Information technology helps the user to produce, operate, store, transfer and broadcast information using computers. Application of IT is seen in the areas of science and technology, business and commerce, education, governance, education, etc. In this article, we will cover recent updates on two IT stocks, with different core businesses and client base.

Adacel Technologies Limited

About the Company: Adacel Technologies Limited (ASX: ADA) is an ASX listed company, which develops operational air traffic management systems and voice recognition applications as well as high-tech ATC simulation and training solutions.

Recent Update/s: On 1 July 2019, the company provided its FY2019 earnings guidance. Since 1 April 2019, the board, as well as the management, was engaged in a comprehensive assessment of all business aspects. Based on which, the company provided the below updated outlook for FY2019 along with the guidance for FY2020.

In the previous financial year, the company registered profit before tax of $ 10.2 million. The three factors identified during the review, which would reduce the financial performance of the company, are:

- ATM System Installations: In Guadeloupe, Fiji and NavPortugal, there were new system installation projects, which resulted in a significant overrun of costs related to software development and customization needed for the projects. The projects in Guadeloupe and Fiji represented the first applications of Approach and Tower Control systems, whose complexity was not experienced earlier. During the review, the reasons for software engineering incompetency were identified, and the company stated that the required actions have already been taken. The company expects that these projects would be completed in the first half of FY2020.

Further, the company has also recognized 30 potential clients for the sale of its Approach and Tower Control software platform.

- Orders Activity: In the second half of FY2019, the company was unable to materialize the forecast orders as per the expectations. Particularly, the level of movement in the ATOP program with the FAA and Leidos grew as compared to the previous year. However, further work forecast was below expectations. Thus, the company has taken a more careful and rigorous approach to its sales forecasting methodology along with the processes. Further, the company identified multiple marginally economic products. All these projects were either eliminated or put on the shelf.

- Restructuring and Other Costs: The FY2019 financial results comprise of compensations, restructuring along with legal charges, amounting to around $ 0.7 million. The updated guidance for FY2019 is quite disappointing for the company. However, based on the substantial work done by the executive team for over the past three months, the actions taken along with the FY2020 budget prepared are encouraging for the company. The company expects to register profit before tax in the range of $ 4.1 million and $ 4.6 million in FY20. This range highlights an improvement of $ 6.0 million - $ 6.3 million when compared with FY2019.

The guidance for FY2020 indicates a more rigorous forecasting procedure and focused product set, in addition to a cost structure right-sized to result in high-probability contracts, ~ 77 per cent of the forecast revenue for the year. Moreover, the guidance reflects completion of the Guadeloupe, Fiji and NavPortugal projects, removal of unprofitable products and services, and ongoing belt-tightening in several business aspects.

Stock Performance: In the last five-year period, the shares of ADA have generated a return of 65.92 per cent. The shares are trading at $ 0.430, up by 4.878 per cent as compared to its previous closing price. ADA holds a market capitalisation of $ 31.26 million with approximately 76.25 million outstanding shares and a PE ratio of 5.040x. (as at AEST: 12:05, 04 July 2019)

Xref Limited

About the Company: Headquartered in Melbourne, Xref Limited (ASX: XF1) has positioned itself within the HR technology industries and operating in the regions of Asia-Pacific, Europe and North America.

The company has a cloud-based, automated platform, which not only saves the time of its clients but also helps in saving their money during the recruitment process. It also supports its clients in taking much smarter and informed recruitment decisions.

Xref has the potential to gather 60 per cent additional data and is 5 times quicker than the traditional reference checking method.

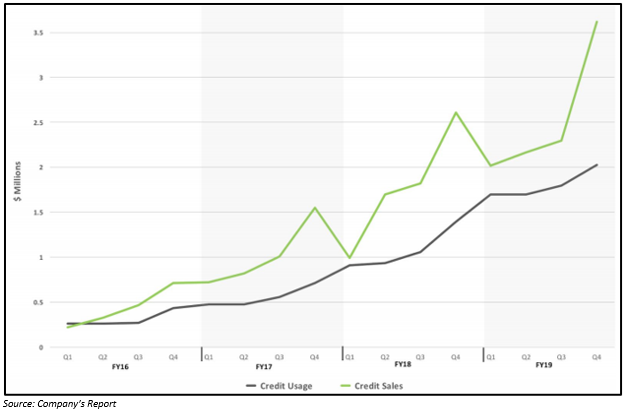

Recent Updates: On 1 July 2019, Xref Limited announced that it was able to achieve record sales and credit usage in the fourth quarter of FY2019. In Q4 FY2019, the sales of the company increased by 38 per cent year-on-year to $ 3.6 million. The credit usage also surged by 40 per cent to $ 2 million on pcp. Of the total credits, 28 per cent was used by clients integrated through its channel partners. Below graph depicts the companyâs credit usage and sales graph.

The international sales of the company also registered strong growth during the reported period. The overseas offices contributed 20 per cent of the sales, which was 10 per cent in the prior corresponding period.

During Q4 FY2019, the company added several new clients. Some of them are the Ministry of Foreign Affairs and Trade in New Zealand, Melbourne Cricket Club in Australia, Southampton Football Club in the UK, Uncommon Schools New York in the US, Mantena AS in Norway, The Ritz London in the UK, and Tipico Services in Malta.

In the same announcement, the company also unveiled that it has decided to acquire Rapid ID Pty Ltd, which has a disruptive ID verification and fraud prevention platform, namely RapidID. The platform aggregates leading customer verification technologies so as to provide flexibility as well as continuous integration for onboarding and risk analysis monitoring. It simplifies the process of identification, screening and compliance in an all-in-one, integrated API, enabling identity check in real time. The platform aids in global ID checks, AML & KYC compliance, ID document verification, and biometric verification.

The acquisition of RapidID is highly complementary for the company, as it would make the company capable of verifying candidates are who they say they are. RapidID has been integrated with XF1âs core platform. The additional paid ID checks would be provided to the customers of XF1 along with its channel partners.

The company has agreed to purchase all the shares in Rapid ID Pty Ltd along with its related intellectual property. XF1 plans to complete the deal with a combination of cash and its shares to a total value of $ 1.5 million. Ashley Hoey, who is the founder of RapidID, and his development team will join XF1 to continue to develop the RapidID platform and business.

Stock Performance: In the last five-year period, the shares of XF1 have given a return of 308.33 per cent. The shares are trading at $ 0.500, up by 2.041 per cent as compared to its previous closing price. XF1 holds a market capitalisation of $ 81.13 million and has approximately 165.58 million outstanding shares. (as at AEST: 12:05, 04 July 2019)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.