In this article, we discuss two stocks from media space in Australia. On 22 August 2019, these two corporations have declared their respective annual report for the period closing 30 June this year. Concurrently, the Australian benchmark index, on 23 August 2019, was trading at 6,524.7, up by 22.9 points or 0.4% (at AEST12:12 PM).

Nine Entertainment Co. Holdings Limited (ASX: NEC)

On 22 August 2019, the media & entertainment company provided the annual report for the period closing 30 June this year.

Acquisitions: During the financial year, in December 2018, the company merged with Fairfax. On other acquisitions front, NEC acquired the remaining 40.78% of securities in CarAdvice.com Pty Ltd in November 2018, and it also acquired remaining 41.3% of 112 Pty Ltd in April 2019.

Dividend: The company has declared a fully franked dividend of AU 5 cents per share, which is payable on 17 October 2019, and the record date for the dividend is 27 September 2019. Also, it would go ex on 26 September 2019.

Financials: Reportedly, the reported revenue from continuing operations was up by 40% over the FY2018 from $1,318.2 million to $ 1,848.1 million in FY2019. The reported group EBITDA from continuing operations reached to $349.9 million in FY2019, up by 36% over the FY2018 from $257.2 million.

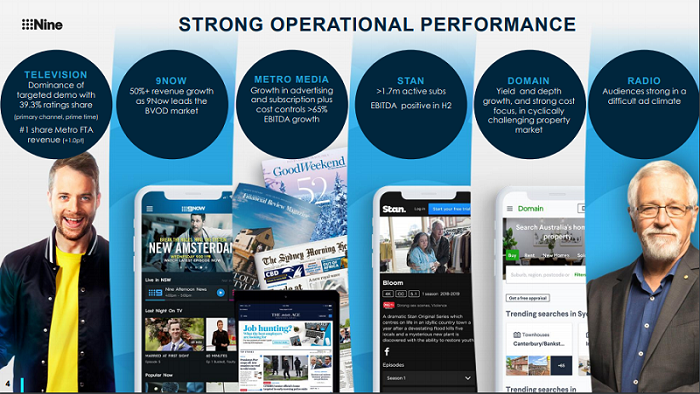

Operational Performance (Source: NECâs FY19 Results Presentation)

Operational Performance (Source: NECâs FY19 Results Presentation)

Meanwhile, the reported net profit after tax from continuing operations was up by 19% to $187.1 million in FY2019, up from $156.7 million in FY2018. It is worth noting that the reported/statutory results consist of the contribution from Fairfax Media and Stan. Besides, the reported EPS from continuing operations was 13.1 cents in FY2019 down by 28% from 18 cents in FY2018.

Broadcast: Reportedly, the companyâs broadcasting division, which includes Nine Network and Macquarie Media (ASX:MRN) (54.4% interest) recorded an EBITDA standing at $241 million in FY2019 down by 11% from $270.8 million in FY2018. The revenues from the segment were down by 5% over FY2018, largely attributed to the subdued performance in the first half.

Digital & Publishing: Reportedly, the revenues from the division were slightly up by 3% to $637.3 million in FY2019 from $619.6 million in FY2018. The EBITDA margin here, improved by 6.9% to 20.4% in FY2019 compared to 13.5% in FY2018. Besides, the EBITDA was noted at $130.1 million in FY2019, up by 56% over FY2018 EBITDA of $83.5 million.

Domain (ASX: DHG): Reportedly, the company holds 59.2% interest in Domain Holdings Australia Limited. Accordingly, the division has suffered a challenging year attributed to subdued property market in its major market, Sydney & Melbourne. Besides, the EBITDA margin was down by 3.2 points to 29.2% in FY2019 compared to 32.4% in FY2018.

Stan: Reportedly, the brand is wholly owned by the company, and its active subscriber base reached 1.7 million. The $2 price increase from March 2019 helped it record revenues of $157.1 million in FY2019 up by 62% over FY2018 of $96.8 million.

On 23 August 2019, NECâs stock was trading at A$1.922, down by 1.436% (at AEST 12:13 PM). Over the past one year, the stock has generated a negative return of by 18.41%. Besides, the stock has provided positive return of 44.44% over the year-to-date period. The market capitalisation of the company is ~A$3.33 billion, with ~1.71 billion shares outstanding.

Southern Cross Media Group Limited (ASX: SXL)

On 22 August 2019, the group reported results for the period ended 30 June 2019.

