Consumer Discretionary Stocks: Facts to Know

- The consumer discretionary sector in an economy comprises those goods and services that hold a "non-essential" ranking in the household budget yet are desirable by consumers when they have the sufficient income to splurge on the same. From new cars, premium apparel, entertainment (movies, theme parks, etc.) and home improvements to vacations, all these constitute the areas of expenditure under this sector.

- Unlike the evergreen consumer staple companies that involve spending on indispensable everyday things like personal hygiene, groceries, and cleaning supplies, the consumer discretionary stocks are cyclical in nature. They thrive when the economy is healthy, unemployment is falling while wages are high and vice versa during a downturn, when consumer confidence is low, and individuals prefer to stock up on savings.

- During an economic boom, the increased demand for consumer discretionary sector goods and services tends to drive the overall economic growth, thus strengthening the stock performance of the related companies.

- There may be several sub sectors in the consumer discretionary industry such as e-commerce, hotels, restaurants and leisure, speciality retailers, and automobiles.

- Due to the high susceptibility of consumer discretionary stocks to the economic cycles, investors add defensive stocks from less volatile sectors to their portfolio. These include consumer staple, alcoholic & beverage, grocery stores and discount retailers, cosmetics, etc.

Discussed below are five Australian companies from the consumer discretionary sector-

Harvey Norman Holdings Limited

Australia-based Harvey Norman Holdings Limited (ASX:HVN) is a holding company for companies and trusts in a third-party franchise agreement. Harvey Norman®, Domayne® and Joyce Mayne® are the three brand names under which the company grants licences. The Groupâs market capitalisation stands at ~ AUD 5.51 billion with ~ 1.18 billion shares outstanding. On 30 August 2019, the HVN stock price settled the dayâs trading at AUD 4.380, down 6.21% by AUD 0.290, with ~ 8.89 million shares traded.

In addition, the HVN stock has delivered positive returns of 25.54% in the last six months and 47.78% year-to-date. The companyâs annual dividend yield stands at 6.42% to date.

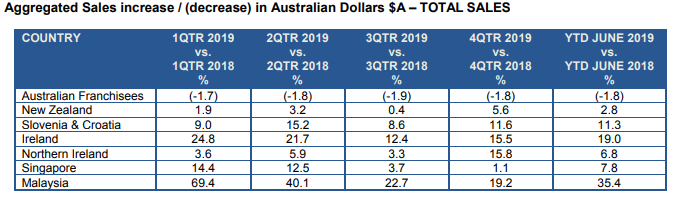

FY19 Results Update â On 30 August 2019, Harvey Norman Holdings announced its financial results for the year to 30 June 2019 (FY19), informing that the aggregated amount of sales from wholly-owned company-operated stores in New Zealand, Slovenia, Croatia, Ireland and Northern Ireland, majority-owned controlled company-operated stores in Singapore and Malaysia, and from independent Harvey Norman®, Domayne® and Joyce Mayne® branded franchised complexes totalled $ 7.65 billion for the year, up 0.9% on FY18.

The uptick in aggregated sales may be attributed to an appreciation of 3.7% in the Euro, 4.3% in the UK Pound, 6.5% in the Singaporean dollar, 7.1% in the Malaysian Ringgit and 1.7% in the New Zealand dollar.

Source: Companyâs Aggregated Sales for FY19

In addition, Harvey Norman Holdings has announced an ordinary fully paid dividend of AUD 0.210 (Record Date: 11 October 2019, Payment Date: 1 November 2019), related to the period of six months to 30 June 2019.

Tabcorp Holdings Limited

Tabcorp Holdings Limited (ASX: TAH), based in Melbourne, Australia, is a world-class diversified gambling entertainment group with a staff of over 5,000 people striving to build a sustainable future for gambling entertainment while making a positive impact on millions of Australians. Tabcorp Holdingsâ market cap stands at around AUD 9.33 billion with ~ 2.02 billion shares outstanding. On 30 August 2019, the TAH stock price settled the dayâs trading at AUD 4.710, up 1.948% by AUD 0.090 with ~ 7.03 million shares traded.

