If you were being told that there exists a single sphere in the world which employs almost 40 per cent of the globeâs population, would you pay heed to its importance? The instant response to this fact would be a âYESâ! The employer in discussion is the field of Agriculture.

Agriculture is the process of manufacturing food, feed and other desired products through cultivation of plants and the raising of livestock. However, contemporary agriculture has evolved into more comprehensive space with Technology; with progress seen from subsistence farming and agricultural chemistry to hydroponics, genetic engineering, improved weed control, plant breeding, hybridization and gene manipulation.

Agriculture in Australia

Agriculture, fisheries and forestry make an important contribution to Australia's economic prosperity. The Australian agriculture is export oriented but given the limited availability of land and water for agriculture, long-term growth in food production largely depends on productivity growth. Australia is a generally warm and dry continent with unreliable rainfall, both in distribution and timing. Recurring droughts and floods are natural features of the climate.

Governmentâs Approach to Agriculture

According to the Department of Agriculture of the Australian Government, population growth is driving worldâs demand for food with greater emphasis on higher quality and wider variety of food. Investment in research, development and innovation is important for ongoing growth and improvement in the sustainability, competitiveness and efficiency of the countryâs agriculture space. For the same, the government has granted $180.5 million for eight years to 2021â22 towards a competitive grants program, in addition to the current government funding of approximately $250 million per year for rural R&D corporations.

What do the statistics reveal?

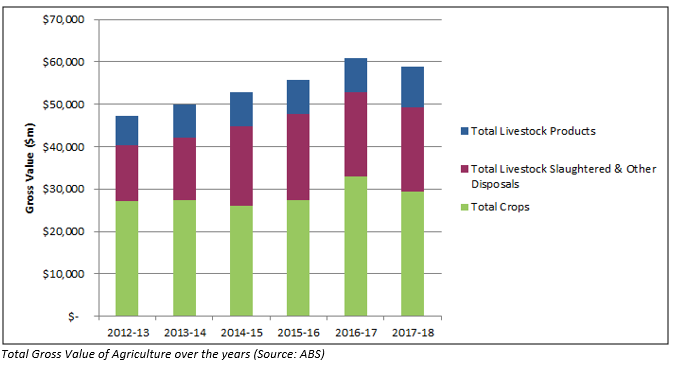

As per the latest statistics on Australian agriculture released by the Australian Bureau of Statistics on 30 April 2019, the value of Australian agriculture in 2017-18 was ~60 billion. This result was the second highest value of agricultural production in recent years.

As at 30 June 2018, there were 85,000 agricultural businesses in the country, down by 3 per cent from June 2017. The recorded 378 million hectares of agricultural land had dropped by 4 per cent. Most of the agricultural land was used for agricultural production in 2017-18, with 328 million hectares used for grazing, 31 million hectares for crops, 731,000 hectares for forestry plantation and 17 million hectares was not used for agricultural production, with 50 per cent of this land set aside for conservation and protection purposes.

The total value of crops was $29.3 billion (down by 11 per cent), returning to similar values to those achieved in 2014-15 and 2015-16. The main drivers of the slump were wheat, valued at $5.7 billion (down by 23 per cent) and barley, valued at $2.3 billion (down 14 per cent). Some of the slowdown was offset by increases in horticultural crops (valued at $10 billion, up by 5 per cent) and cotton (valued at $2.5 billion, up by 49 per cent).

A feather in the sectorâs cap was the increase in total value of livestock products, which were beamingly valued at $9.6 billion (up by 20 per cent). The catalyst for this result was the increase in the global demand for Australian superfine wool which had surged the value of wool to $4.5 billion, up 30 per cent.

As per the ABS findings, the farming businesses received most of its income from agricultural production, with 85 per cent of the income generated from agricultural production, 11 per cent from off farm employment or business activities and 0.6 per cent from grants, government transfers and relief funding.

