Post reporting highest-grade intersections at Menzies Gold Project (MGP) since the acquisition, Kingwest Resources Limited (ASX:KWR) is out with another significant announcement this week.

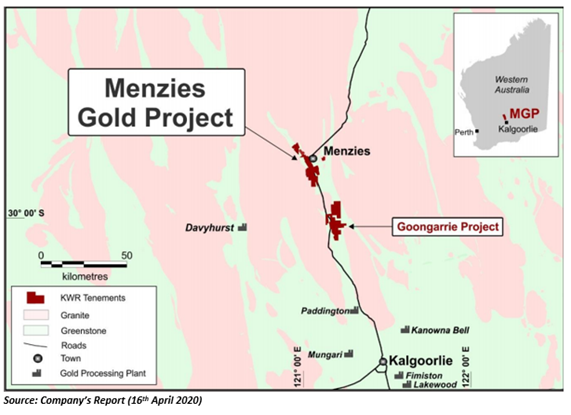

The gold explorer has declared the completion of a Scoping Study at the Goongarrie Lady deposit, situated about 40km southeast of MGP and 90km north of Kalgoorlie, close to the Goldfields Highway. Goongarrie Lady was mined by Julia Mines NL in the 1990s, producing 29,000t of ore grading 4.5g/t Au. Later on, mining was ceased at the project due to heavy rains flooding the pit.

Kingwest appointed an independent mining consultancy in January 2020 to undertake the Scoping Study on the open pit mining and third-party toll treatment of the wholly owned Goongarrie Lady gold Mineral Resource. The purpose of the study was to assess the practicalities of mining the Goongarrie Lady Mineral Resource.

The initial scope of the assignment was to examine the economics of the Mineral Resource being operated and mined by a third party, using arrangements to cover haulage, mining, and toll treatment.

The consultant hired by Kingwest reviewed a Feasibility Study, an existing and recently generated (2016-2020) Mineral Resource estimate, cash-flow models, a metallurgical report and supporting information for the Goongarrie Lady Project.

Don’t Miss Turning Attention to Kingwest’s Exploration and Development Strategy for 2020 and Beyond

Let us now discuss the key conclusions of the Scoping study reported by the Company:

High-Grade Production Target

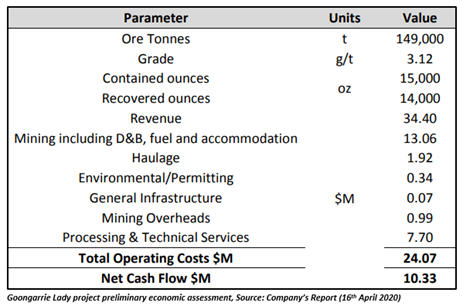

A Production Target of 150,000t at an overall grade of 3.14g/t and strip ratio of 14.94:1 to produce 15,000oz of gold has been identified in a preliminary pit design. The financial modelling is contingent on an assumption of 14,000 oz gold recovery.

The Company notified that on investigation of the Mineral Resource categorization of the Production Target included in the pit, around 5 per cent of the material (tonnes) has been graded as Inferred. This material, which is lower grade (approx. 1.6 g/t Au) than the average of the Production Target, signifies nearly 3 per cent of the total gold production.

Favourable Historic Metallurgy

The prior metallurgical test work has indicated good metallurgical recovery in the oxide material, which comprises the bulk of the mineralisation.

The existing Goongarrie Lady pit is 22m to 25m deep, 250m long and 60m wide, with drilling signaling that the mineralisation extends to a depth of minimum 40m and gold mineralisation is open at depth and along strike to the south.

It is worth mentioning that mineralisation extends at depth beneath the base of current optimisation, but confidence is diminished through low density drilling.

Significant Cash Flow Estimated

A high-level financial model has been created, returning a net cash flow of $10.3 million from the preliminary pit design, over a schedule of 10 months. The accuracy of this estimate is believed to be +/- 30 per cent to 35 per cent, which is proportionate with a Scoping Study.

Net cash flow from the project is projected to be in the range of $6 million to $12 million, before taxation and financing, with an indicated net cash flow of $10.3 million.

Cost-Effective Production Schedule

A preliminary high-level production schedule has been noted at a production rate of 250,000m3 per month, which is believed to be attainable by a single 120-t class excavator in a confined pit. The production schedule considers six months’ ore production, with ore being carried by road train to one of the numerous available toll treating mills within 150km radius.

Besides, equipment operating hours have been assessed along with gross mining and fuel costs, comprising accommodation, flights and contractor’s margin when formulating the total costs.

All-In Sustaining Costs (AISC) are assessed at $1,719 per recovered oz gold.

Remarkably, there is high confidence in Mineral Resource basis for Scoping Study with 97 per cent of the gold and 95 per cent of proposed mined material is contained in Measured or Indicated JORC class Mineral Resources inside pit shell.

Way Ahead

Kingwest expects follow-up drilling to possibly enable an increase in mining material post Stage 1 and convert Inferred Resources below the chosen pit optimisation.

Additionally, the Company is evaluating options to swiftly sell, partner or commercialise Goongarrie Lady owing to its proximity to gold processing plants, low strip/high grade Production target, favourable historic metallurgy and advanced permitting status.

The Company’s initial focus is on its flagship Menzies project, wherein it is currently undertaking diamond drilling in order to convert proven high-grade Exploration Targets to Mineral Resources.

Undoubtedly, the conclusions derived from the Scoping Study at the Goongarrie Lady deposit seem significant. However, it is imperative to note that this Scoping study is based on low accuracy technical and economic assessments and is not sufficient to provide assurance of an economic development case at this stage, or support estimation of Ore Reserves, or to offer certainty that the conclusions of the Study will be realised.

As on 16th April 2020, KWR ended the day at $0.150.