In addition, TAH has delivered a positive return of 8.96% year-to-date and 1.99% in the last three months. The companyâs annual dividend yield stands at 4.76% to date.

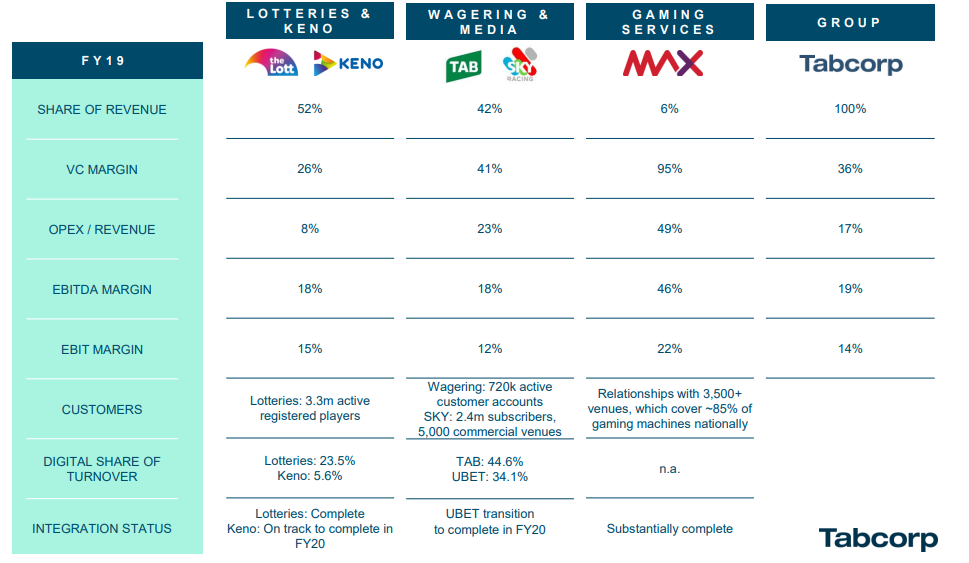

FY19 Results Update - On 14 August 2019, Tabcorp Holdings released its financial results for the year to 30 June 2019 (FY19), reporting an 8.7% increase in revenue to $ 5,482.2 million and a 7.6% increase in EBITDA to $ 1,064.7 million. The strong group results may be attributed to record Lotteries & Keno result that were made possible through successful game portfolio initiatives, strong growth in digital and retail channels and favourable jackpots. The Gaming Services segment specifically experienced good progress during the year, on account of contract extensions, and consolidated under the MAX brand.

Diversified Portfolio; Source: FY19 Results Presentation

The Group also announced a dividend of AUD 0.110 (Record Date: 22 August 2019, Payment Date: 20 September 2019). The full-year fully franked dividend amounts to 22.0 cents per share, depicting an increase of 4.8% on pcp.

Crown Resorts Limited

Crown Resorts Limited (ASX:CWN), based in Australia, is engaged in operating and managing gaming and entertainment facilities, bars, restaurants, night clubs, cinemas and retail outlets while the company also builds hotels and conference centre facilities. Crown Resorts has a market cap of around AUD 8.09 billion with ~ 677.16 million shares outstanding. On 30 August 2019, the CWN stock price closed the trading session at AUD 12.010, edging up 0.502% by AUD 0.060, with ~ 2.214 million shares traded. The stock has also generated a positive return of 3.46% in the last six months.

The company also has an annual dividend yield of 5.02% to date.

