Helloworld Travel Limited (ASX: HLO) is involved in retail travel networks, air ticket consolidation, corporate travel management, destination management services, wholesale travel services and online operations. It is a leading travel distribution company of Australia and New Zealand. Today, on 6th June 2019, the company via release announced that it has successfully concluded the acquisition of a New Zealandâs sports travel specialists, Williment Travel Group, subsequent to its departure from the former First Travel Group. Its annual TTV is more than NZ$15 million.

Additionally, HLO pointed out that while consideration for the acquisition is not material, the acquisition of Williment Travel Group has been a major strategic step in broadening the companyâs range of unique travel offerings for its network members.

Williment teamâs experience and breadth of products will enable the company to open up some amazing offerings it has through the companyâs network members.

Trading Update

The company recently presented its trading update for the nine month period ended 31st March 2019. The total transaction value for the period stood at $4.71 billion for the period, which reflects an increase of $382.8 million on the corresponding period last year. The revenues of HLO stood at $260.5 million at a gross margin of 5.5%, a rise of $19.3 million on last year. The Australian segmentâs TTV increased by 10.3% for the period, which includes 11.0% growth in retail. In addition, New Zealand segmentâs TTV witnessed a rise of 2.4%, while the rest of the world segment experienced a fall of 8.3% but off a relatively small base. HLOâs operating expenses went up 6.3% to $12.3 million, which resulted in an EBITDA of $54.9 million, up $7 million (14.7%) on the same period last year.

Furthermore, Helloworld Travel acquired 100% of the Show Group business for a total consideration of $7 million, which was funded from cash and existing debt facilities in December 2018.

Corrections and Statement of Regret

The company, in another release dated 25th Feb 2019, addressed erroneous information aired in Senate Estimates hearings. Furthermore, both the newspapers, the Sydney Morning Herald and The Age published an editorial, which contained serious errors. Both the newspapers acknowledged the accusations they made were wrong and suggested that the company won a competitive tender run by the Department of Foreign Affairs and Trade after a meeting between Ambassador Joe Hockey and HLO Executive in April 2017. Both the newspapers acknowledged their mistake in Corrections and statement of regret.

Half Yearly Results

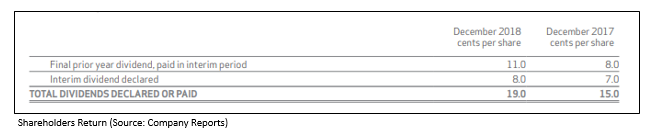

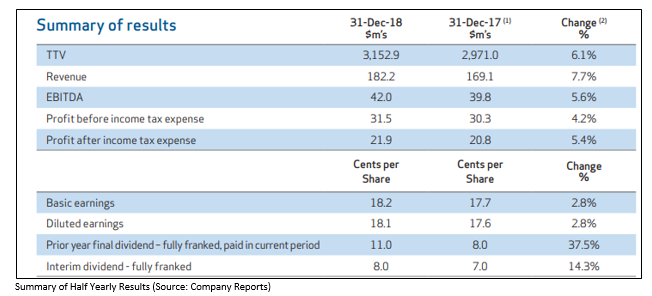

The company presented its half-yearly result for the period ended 31st December 2018. The total transaction value of the HLO for the period stood at $3.2 billion, a growth of 6.1%, which was supported by the business expansion. Revenues of $182.2 million implied an increase of $13.1 million (7.7%), driven by the six-month impact of the FY18 acquisitions and improved revenue margins. HLO reported EBITDA of $42.0 million, up 5.6% or $2.2 million when compared to the pcp. Basic earnings for the period were 18.2 cents per share, a rise of 0.5 cents per share as compared to the pcp. In addition, HLO also rewarded the shareholders with an interim dividend of 8.0 cents per share, which is fully franked.

The half-year focus on business expansion includes the integration of previous year business acquisitions, which consists of the Flight Systems Group, Asia Escape Holidays and Magellan Travel Group and growth in the Trans-Tasman retail network to 2,233 members as at 31 December 2018, among many.

The total cash balance stood at $130.1 million when compared to $203.5 million at 30th June 2018. The decrease reflected the seasonality of monies, which was held by the group for travelers or customers prior to travelling. The current half-year experienced an additional fall because of changes in the terms and timing of the payment cycle under International Air Transport Association regulations, which reduced the level of cash held prior to payment to IATA. In addition, the level of cash was affected by higher working capital from better contracting outcomes and payment timing of override commission revenues.

Looking at the key performance ratios of the company. The company presented very satisfying numbers. The net margin of the company stood at 12.0% in 1H FY19, when compared to the industry median of 9.1%, which implies that the company is addressing its operating expenses very efficiently compared to the peer group. The current ratio of the company stood at 1.15x, which reflects a growth of 1.1% on Y-o-Y basis, indicating that the company is in a sound position to address its short-term obligations. The return on equity stood at 7.3%, while ROE of industry stood at 6.3%, which is a proof that the company is providing better returns to its shareholders.

(Source: Data from Thomson Reuters)

Aspects

The company has successfully grown the scale of its business in Australia and New Zealand while benefiting from its focus on continued cost control and profitable revenue streams. These initiatives are likely to continue to boost the companyâs margins and profitability in future financial years. HLO is focused on driving the business forward via new revenue initiatives, maintaining cost control, profitable revenue growth, and extracting further efficiencies from its investment in technology developments, enhanced travel platforms, improved product offerings and increasing brand recognition in the second half of FY19.

Leading into the second half of FY19, Helloworld Travel Limited has positive momentum and is well capitalised for long-term sustainable growth. As a result, the company has re-confirmed its earnings guidance for FY19 that its EBITDA will be in the range of $76.0 million to $80.0 million. In the half year, the company has not issued any shares, and under the franchise loyalty plan, 675,500 shares were vested.

At market close on 6th June 2019, the stock of HLO was trading at a price of $4.600, up 3.371% during the dayâs trade with a market capitalisation of $554.73 million. Looking at the stockâs performance, it has provided returns of 3.97% and -24.83% for one month and six months period, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.