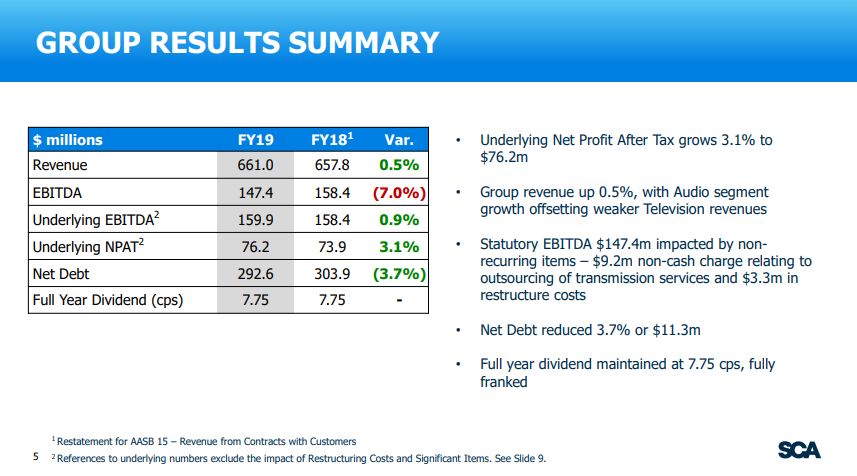

Financials: Accordingly, the revenue from continuing operations stood at $661 million slightly up by 0.5% over FY2018 of $657.8 million. The EBITDA was down to $147.4 million, a decrease of 6.9% over FY2018 of $158.4 million. Besides, the group reported a loss of $91.3 million for the period compared with a restated profit of $0.1 million in FY2018.

Dividend: Meanwhile, the group has declared fully franked dividend of AU 4 cents per share payable on 8 October 2019, and the record date of the dividend is 9 September 2019. It would go ex on 6 September 2019.

Results Summary (Source: SXLâs Full Year Investor Presentation)

Results Summary (Source: SXLâs Full Year Investor Presentation)

Group Results: Reportedly, the current results include an impairment charge of $226.9 million and fair value loss on assets held for sale of $9.2 million. The impairment charge was related to the carrying value in the Television Cash Generating Unit.

Meanwhile, the group reduced its net debt by 3.8% over FY2018 with net debt of $292.6 million, and its leverage ratio was 1.76x down from 1.79x in June 2018, while interest cover improved to 13.03x from 12.03x in June 2018.

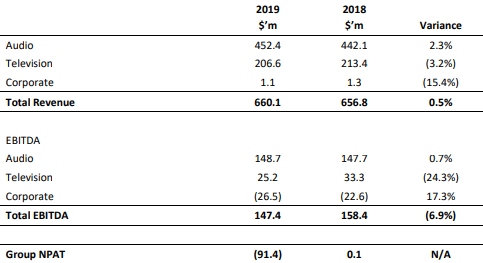

Segment Results:

Segment Profit & Loss (Source: Appendix 4E and Full Year Accounts)

Audio: Reportedly, the audio business of the group includes two complementary radio brands operating in the countryâs capital cities and regional areas. These brands have been targeting different demographics, with Triple M network tapping males in the 25 to 54 age bracket and the Hit Network tapping females in the 18 to 49 age bracket.

Besides, the segment recorded a revenue growth of 2.3%, which increased EBITDA by 0.7% backed by growth capital cities and regional areas of the country. The metropolitan free-to-air radio advertising market has performed better throughout the 2019, with a slight decrease of 0.5% year on year.

Meanwhile, the regional radio continues to remain strong performer for the group, and advertising revenues were up 1.5% over 2018. The revenue from national agency clients grew by 10.6%. This growth is attributed to the groupâs objective of increasing the profile of regional radio by undertaking surveys in markets to understand the market.

Television: Reportedly, the segment includes a number of regional television licenses, and each of them receives programming from a metropolitan television network affiliate. The combination of two premium programming agreements allow the group - a strong audience share across its TV license areas, and these two programming agreements are with Nine Network & Seven Network.

Besides, the impairment charge on the intangible assets of television license had dragged down the performance of the segment during the year.

Corporate: Reportedly, the corporate segment includes group wide centralised function of the group. Besides, corporate expenses increased due to software licensing. This was attributed to investment in new software tools to improve the efficiency of the groupâs operation, and the insurance costs had added to the impact as well.

Strategic Update: Reportedly, the group has focused on the continued development of local content in its radio network to improve the audience experience. The group has increased the personalisation of its products and the development of on-demand audio assets. Besides, PodcastOne has emerged as one of the leading commercial premium podcast platforms across the country backed by a high-quality local content.

Meanwhile, the group has expanded its digital audio assets, introduced instream advertising, and engaged in a partnership with global music streaming platform Soundcloud. The group has been focusing on improving the proportion of national advertising investments in regional markets.

2020 Outlook: Reportedly, the groupâs majority of the earnings are derived from its Audio division, and it plans to improve in this space by additional content offering. Meanwhile, it intends to improve the digital radio spectrum through the development of personalised and on-demand content. Besides, in the television space, the group would improve efficiency after the decision to outsource both playout and transmission services.

On 23 August 2019, SXLâs stock was trading at A$1.172, up by 0.171% (at AEST 12:16 PM). Over the past one year, the stock has generated negative return of 9.65%. Besides, the stock has given positive return of 18.78% over the year-to-date period. The market capitalisation of the company is ~A$899.75 million, with ~769.01 million shares outstanding.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_09_03_2024_01_03_36_873870.jpg)