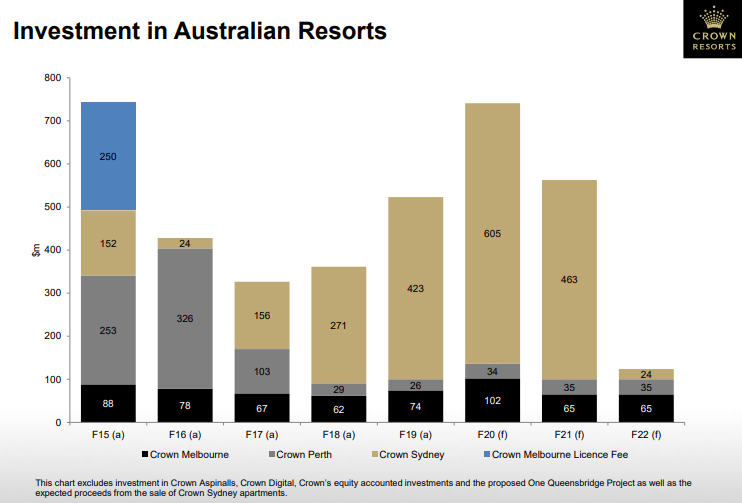

FY19 Results Update â On 21 August 2019, Crown Resorts Limited released its full year results for financial year 2019 (FY19), reporting that its normalised NPAT attributable to the parent was 4.7% down to $ 368.6 million, while the reported NPAT was up 23% to $ 401.8 million before significant items.

Source: 2019 Full Year Results Presentation

In addition, the companyâs normalised revenue was also recorded 5.4% lower at $ 2,954.8 million. The company announced a final dividend of 30 cents per share, which take the total full year dividend to 60 cents per share.

Flight Centre Travel Group Limited

Brisbane, Australia-based Flight Centre Travel Group Limited (ASX: FLT) operates as a retail travel agency business and caters to clients across the country as well as global locations like New Zealand, Canada, Hong Kong, South Africa, and the UK. Some of the groupâs agencies and brands are Travel Associates, Flight Centre and Student Flights. With a market capitalisation of around AUD 4.71 billion and ~ 101.12 million shares outstanding, the FLT stock price settled the dayâs trading on 30 August 2019 at AUD 46.510, down 0.107% by AUD 0.050 with ~ 782,008 shares traded.

The FLT stock has also delivered positive returns of 15% year-to-date and 6.57% in the last six months. FLTâs annual dividend yield stands at around 3.39% to date.

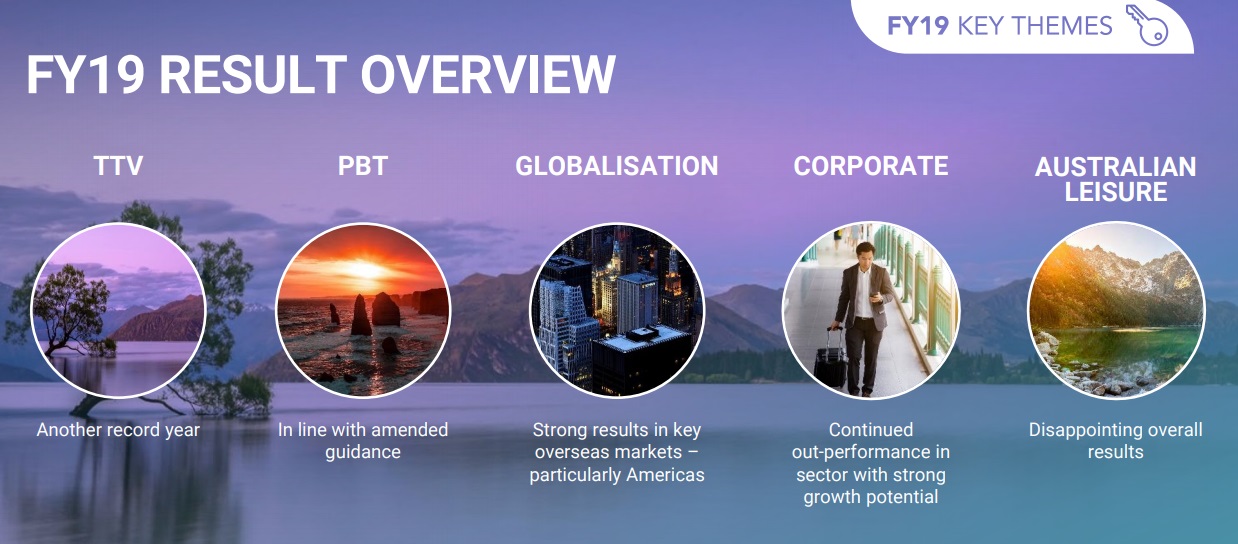

FY19 Results Update â On 22 August 2019, Flight Centre Travel Group announced its full year financial results for the 12 months to 30 June 2019, posting another year of record sales and a profit within its targeted range for the 2019 fiscal year (FY19).

