It would be fair to say that information technology, as well as communication technology, forms the backbone of modern-day businesses as technology is part and parcel of the business model of todayâs companies. Technology helps the businesses in managing the business efficiently, enhance business process, and in turn improve productivity.

Technology has a wide-scale impact on any business irrespective of its size. The infrastructure influences the efficiency, culture as well as the relationship of the business.

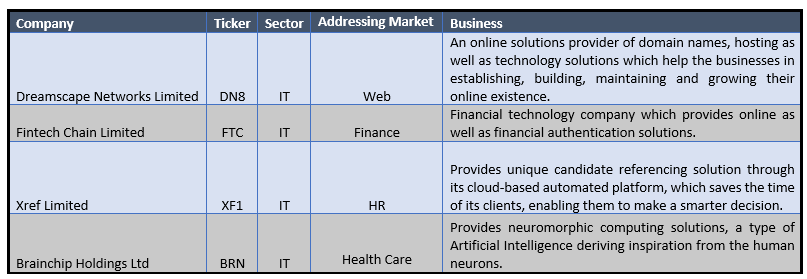

In this article, we have covered four IT stocks with application in diverse fields along with their recent update

Dreamscape Networks Limited

Updates:

Scheme Implementation Deed with Web.com:

On 24 July 2019, Dreamscape Networks Limited (ASX: DN8) announced that it had signed a Scheme Implementation Deed (âSIDâ) with Web.com Group, Inc. (âWeb.comâ) under which Web.com (or its wholly owned subsidiary) would be acquiring 100% of the issued share capital of the company via Scheme of Arrangement.

Web.com is 100% owned by an affiliate of Siris Capital Group, LLC, which is one of the top private equity firms based in New York.

Under this Scheme of Arrangement, the shareholders of the company would be receiving a cash consideration of A$0.27 per DN8 share. Post which, the company would be the wholly-owned subsidiary of Web.com.

As per the Scheme, the company is valued at ~ A$105.2 million. Web.com would be funding the transaction through its existing cash on the balance sheet as well as its revolver facility.

The Independent Board Committee of the company consider this Scheme to be in the best interest of the shareholders of the company and universally recommended shareholders vote in favour of the Scheme in the absence of a superior proposal emerging earlier to the scheme meeting as well as depending on an Independent Expert.

The Independent Board Committee highlighted the following reasons to vote in favour of the scheme:

- Shares offered at a significant premium to recent trading.

- Since the shares of DN8 got listed on ASX, the shares have never traded at a price above its bid price.

- Bid price implies an enterprise value of ~A$119.2 million, at 9.8x EBITDA multiple (FY19 Number)

- The Scheme does not depend on finance condition but depends on conditions customary for the transaction.

- There is a certainty of value based on 100% cash consideration.

Stock Performance:

The shares of DN8 have provided an outstanding return of 185.71% in the past six months. The shares of DN8 opened flat at A$ 0.260. DN8 closed flat on ASX 25 July 2019. DN8 has a market cap of A$ 101.1 million with ~ 388.85 million outstanding shares and PE ratio 27.66x. DN8 is trading near its 52 weeks high price.

FinTech Chain Limited

Update:

FTCâs agreement with Shaanxi Rural Credit Union:

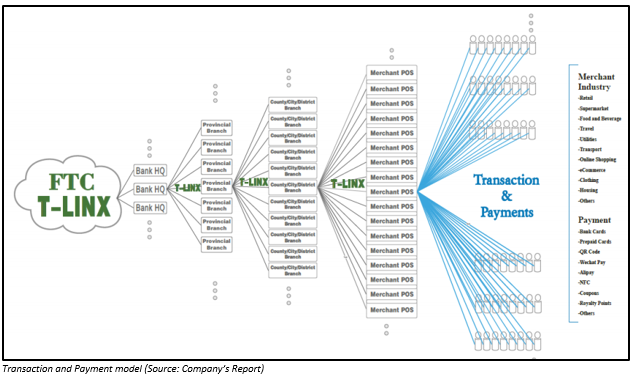

On 25 July 2019, FinTech Chain Limited (ASX: FTC) announced that it has entered into an agreement with Shaanxi Rural Credit Union for deploying integrated TLinx payment solutions of the company. This is the sixth contract signed by the company within a span of 4 months.

The deployment of integrated TLinx payment solutions as per the agreement would be done across all Rural Credit Banks in Shaanxi Province.

