Every investor looks for a better return on their investments, be it securities price appreciation or dividends in the short, medium or long term. Distributing dividends is not an obligation for the company, but in general, to retain investors, companies pay dividends. Considering this as a backdrop, letâs have a look at 7 dividend paying agricultural stocks.

Costa Group Holdings Limited (ASX:CGC)

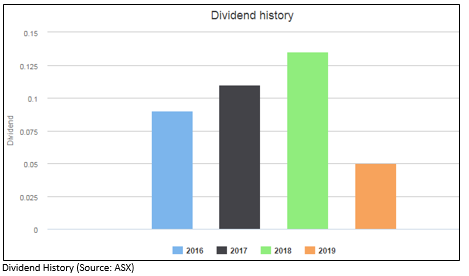

Costa Group Holdings Limited (ASX: CGC) is an Australia registered company involved in growing, packaging and marketing fresh produce. The company was officially listed on ASX in 2015. Recently, the company via a release stated that Frank Costa had stepped down as a Non-Executive Director effective from 4th July 2019. The company anticipates its EBITDA-SL for CY19 in the region of $140 million to $153 million. Importantly, for the six months ended 30th December 2018, the company declared and paid a fully franked final dividend of 8.5 cents per share. Moreover, the Board has approved a final dividend of 5.0 cents per share for the six months Financial Period 2018, with a record date of 14 March 2019 and payment date of 12 April 2019. The dividend was fully franked.

At the time of writing on 18th July 2019 (AEST 1:45 PM), the stock of CGC was trading at a price of $4.275 per share, down 0.352%, with a market capitalisation of $1.37 billion. The stock has produced returns of 8.95%, -17.76% and -15.98% for the one month, three months and six month period, respectively.

Tassal Group Limited (ASX:TGR)

Tassal Group Limited (ASX: TGR) is involved in the production and marketing of salmon. The company was officially listed on ASX in 2003. Recently, the company stated that Mr John Watson changed his holding in the company by acquiring 10,000 ordinary shares at a price consideration of $4.77 per share on 15th April 2019. In parallel, in the 1H FY19, the company reported operating EBITDA of $64.3 million, reflecting a rise of 20.8% from 1H FY18. Moreover, the company anticipates a gradual growth curve for salmon. On 23rd February 2018, the company declared an interim fully franked dividend of 8.00 cents per ordinary share amounting to $13.862 million in respect of the half year ended 31st December 2017. The record date for determining entitlements to this dividend was 15th March 2018 with a payment

date of 29th March 2018. On 24th August 2018, the company declared a fully franked dividend of 8 cents per share, equating to $13.957 million for FY18.

At the time of writing on 18th July 2019 (AEST 2:00 PM), the stock of TGR was trading at a price of $4.775 per share, up 1.165%, with a market capitalisation of $842.28 million. The stock has produced returns of -745%, -3.08% and 5.12% for the one month, three months and six month period, respectively.

Select Harvests Limited (ASX:SHV)

Select Harvests Limited (ASX: SHV) is involved in growing, processing and packaging of almonds. The company was officially listed on ASX in 1978. The company is focused on export business within Asia, which is a key target market. The company has exclusive trademark License & Distribution Agreement with PepsiCo Foods (China) Co. Ltd. Additionally, Select Harvests reported net profit after tax of $20.0 million in 1H FY19, reflecting a rise of 96.1% and posted EBITDA of $38.5 million in 1H FY19, a rise of 48.6% on pcp. Importantly, a 7 cents final dividend has been declared by the company, resulting in a total dividend of 12 cents per share for the financial year 2018. This compares to a total dividend of 10 cents per share in FY17.

At the time of writing on 18th July 2019 (AEST 2:30 PM), the stock of SHV was trading at a price of $7.080 per share, down 0.701%, with a market capitalisation of $682.6 million. The stock has produced returns of 4.85%, 6.42% and 11.76% for the one month, three months and six month period, respectively.

