The Agriculture industry and Agritech companies have some dependencies on each other. The use of modern technology in agriculture can provide a boost to the concerned company. For example- a farmer cultivating crops by traditional method will be less productive than the one who cultivated crops by making use of the machineries.

Letâs now have a look a few Australian Agritech companies.

Roots Sustainable Agricultural Technologies Limited

Agricultural technology company Roots Sustainable Agricultural Technologies Limited (ASX: ROO) develop and commercialises innovative technologies to address issues faced by the agriculture sector.

On 19 July 2019, ROO notified that Mr Dror Nagel has been hired as a Non-Executive Director of the company, effective immediately.

Recently, on 18 July 2019, the company released a supplementary prospectus, wherein it mentioned that ROO has pursued approval of the shareholders of the issue options totaling to 3,000,000 to EverBlu Capital at its Annual General Meeting.

RZTO Technology

As per the release dated 24th June 2019, the company presented Root Zone Temperature Optimisation (or RZTO) technology and irrigation by Condensation (or IBC) to South Australia business delegation and Government. The application of the technology in Australian region to amend the influence of drought on agriculture sector was also explained. The RZTO technology stabilises the plant root zone temperature for optimising the plantâs physiology for increased productivity, quality and growth.

Expansion into North American Cannabis & Agriculture sectors

Subsequently, the company via a release dated 28th June 2019, stated that it is expanding into North American Agriculture and Cannabis sectors on the back of providing lower operating costs and mitigation of environmental pressures. Since March 2019, ROO had achieved milestone of selling RZTO to 4 commercial processors and organic growers. On the back of achieved milestone, it was appointing US-based experienced management and staff for operation, in order to knob the rising demand from consumers as well as to handle upcoming RZTO technology installations.

Turning to financial aspects, in Q1 FY19 period, the company got 2 installation and sale agreements from its exclusive distribution partner in China- Dagan Agricultural Automation, which amounted for A$278,000. The company is continuing to invest in commercial validations and product engineering in new territories and on the present product development. At the quarter ending 31st March 2019, the companyâs cash balance stood at US$563,000. The net cash used in the operating activities stood at A$0.538 million in Q1 FY19 period.

At the end of the trading session, on 19th July 2019, the stock of ROO was at a price of $0.065, down by 1.515%, with a market capitalisation of A$5.69 million. The stock has produced return of 1.59%, -20.00% and -44.35% for the one month, three months and six months period, respectively.

Australian Agricultural Company Limited

Australian Agricultural Company Limited (ASX: AAC) is the biggest producer of beef and integrated cattle, and was formed in 1824.

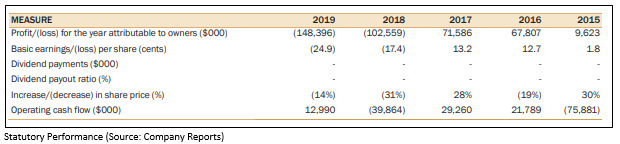

Recently, on 25 June 2019, the company published its Annual report for FY19. It communicated about its operational and financial performance for FY19. AAC reported Underlying Operating Profit of $23.7 million for the financial year 2019, post adjusting operating loss of $46.6 million for the effect of the Gulf flood livestock write-offs and related emergency expenditure.

However, it reported operating loss for FY19 of $22.9 million against a loss of $13.5 million in FY18. It posted NTA per share of $1.42 at the end of FY19 in comparison to $1.62 in FY18. This was resulted by the decrease in the livestock balance but offset by improvements in the property portfolio. Australian Agricultural Company Limited delivered positive net operating cash flows of $13.0 million in FY19 against negative operating cash flows of $39.9 million in FY18.

On the liquidity front, it posted current ratio of 5.37x in FY19 as compared to the industry median of 1.40x. This indicates that AAC is in a good position to meet its short-term obligation against the broader industry.

On 19th July 2019, the stock of AAC, by the closure of the trading session, was at a price of $1.055, down by 0.472 %, with a market capitalisation of A$638.93 million. The stock has produced returns of 2.91%, -3.2% and -2.75% for the one month, three months and six months period, respectively.