Both parties are on the same page with respect to 3 basis point service fee for all the transactions would be through the T-Linx system.

Upon this agreement, the President of FTC, Mr Xiong highlighted the companyâs improvement with respect to the negotiation of the service. The negotiation shows the effort made by the company on marketing its T-Linx system. He also stated that the team would be working with the existing as well as the potential clients and provide the best-integrated payment solutions and simultaneously strengthen the companyâs position in the banking sector.

Stock Performance:

The shares of FTC have provided an outstanding return of 210.81 % in the past six months. The shares of FTC opened at A$ 0.130, up by A$0.015 above its previous closing price of A$0.115. The shares shot up by 4.348 % to A$0.120 by the end of the trading session on 25 July 2019. FTC has a market cap of A$ 74.84 million with ~ 650.77 million outstanding shares, and a PE ratio 95.83x.

Xref Limited

Updates:

Sales & Credit Usage:

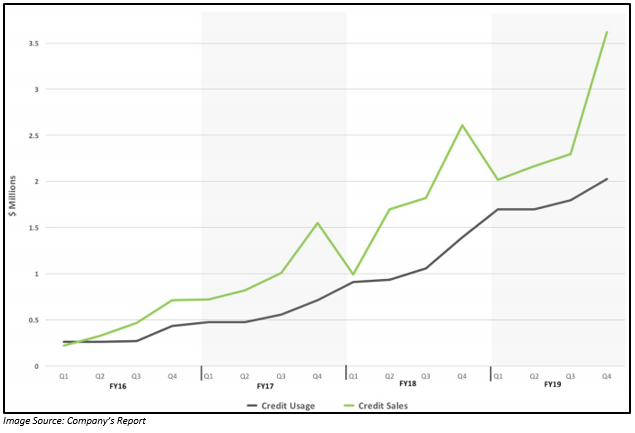

As per the ASX announcement made by the company on 1 July 2019, Xref Limited (ASX: XF1) posted record sales as well as the credit usage in the fourth quarter of FY2019. The sales in the Q4 FY2019 increased by 38% to $3.6 million and credit usage by 40% to $2 million as compared to Q4 FY2018. Around 28% of credits were being used up by the clients who were integrated through the channel partners of the company.

RapidID Acquisition

The company also announced that it agreed for the acquisition of disruptive ID verification and fraud prevention platform, Rapid ID Pty Ltd (âRapidIDâ).

To know more, click here.

Stock Performance:

The shares of XF1 have provided a return of 4.35% in the past six months. The shares of XF1 opened flat at A$0.480 and also traded flat on ASX during the trading period on 25 July 2019. XF1 has a market cap of A$ 79.48 million and ~ 165.58 million outstanding shares.

BrainChip Holdings Ltd

Recent Updates:

Completion of the Retail Entitlement Offer

On 16 July 2019, BrainChip Holdings Ltd (ASX:BRN) announced the completion of the 1 for 4 accelerated non-renounceable entitlement offer of new fully paid shares which was announced on 26 June 2019.

On 12 July 2019, The retail component the Entitlement Offer got closed, and the book-building process was conducted before the market open on 16 July 2019 for those entitlements which were not taken up. Through Retail Entitlement Offer, the company raised ~ $2.8 million and received support from the eligible retail shareholders of the company. Through the institutional component of the Entitlement Offer, the company raised around $6.7 million.

The company would be releasing around 67 million new shares of the company. On 19 July 2019, the company issued new shares under the Retail Entitlement Offer which started trading on ASX from 22 July 2019. These shares issued under the Retail Entitlement Offer are of equal rank as that of its existing ordinary shares.

Application of the Funds/Proceeds:

The proceeds generated through the Entitlement Offer after meeting the cost would help the company in funding its ongoing product development of AkidaTM and its manufacture with Socionext and the subsequent introduction of the AkidaTM Neuromorphic System-on-Chip. These funds would also strengthen the working capital to enable the production as well as the general availability of the AkidaTM product in 2020.

Stock Performance:

The shares of BRN have provided a decent return of 39.90% in the last three months. The shares of BRN opened flat at A$0.061. There was a fall in the share price by 1.639% to A$0.060 by the end of the trading session on 25 July 2019. BRN has a market cap of A$ 76.87 million and ~ 1.26 billion outstanding shares.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.