GrainCorp Limited (ASX:GNC)

GrainCorp Limited (ASX: GNC) is an Australia registered company involved in the global agribusiness. The company was officially listed on ASX in 1998. Recently, the company made an announcement related to the demerger of its malting business, MaltCo. Importantly, the company reported revenues of $610 million in 1H FY19 from its malting business as compared to $534 million in 1H FY18. GrainCorp continued its high utilisation throughout the global portfolio of malting plants. Previously, the company inked a ten-year agreement for managing ECA grain production risk. Furthermore, the company paid a final dividend of 8.0 cents per share for the year ended 30th September 2018, equating to $18.3 million and also paid an interim dividend of 8.0 cents per share for the half year ended 31st March 2019.

At the time of writing on 18th July 2019 (AEST 2:45 PM), the stock of GNC was trading at a price of $8.620 per share, down 0.806%, with a market capitalisation of $1.99 billion. The stock has produced returns of 7.15%, -7.65% and -3.34% for the one month, three months and six month period, respectively.

DowDuPont Inc. (NYSE:DWDP)

DowDuPont Inc., (NYSE:DWDP) recently made an announcement dated 2nd May 2019, highlighting its results for Q1 FY19. The company reported Generally Accepted Accounting Principles (or GAAP) EPS of $0.23 from its ongoing operations, which demonstrated a fall of 51% as compared to the year-ago period EPS of $0.47. DowDuPont witnessed a decline of 9% to $19.6 billion in net sales versus a year-ago period on a 3% currency headwind, volume decline of 2% and lower local price of 4%. The company posted organic revenue growth of 5% and adjusted operating EBITDA margin of 28% in FY18.

In Q1 FY19, the company reported an annual dividend payout of $2.1 billion and open share repurchase program of $3 billion. In addition, DowDuPont paid a dividend of $2.4 billion to shareholders in Q1 FY19.

Cosan Limited (NYSE:CZZ)

Cosan Limited (NYSE:CZZ) is a leading economic group of Brazil, investing in strategic sectors such as agriculture, fuel, etc. In the first quarter of the financial year 2019, Cosan posted pro forma adjusted EBITDA of R$1.5 billion and adjusted net income of R$401 million. Pro forma free cash flow generation, including 50% from RaÃzen, totaled R$1.7 billion, and leverage for the period ended at 2.0x. With respect to RaÃzen CombustÃveis Brasil, it reported adjusted EBITDA of R$714 million and an increase of 3% in sales volume. RaÃzen Energia closed the 2019/18 crop year with adjusted EBITDA of R$2.9 billion, which was affected due to lower agricultural yield due to weather and lower sugar prices. Moove reported earnings before interest, tax, depreciation and amortisation of R$81 million, a rise of 58%, demonstrating the higher sales volume.

In terms of its business unit Comgás, it reported total natural gas volume distributed growth of 3% in Q1 FY19. The industrial segment sales witnessed a rise of 2% from Q1 FY18 on the back of better performance of some industries served by Comgás. The Commercial volume was 7% higher than in the same quarter last year, reflecting the addition of more than 800 clients to the base in the last year. In the residential segment, volumes decreased by 4% due to the higher average temperature in the period, partially offset by the addition of 100,000 clients in the last 12 months.

On 27th April 2018, the company approved the distribution of dividends received by Cosan Limited from Cosan S.A. The dividends were paid to shareholders for the fiscal year ended 31st December 2017, equating to US$20,000,000,00 corresponding to US$0.08223712 per share. For the fiscal year ended 31st December 2018, the company declared dividend per share of R$1.7390.

Deere & Company (NASDAQ:DE)

Deere & Company (NASDAQ:DE) is involved in the manufacturing of agriculture, engine and drivetrain equipment such as tractors, harvesters, etc. The company reported net sales and revenue of $37.36 billion in FY18, reflecting a rise of 26% and posted a net income of $2.37 billion in FY18, a rise of 10%. The shareholder value added for the period stood at $1.86 billion, reflecting an increase of 45%. The company reported positive cash flow from consolidated operating activities of $1,820 million in FY18, resulted from net income adjusted for non-cash provisions and a rise in accounts payable and accrued expenses. The cash inflows from financing activities stood at $876 million for the same period, mainly because of a rise in borrowings of $2,516 million and proceeds from the issuance of common stock of $217 million. The total short-term borrowing of the company primarily includes equipment operation, wherein the notes payable to the bank stood at $464 million.

For the financial year 2018, the company declared per share dividend of $2.58 as compared to $2.40 per share in FY17. In FY18, the company paid total dividends of $805.8 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.