Sensera Limited

Sensera Limited (ASX: SE1) is an Australia registered company, which provides end to end services and solutions, which are majorly served in animal wellness, mine safety etc. After the acquisition of nanotron business, who has previously developed dairy cattle management system to handle herd health and grow the yields in dairy cattle.

The company, in the release dated 26th June 2019, mentioned that the newly introduced MicroDevices manufacturing capabilities fast-tracked its customersâ technical strengths in the global medical fibre market for US$1 billion and the overall US$6.5 billion global fibre optics market.

On financial perspective, the company is on rising trend in terms of revenue. As mentioned in the Investor Presentation, during FY17 period, the company posted revenue of US$1.2 million,whereas in FY18, revenue stood at US$6.4 million. The following picture represents broader view of sales pipeline. Previously, the company also secured placement amounting to A$3 million.

Outlook:

As per the release dated 2nd July 2019, the company stated that its revenue for Q4FY19 is not yet final. However, it is anticipating revenue to be in the range of US$3.75 million â $3.85 million. Adding to that, this will witness a significant growth in comparison to prior quarters revenue amounted to US$2.7 million. Moreover, there is an expectation a fall on 0.3 million in the final year revenue (FY19) in the projected range of US$10.5 million - $11 million.

On 19th July 2019, the stock of SE1, last traded at a price of $0.105 per share, down 4.545, with a market capitalisation of $30 million. The stock has produced returns of 4.76%, -12.00% and -21.43% for the one month, three months and six months period, respectively.

Abundant Produce Limited

Abundant Produce Limited (ASX: ABT) is an Australia registered company, which is the developer of plant intellectual property. The company was officially listed on ASX in 2016.

Recently, the company via a release dated 11th July 2019, the company offered the shareholders to participate in share purchase plan to purchase up to A$10,000 worth of fully paid ordinary shares in the company. Adding to that, the company is intending to raise up to $2.5 million from the share purchase plan. The proceeds from SPP will be used to finance ABTâs operations and development of its Abundant Natural Health operations. The plan is underwritten by Top Cat Consulting Services Pty up to an amount of $1 million.

March Quarterly Report

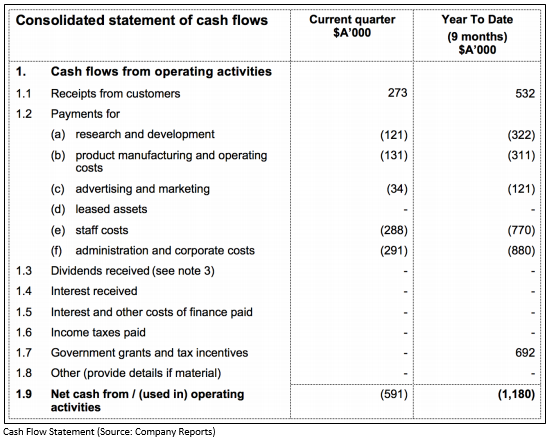

At the quarter ended on 31st March 2019, the net cash used in the operating activities stood A$0.591 million after settling payments of staff costs and administration & corporate costs of $0.288 million and $0.291 million. Moreover, the companyâs cash balance stood at $1.9 million with zero debt as at 6th June 2019.

The company reported gross margin of 89.1% in comparison to the industry median of 40.7%. The current ratio of the company stood at 13.36x in 1H FY19 against the industry median of 1.42x. This implies that ABT is in a sound position to address its short-term obligations in comparison to the peer group. The asset to equity ratio stood at 1.07x in 1H FY19 as compared to the industry median of 1.97x. The quick ratio reported by the company stood at 11.24x in comparison to the industry median of 1.01x.

On 19th July 2019, the stock of AAC, by the closure of the trading session, was at a price of A$0.065 unchanged, with a market capitalisation of A$3.94 million. The stock has produced returns of -18.75%, -30.11% and -69.05% for the one month, three months and six months period, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.