The S&P/ASX 200 Consumer (Discretionary) Sector closed the dayâs trading at 2,566.1 on 18 September 2019, down by 0.21% or 5.5 points, while the benchmark index S&P/ASX 200 settled at 6,681.8, down by 13.5 points or 0.2% on the same day.

In this article, five companies operating in the consumer discretionary sector have been discussed.

Helloworld Travel Limited

Helloworld Travel Limited (ASX: HLO), a travel distribution company, is headquartered in Sydney, Australia. The company has retail travel networks and online operations. Additionally, it offers corporate travel management, destination management and wholesale travel services.

FY2020 Earnings Guidance

On 17 September 2019, the company updated the market with earnings guidance for FY2020, after the finalisation of its major new GDS contract and commercial agreements for the year. EBITDA is expected to lie between $83 million and $87 million for FY2020 ending 30 June 2020. According to the companyâs CEO, HLO is confident of achieving strong growth in the reported financial year.

FY2019 Results

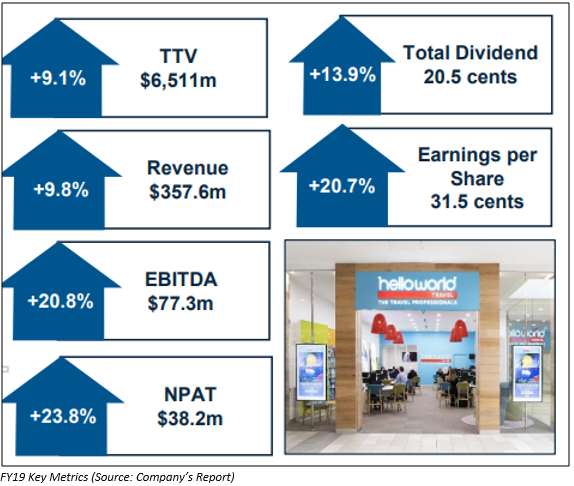

On 21 August 2019, HLO released its FY2019 results. Some highlights from the release are:

- Revenue increased by 9.8% to $357.6 million compared to the previous corresponding year (PCP)

- EBITDA grew by 20.8% year-on-year to $77.3 million

- Net profit after tax of the company increased by 23.8% to $38.2 million

- Total dividend for the year stood at 20.5 cps, a 13.9% increase from the previous year

Stock Performance

With ~124.72 million outstanding shares and a market cap of $569.97 million, the stock of HLO closed the dayâs trading at $4.580 on 18 September 2019, up 0.219% from the previous close. The 52-week high and low value of the stock is $6.450 and $4.000, respectively. The stock generated a positive return of 0.22% in the last six months and a negative return of 24.71% on a year-to-date basis.

Nick Scali Limited

Nick Scali Limited (ASX: NCK) is an importer of quality furniture in Australia. The company got listed on the Australian Stock Exchange in the year 2004 under the ticker âNCKâ in the consumer discretionary sector. Some of its products are dining tables, lounges, chairs, dining chairs, buffets and coffee tables. The company is involved in the retailing of household furniture and related accessories.

September Updates

- On 10 September 2019, NCK announced that UBS Group AG and its related bodies corporate have ceased to be a substantial holder of Nick Scali Limited.

- On 6 September 2019, the company informed that its Annual General Meeting would be held on 29 October 2019.

- On 5 September 2019, the company unveiled that KUKA Investment and Management Co., Limited disposed of its 11.04 million ordinary shares in Nick Scali.

Financial Highlights

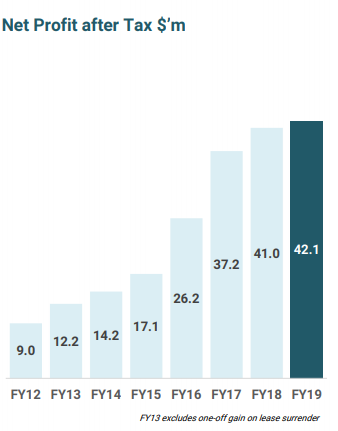

For FY2019, Nick Scali reported NPAT of $42.1 million, up by 2.8% on previous corresponding year, representing 7th consecutive record profit growth for the company. Sales increased by 7% to $268.0 million (FY18: $250.8 million), while gross margin grew by 20 bps to 62.9%. The company also declared a final dividend of 20.0 cps.

NPAT Growth (Source: Companyâs Report)

NPAT Growth (Source: Companyâs Report)

Stock Performance

On 18 September 2019, the stock of NCK settled at $7.090, up 0.425% from its previous close, with a market cap of $571.86 million and ~81 million outstanding shares. The 52-week high and low value of the stock is $7.390 and $4.880, respectively. The stock generated a positive return of 18.66% in the last six months and 38.16% on a year-to-date basis.