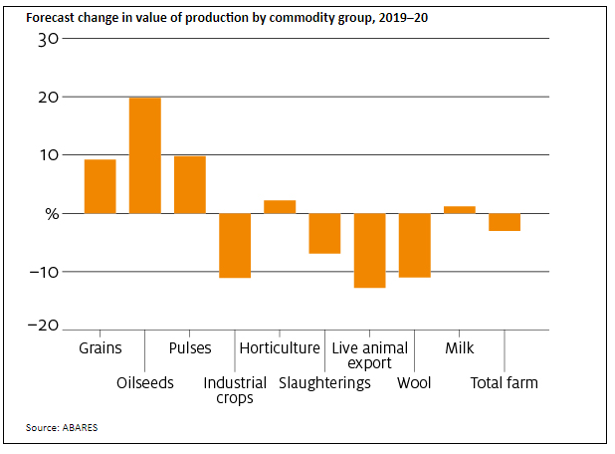

As per the June quarter overview of Agriculture sector by the Australian Bureau of Agricultural and Resource Economics and Sciences (ABARES), there may be a 5% dip in the agricultural export earnings this year, driven by an expected dip in exports of livestock and livestock products. The average agricultural export price is forecasted to remain unchanged, following an estimated 8% increase last year.

In the backdrop of this discussion, we would now shift our focus to the Australian equity market. In the remainder of the article, we would dive into few Agricultural stocks, understand the nature of their businesses and investigate the performance on the ASX.

Agricultural Stocks

It is important to note here that with the prevailing reporting season; stock investment is a hot topic for market enthusiasts. Itâs the period wherein companies release their earnings reports and outline their future moves and goals, as the market awaits the same.

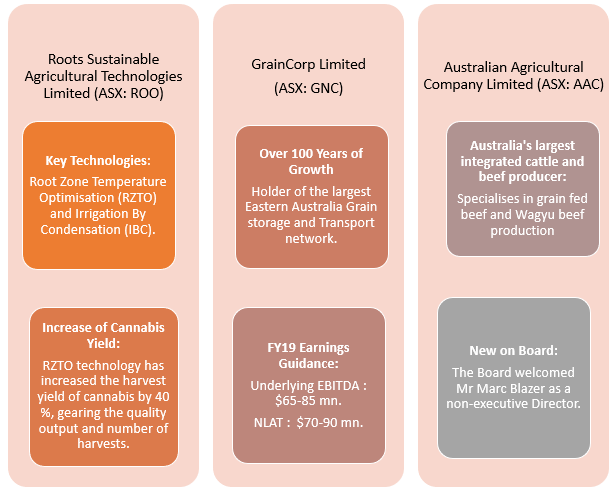

Below are three ASX listed agriculture stocks: Roots Sustainable Agricultural Technologies Limited (ASX:ROO), GrainCorp Limited (ASX:GNC), Australian Agricultural Company Limited (ASX:AAC)

Amid these updates, market players may also keep a watch on the recent developments in the agriculture space of Australia:

- The Australian Farmersâ Federation has been asking for a stand-alone visa for the agriculture sector. However, the Federal Government is likely to expand the work and holiday visa to include thirteen countries. Market experts believe that would ease the labour supply issue in the nationâs agriculture sector.

- Mr Donal Trump has dropped hints to raise tariffs on $US300 billion in Chinese goods by another 10 per cent within four weeks, which does not ease the existing US-China trade war, as both countries are failing to reach a deal on long-term supply deals on agriculture and energy. Amid this, Australia might play a constructive role, liberalising trade.

- Queensland's famed Cubbie Station, the countryâs largest cotton irrigator, is expected to have a renowned agricultural fund taking almost half of the stakes in it.

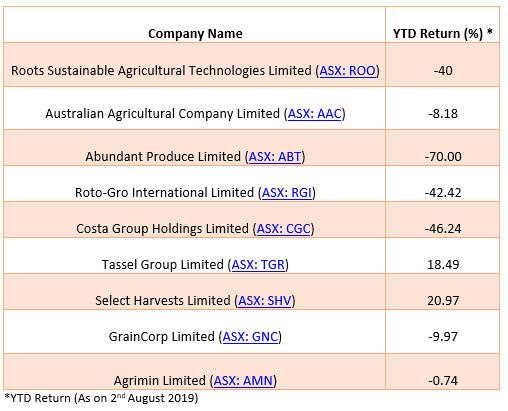

Let us now look at the YTD return of few agricultural stocks, listed and trading on the ASX:

As per several market analysts, Australian agriculture sector is poised for growth on grounds of rising offshore demand, improved market access, enhanced investments due to export market opportunities and higher prices for Australian crops and livestock. However, one cannot deny major headwinds pertaining to climatic pressure, rainfall deficiencies, slowing Chinese economy and heightened trade tensions.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.