Undoubtedly, Australian gold explorer Kingwest Resources Limited (ASX:KWR) has progressed considerably well with the exploration activities at Menzies Gold Project (MGP) since its acquisition in September 2019.

Situated 120km north of the Super Pit in the Goldfields of Western Australia, Menzies is one of the highest-quality and substantial scale Australian gold fields. A series of structurally controlled superior gold deposits have been previously mined within the project, which exhibit extensive exploration capability for high-grade extensions. Besides, modern exploration at the project since closure over 20 years ago has been limited.

Kingwest intends to develop the high-grade Menzies project, which it believes to have significant exploration upside and production potential.

As per the Company, the historic production of 643,000 oz gold @ 22.5 g/t Au at the MGP compares favourably to other structurally controlled high-quality gold deposits. The Company believes there is tremendous potential for strike and depth extensions to known lodes, parallel lodes and extensions to the main lodes at the project.

Want to Know More on Menzies Project, Read A lens on the Menzies Gold Mine: the past, present and the future

What is Kingwest’s Exploration and Development Strategy?

Kingwest is continuing with the advancement of high-grade Menzies project, with a well-defined exploration and development strategy for 2020 and beyond, comprising three key elements, as stated below:

- To boost resources with an objective of setting a base for high-margin underground mining, drilling to be done at known high-quality Brownfield targets at Menzies.

- Drill new exploration targets in belt (defined by Kingwest geophysics and new structural model) at Menzies project.

- Monetise and Sell Non-Core Leonora Projects (~100k oz Au and exploration package).

Also Read Meet Kingwest’s Board and Management Team Driving Development of Menzies Project

Considerable Progress Reported in Harmony with 2020 Strategy

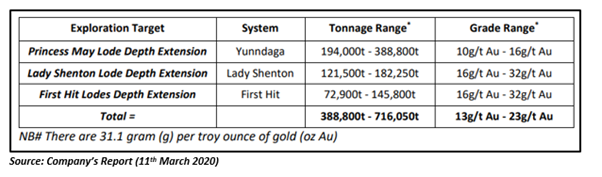

In line with its overarching strategies, the Company is continuing with an initial Reverse Circulation (RC) and Diamond core (DD) drilling programme (~8,300m), targeting high-grade extensions to the current known mineralisation within the Yunndaga, First Hit and Lady Shenton Systems. The ongoing drilling programme is focussed on testing recently delineated Exploration Targets at Menzies, summarised in the table below:

Recently, the Company reported about the completion of the RC drilling involving fourteen RC pre-collars and ten RC drill-holes, for 3,402 metres at three target areas. The Company is now progressing with the diamond drilling programme to extend the fourteen RC pre-collars and test high-grade gold targets at Yunndaga, Lady Shenton and First Hit systems.

It is worth mentioning that the Menzies near surface Mineral Resource Estimate’s (MRE’s) have continued to grow from 171koz Au in December 2019, 208koz Au in February 2020 to 233k oz Au in March 2020 and the Company believes ongoing work will further improve MRE’s.

Significantly, Kingwest is on track to complete its continuing RC and diamond core drilling of high-grade gold deposits in a timely manner and drill new - geophysical and structural interpreted targets in the coming months. The drilling results from these known and new exploration targets may pave the way for further drilling this year, including Resource Definition drilling.

The Company is also likely to work with the invited parties currently reviewing to transact on the non-core Leonora assets in 2020.

KWR closed the trading session at $0.130 on 9th April 2020.