The dynamic businesses across the globe are witnessing trade war at one end and technological advancements on the other. Amid these diversities impacting the business and investing world, the equity market has been twisting and turning to the repercussions laid down by factors impacting the globe.

This article would focus on technology and e-commerce player, Amazon, which trades on the NASDAQ, and is likely enduring a bear market situation presently.

What is a bear market?

A bear market is the one wherein the share prices have been falling and encourage sale. This ideally depicts negative investors sentiment and depicts a decline in the overall stock market or exchange index. The bear market is caused due to weakening and gradual slowing of an economy, driven by low employment rates, low income, amendment in government regulations and tax rates, drop in business profits and weak productivity in the economy. This slumps the investorâs confidence in the economy and arouses a sense of fear of adverse monetary returns. One of the most impacted and prolonged bear markets occurred during the Great Financial Crisis, between 2007 and 2009 and lasted for approximately 17 months, at a stretch. During a bear market situation, investors make money through short selling, put options, and inverse ETFs.

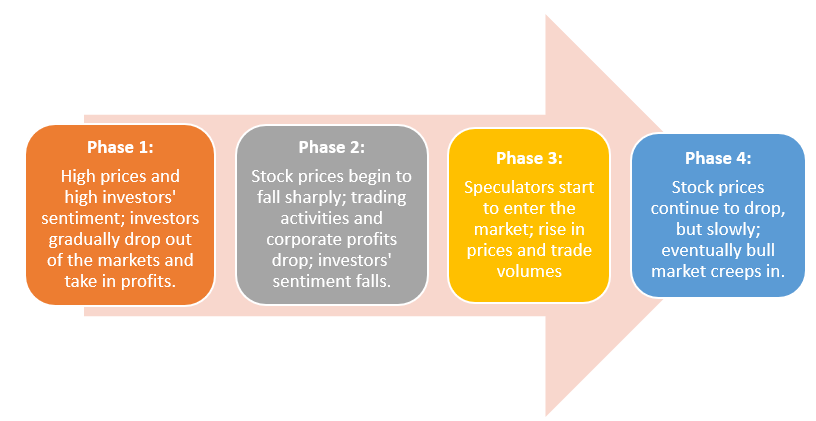

A bear market could have the following four phases:

The contrary situation of the bear market is the bull market, where prices for securities are rising or are expected to rise.

These market conditions get their names from the way a bear attacks its prey (with paws down, depicting the downward trend of stock prices) and the way a bull attacks (with thorns in the air, depicting the upward trend of stock prices).

Acquaint yourself with Amazon.com

A participant of the Big Four Tech companies and constituent of FAANG (Facebook, Apple, Amazon, Netflix and Google) and one of the most famous and talked-about American multinational and tech-savvy player, Amazon.com has its focus on e-commerce, digital streaming (amazon prime video and amazon music), cloud computing and artificial intelligence. The company was founded by Jeff Bezos in 1994 and is headquartered in Seattle and Arlington. It is the first of its kind to disrupt the well-established industries through technological innovation and mass scale and is the largest AI assistant provider, e-commerce marketplace and cloud computing platform across the globe. The company is also the largest internet player by revenue and employees over 600,000 people alone in the US. Amazon trades as AMZN on the NASDAQ and went public in 1997.

The Bear Case Against Amazon?

Market experts state that there have been challenges piling up around Amazon. Experts have anticipations that a negative cash flow, poor working-capital management and high debt load in a competitive environment might have Amazon under both risk and scrutiny. Even though it is extremely difficult to value a revolutionary company like Amazon, the giant might fall victim to the slump in the economic conditions prevailing in the present time.

However, a section of retail experts believe that the company is becoming a profit machine and the growth in the Amazon Web Services division and advertising businesses might deliver an all-time high by the end of 2019, as the company was growing rapidly.

With these opinions, it would be an interesting watch to witness the unfolding of the Amazon stock in the days to come.

Amazonâs Financial Update

On 25 July 2019, the company announced its financial results for the second quarter ended June 30, 2019. For the trailing twelve months period, the operating cash flow increased by 65 per cent to $36 billion. The free cash flow was up to $25 billion. In the quarter, Amazonâs net sales were up by 20 per cent and amounted to $63.4 billion, and operating income increased to $3.1 billion. The net income rose to $2.6 billion.

According to AMZNâs founder, Mr Bezos, customers were responding to Primeâs move to one-day delivery and the company witnessed positive feedback and accelerating sales growth. Moreover, the company introduced the all-new Echo Show 5, the all-new Kindle Oasis, the all-new Fire 7 and the all-new Fire 7 Kids Edition tablet and Echo Dot Kids Edition during the quarter. It also thrives to enhance its Alexaâs features and capabilities, and introduced the ability for Alexa developers to earn money using in-skill purchasing for their skills in Japan, Germany, and the U.K.

Amid accolades, the company was named the Marketplace Innovator of the Year at the 2019 Disability:IN Inclusion Awards, while Prime Video received 47 Emmy nominations for its original programming.

Amazonâs Outlook

As outlook and subject to substantial uncertainty, the company expects net sales to range between $66.0 billion and $70.0 billion in Q319 and anticipates the unfavourable impact of approximately 30 basis points from foreign exchange rates. The operating income is likely to be in the range of $2.1 billion and $3.1 billion.

Recent With Amazon

The company recently announced that AmazonFresh had expanded to three new cities, Minneapolis, Houston and Phoenix, enabling the prime members to avail meat, sea food and daily essentials for free two-hour delivery. In another announcement, the company intimated that it was on track to invest over $15 billion in 2019 in infrastructure, people, tools, services, and programs to help third-party sellers succeed. The company has launched tools like Sold by Amazon, Target Inventory Levels and Amazon Marketplace Appstore to aid Independent third-party sellers.

Pacing its tech-game, Amazon notified about the general availability of Amazon Forecast. Besides this, the company opened a new office in Portland where it aims to twice its tech workforce and create approximately 400 new high tech jobs.

Stock Performance

After the close of the dayâs trade session on 30 August 2019, NASDAQ: AMZN quoted $1,776.29, down by 0.57 per cent, relative to its last trade. The market capitalisation of the company on the exchange is $878.65 billion and the P/E ratio of the stock is 73.64x.

Amid all market speculation, financial performance and growth perspectives, it would be interesting to validate the stockâs trend and the path it follows- bull or bear, in the days to come. Investors have always regarded Amazonâs stock as one of the favourites, but the dynamicity of the business world overpowers these sentiments.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.