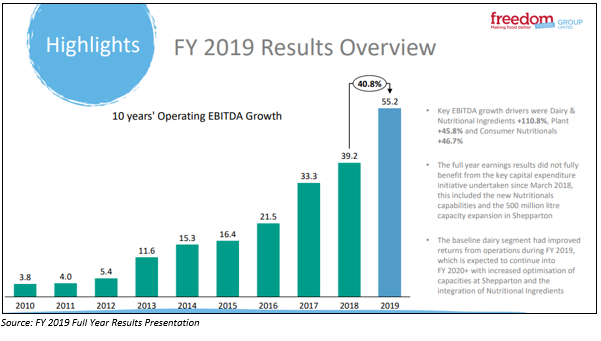

FY19 Results Overview â According to the Groupâs FY19 Results, the net sales increased 34.9% ($ 123.2 million) to $ 476.2 million, and the operating EBITDA increased 40.9% to $ 55.2 million while the EBITDA margins expanded from 11.1% to 11.6%. The companyâs operating NPAT improved by 40.1% to $ 21.9 million and the final unfranked dividend of 3.25 cents per share was declared for the shareholders.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.