Australia is one of those attractive economies, which is ever evolving in the dynamics surrounding the world. An educated, tech-savvy and financially stable economy, Australians are categorised amongst the most urbanised societies of the current era, with a high per capita GDP. Amid the issues of low increase in wages and rising household debt witnessed by the Australian economy in 2019, the retail sector has been in a better stance, reporting positive growth.

The future of retail in any economy is largely dependant on the changing consumer spending patterns, shifts in consumer preferences given technology and competition and influx of foreign companies, which formulate new retail approaches.

Future of Retail in the Aussie Land

In the context of Australia, a section of industry experts believe that the deteriorating labour market, weak consumption, inflation below the target range and falling house prices prompted monetary easing by the RBA. The lower rates are likely to leave the requisite cash with the countryâs highly indebted households.

Renowned companies like KPMG and Deloitte have conducted studies and formulated research reports regarding the future of Australiaâs retail industry. According to these companies, the industry is moulded by unruly forces like constant shifts in the spending patterns of consumers along with the presence and dominance of overseas players, which bring new flavours to retailing. Delivery platforms are the need of the hour as they can leave the non-responsive retailers behind.

Moreover, a report issued by Deloitte, which suggests that the real retail turnover growth is expected to slow from 2.2 per cent in 2018 to a mere 1.5 per cent in 2019, before it strengthens back to 2.9% in 2020. The post-election period hit of tax offsets for low and middle earners would boost household incomes in the second half of 2019.

In the light of this context and the changing landscape of the retail sector in Australia, let us gaze through the three related stocks, that are listed and trading on the ASX:

Kogan.com Limited

About Kogan: A provider of retail and services businesses with headquarters in Melbourne, Kogan.com Limited (ASX: KGN) is a brand known for price leadership through digital efficiency. The company aims to make in-demand products and services more affordable and accessible. Kogan Mobile, Kogan Internet, Kogan Pet Insurance, Kogan Life Insurance Kogan Insurance and Kogan Marketplace are few of its businesses. In FY19, KGN bagged the People's Choice Award at the Australia Post Online Retail Industry Awards and MOZO Experts Choice Awards for Kogan Internet, Kogan Money & Kogan Life Insurance along with Finder Award for Best Prepaid SIM.

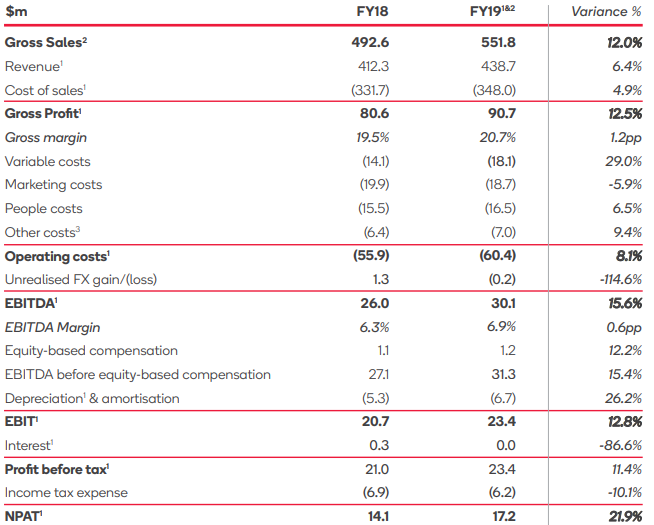

Financial Results for FY19: On 20 August 2019, Kogan declared the annual report for the period ended 30 June 2019. Continuing its significant investments and improving the customer offering, KGN reported Gross Sales of $551.8 million, up by 12% on pcp and Revenue of $438.7 million, up by 6.4% on pcp. The gross profit was reported to be $90.7 million, up by 12.5% on pcp while the EBITDA was up by 15.6% to $30.1 million. KGNâs NPAT grew by a significant 21.9% to $17.2 million. As at 30 June 2019, KGN possessed cash of $27.5 million and Inventories of $75.9 million. An undrawn bank debt facility of $30.0 million was reported.

The company declared a fully franked dividend of AU 8.2 cps for the period ending 30 June 2019. It has an ex date of 26 August 2019, and record date of 27 August 2019. The dividend is payable by 14 October this year.

The company also issued 229,360 fully paid Ordinary shares in the capital on 20 August 2019 as a result of the vesting of Performance Rights.

KGNâs FY19 Results (Source: KGNâs Report)

The main drivers of the strong performance were the 1,609,000 Active Customers of the company and its YOY revenue growth via Exclusive Brands, which contributed to 49.7% of overall Gross Profit in FY19. The newly launched Kogan Marketplace achieved $1.5 million in commission-based revenues and Kogan Mobile grew Active Customers by 24.4% in the period. The expansion of warehousing footprint to 13 fulfilment centres was an icing on the cake.

After delivering the much talked about results, the company aspires to differentiate itself from online giants like eBay and Amazon by selling superannuation, credit cards and energy deals.

July 2019 has kick-started 1HFY20 for KGN, with Gross Sales growth of 18.3%, Gross Profit growth of 32.0% and Kogan Marketplace Gross Sales of $7.1 million.