Source: FY19 Full-Year Results Presentation

The Group achieved a new milestone regarding its total transaction value (TTV), which exceeded FY18 record by almost $ 2 billion to $ 23.7 billion. The underlying profit for the period was at $ 343.1 million, in line with the amended guidance.

The company also declared a dividend of AUD 0.98 (Record Date: 13 September 2019, Payment Date: 11 October 2019) concerning the six months to 30 June 2019.

IDP Education Limited

IDP Education Limited (ASX: IEL), based in Melbourne, Australia, provides student consulting services like university and course guidance, visa application and scholarships assistance, and pre-departure support enrolment services worldwide. IDP Educationâs market capitalisation stands at around AUD 4.1 billion with ~ 254.44 million shares outstanding. On 30 August 2019, the IDP stock price settled the dayâs trading at AUD 16.620, climbing up 3.23% by AUD 0.520 with ~ 1.03 million shares traded.

In addition, the stock has delivered a positive return of 64.12% YTD. The companyâs annual dividend yield stands at around 1.21% to date.

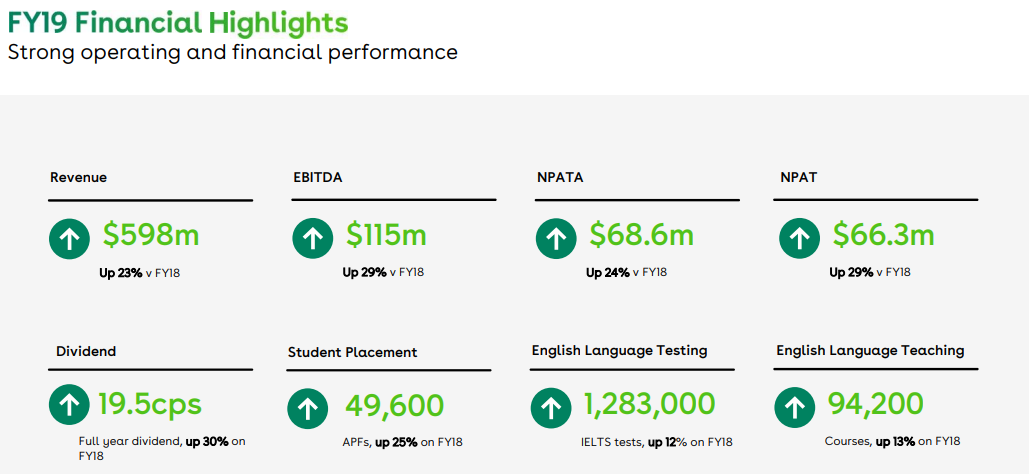

FY19 Results Update â For the 12 months to 30 June 2019 (FY19), the company reported total revenue of $ 598 million, an increase of 23% compared to FY18 and EBITDA of $ 115 million, representing an increase of 29% on FY18. Each of the companyâs core product categories contributed to the good performance â student placement volume was up by 25%, student placement network expanded to include Nepal, Pakistan, India and Canada; the IELTS English Language Testing volume also increased by 12% and the Hotcourses Group was successfully integrated into IDP as a rebranded B2B division, IDP Connect.

Source: IEL Investor Presentation

IDP Education also reported strong cash generation, which resulted in a balance sheet with only $ 4.4 million of net debt.

For the six months to 30 June 2019, IDP also declared a dividend of AUD 0.075 (Record Date: 10 September 2019, Payment Date: 26 September 2019).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.