Kathmandu Holdings Limited

Kathmandu Holdings Limited (ASX: KMD), headquartered in Melbourne, is a retailer, engaged in developing sustainable products like clothing, travel accessories and other equipment. KMD opened its first store in 1987. Its product breakdown is ~ 40% of equipment and 60% of apparel.

FY2019 Highlights

During the year ended 30 June 2019, the company reported

- Sales of $545.6 million, up 7% year-on-year

- NPAT of $57.6 million, representing an increase of 13.6% from the previous year

- Online sales of $48.4 million

- Operating expenses reduced by 2.5% as a percentage of sales

- Rolled out World Ready, the companyâs first global brand campaign

Director Nominationsâ Closing Date

On 12 September 2019, the company unveiled that the closing date for receiving director nominations is 27 September 2019. The nomination can only be made by a shareholder entitled to attend the Annual General Meeting.

Stock Performance

On 18 September 2019, the stock of KMD closed the dayâs trading at $2.830, up 7.605% from the previous close, with ~226.74 million outstanding shares and a market cap of $596.33 million. The 52-week high and low value of the stock is $3.180 and $1.955, respectively. The stock generated a positive return of 10.04% in the last six months and 0.38% on a year-to-date basis.

Audio Pixels Holdings Limited

Audio Pixels Holdings Limited (ASX: AKP), established in 2006 and listed on ASX in 2004, has developed a technological platform for reproducing sound. The company uses the latest technologies to generate sound waves from an audio stream using micro-electromechanical structures (MEMS).

Special Crossing

On 17 September 2019, the company announced that there was a special crossing of 450,000 shares in AKP pre-market on the day. The shares, which were overhanging the market for some time, were purchased by Bart Superannuation Pty Limited and other shareholders.

1H19 Financial Highlights

On 29 August 2019, the company announced half-yearly results for the period ended 30 June 2019. Few highlights from the results released are below.

- Revenue from ordinary activities increased by 330% to $157,024

- Net loss attributable to shareholders stood at $2.56 million

- Cash and cash equivalents of the company reached $8.62 million

Stock Performance

On 18 September 2019, the stock of AKP settled at $18.800, down 1.828% from its previous close. The company has ~28.3 million outstanding shares and a market cap of $541.98 million. The 52-week high and low value of the stock is $24.750 and $11.100, respectively. The stock generated a negative return of 6.63% in the last six months and 12.56%% on a year-to-date basis.

Ardent Leisure Group Limited

Ardent Leisure Group Limited (ASX:ALG) is one of Australiaâs leading companies engaged in operating and owning premium leisure assets. The group includes assets - WhiteWater World, SkyPoint and Dreamworld theme parks and attractions across Australia. Moreover, it has a growing portfolio in the United States. The company is scheduled to hold its annual general meeting on 13 November 2019.

ALG Assets (Source: Companyâs Website)Removal from S&P/ASX 200 Index

On 6 September 2019, S&P Dow Jones Indices announced changes in S&P / ASX Indices. As per the announcement, Ardent Leisure Group Limited would be removed from the S&P ASX 200 Index, effective at the open of trading on 23 September 2019.

Change of Director's Interest

On 5 September 2019, the company announced a change in the indirect interest of director, David Haslingden, in ALG. The director acquired 192,307 ordinary shares for a consideration of $1.03 average price per ordinary share, owing to which the number of securities held by the director increased to 523,980.

FY2019 Financial Highlights

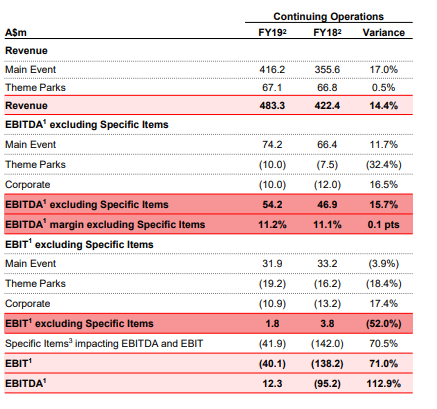

- Revenue and EBITDA (before specific items) from continuing businesses increased by 14.4% and 15.7% year-on-year, respectively

- Constant centre revenue declined by 1.0% on a like-for-like basis

- Net loss after tax reduced from $90.7 million in FY2018 to $60.9 million in FY2019

Main Event and Theme Parks (Source: Companyâs Report)

Stock Performance

On 18 September 2019, the stock of ALG closed the dayâs trading at $1.030, down 1.905% from its previous close. The company has ~479.71 million outstanding shares and a market cap of $503.69 million. The 52-week high and low value of the stock is $1.675 and $0.975, respectively. The stock generated a negative return of 18.29% in the last six months and 26.83%% on a year-to-date basis.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.