KGNâs Stock performance on ASX: On 22 August 2019, KGNâs stock was trading A$5.9, down by 1.83% 9 (at AEST 2: 24 PM) with a market capitalisation of A$564.69 million and approximately 93.96 million outstanding shares. The YTD return of the stock is 72.21%.

Kathmandu Holdings Limited

About Kathmandu Holdings: Starting as a small specialist outdoor retailer and presently headquartered in Melbourne, Kathmandu Holdings Limited (ASX:KMD) opened its first store in 1987. Presently, the company is dual listed on ASX and NZX and designs and develops sustainable products like clothing and travel and adventure equipment. Its online and mail order operations began in 2008, a year before going public on the stock exchanges.

Also, the company would release its audited results for FY2019 in late September this year.

KMDâs Products (Source: KMDâs Report)

Issue of Shares: On 13 August 2019, KMD issued 551,186 Ordinary fully paid shares with Performance Rights issue price of A$1.94 as part of its Long-Term Incentive Plan for Employees.

FY19 Unaudited Result: KMD disclosed a report on 8 August 2019, highlighting the update on its sales and earnings for FY19 for the period ended 31 July 2019. Amid the challenges witnessed in New Zealand and a good second half performance in Australia, the company looks forward to releasing its final results next month. Post analysis and based on unaudited results for the year, KMD expects Total sales of NZ$545 million, which would be up by 9.6% on pcp. The Group SSS growth is likely to be +0.6% at constant exchange rates. The Normalised EBIT would range between NZ$82.5 million and NZ$84 million, while the Normalised NPAT would be in the range of NZ$55.5 million and NZ$57 million. The company is expecting a net debt of NZ$19.2 million.

A highlight of this report was the mention of Oboz, which was acquired by KMD in April last year, which is deemed to have delivered strong sales and EBIT growth in 2H and is expected to keep up the performance in and after FY2020.

KMDâs Stock on ASX: On 22 August 2019, KMDâs stock was trading A$2.37, up by 0.424% (at AEST 2:@4 PM), and traded with a market capitalisation of A$535.11 million and approximately 226.74 million outstanding shares. The YTD return of the stock is -9.92%.

Nick Scali Limited

About Nick Scali: Established more than 50 years ago, Nick Scali Limited (ASX:NCK) is regarded amongst one of the Australiaâs largest importers of quality furniture. In 2017, the company expanded itself globally to regions like New Zealand, Auckland and inaugurated its first store named Boxing Day, in Mount Wellington area. The company imports more than 5,000 containers of furniture on a yearly basis and claims to offer products for every budget. The company got listed on the ASX in 2004 under the consumer discretionary group and has its registered office in New South Wales.

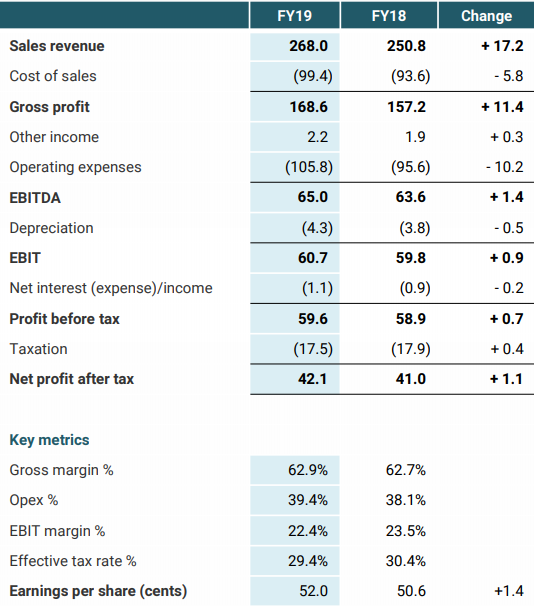

FY19 Results: Marking its 7th consecutive year of record profit, NCK released its FY19 results in the beginning of the reporting season, on 8 August 2019 for the period ended 30 June 2019. The NPAT was reported to be $42.1 million, up by 2.8% on pcp. Sales revenue increased to $268 million by almost 7% and Despite the currency headwinds, the gross margins was strong by 20 bps to 62.9%.

Following the results, the Directors of the company announced a fully franked final dividend of AU 20 cps, which marked the total dividend for the year at 45 cps, up by 12.5% on pcp. The final dividend would be paid on 29 October 2019. Its ex date is of 7 October 2019 and record date is mentioned as 8 October 2019.

NCKâs FY19 Highlights (Source: NCKâs Report)

One of the highlights of the report were the store openings, with a second store opened in NZ, taking the total network to 57 stores, with 55 in Australia and 2 in New Zealand. 4 more stores would be opened this year in Auckland, as NCK drives towards its long-term store network target of 80-85 stores in ANZ.

On the outlook front, the company stated that it was heavily dependent on the housing sales and renovations. Its trade situation would get better once these two factors improve in the region.

NCKâs Stock on ASX: On 22 August 2019, NCKâs stock was trading at A$6.87, up by 0.292%, with a market capitalisation of A$554.85 million and 81 million outstanding shares. The YTD return of the stock is 34.05%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.