Penny Stocks Defined: Penny stocks are the stocks belonging to small businesses and are usually priced below $ 5. The cap was earlier defined at $ 1 before the U.S Securities and Exchange Commission modified the definition to increase the price to less than $ 5. Alternately known as nano-cap stocks, small cap stocks or micro-cap stocks, penny stocks are characterised by a very low market capitalisation.

Trading in penny stocks comes with its own pros and cons. While investment in these stocks can provide significant returns to the stockholders, there lies an equal risk of losses due to the lack of liquidity and high risk associated. Usually associated with small companies, the stocks donât see frequent trading due to lack of buyers in the market. This gives a rise to difficulty in selling these stocks and finding an accurate price for the investment.

Process Behind Creating a Penny Stock: A penny stock is created through an IPO, which includes a set of regulatory requirements to be completed before the trading begins. Upon approval of the IPO, the company may either choose to list itself on a stock exchange or trade on the over-the-counter market. The first step of a new offering requires the company to hire an underwriter, specialising in securities offerings. Based on certain regulations, some companies may also be required to file their financial statement for review by public. Post appointment of an underwriter and receival of initial orders, actual trading of the offering can begin in the secondary market. In order to gain access to more investors and increase their capital, businesses may also make an additional secondary market offering after the IPO.

What is the risk? As discussed in the above section, the lack of liquidity associated with penny stocks make it difficult for investors to sell these stocks once acquired. There are various other characteristics associated with these stocks that make them highly risky to invest in.

- First and foremost, since these stocks originate from small companies, there is no track record of how the company and its stock has been performing. Unlike well-established companies, information on such companies or stocks may not come from credible sources. These businesses may not be required to compulsorily file their financial statements on any trusted platform, which induces the risk of the company landing into insolvency or bankruptcy.

- The companies selling the stock may have been formed recently and might not have any previous record of performance, making it difficult for the investors to determine its business potential.

- The lack of liquidity characteristic may drag the investors into losses by requiring them to lower the price in order to attract buyers. In addition, low liquidity exposes investors to the risk of manipulation in stock prices. Investing in penny stocks often includes trading scams, which will be discussed in the next section.

Scams Associated: Along with the above inherent risks, investment in penny stocks also comes with a risk of exposure to manipulation about the demand for the stock and hence persuades them into buying the stock. Some of the popular scams are discussed as under:

- Pump-and-Dump Schemes: This approach involves the promoters of the company buying large amount of the stock which raises the stock price substantially. This leads other investors into buying the stock, which is later sold by the scammers, resulting in a loss-making deal for the inexperienced investors.

- Short-and-Distort: Exactly opposite of the above discussed case, this scam involves short-selling of the stock to earn profits. In layman terms, an investor gets engaged in borrowing and immediate selling of the stock at a high price. Such investors engage in spreading false rumours about the companyâs performance, resulting in a fall in the stock price. The same investors then acquire the shares on a relatively low price and return them to the lender at a profit.

- Reverse Merger: At times, a small company may falsify its earnings behind the blanket of merger with a renowned public company. The investors can avoid this risk by keeping a check on the historical record of the business they are choosing to invest in.

Preventive Measures: The above scams can be avoided if an investor does an in-depth analysis of the financial information provided by the company. Looking at aspects like outstanding debt or liabilities, cash in hand and revenue offers crucial insight into the companyâs potential. Apart from financials, the investors can also look for the track record of the management to check for any notable successes or failures. If a company issues a business plan, the investor needs to scrutinise if the company is well placed to achieve the stated plan.

A look at few Penny Stocks listed on ASX

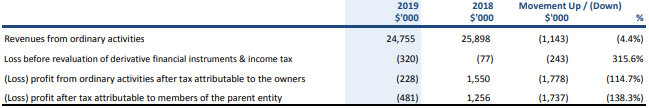

- Oilfields Holdings Limited (ASX: OLH) is engaged in the import and distribution of paint brushes, paint rollers, tools and accessories. In the recently released financial results for FY19, the company notified that it generated revenue from ordinary activities amounting to $ 24.76 million, down 4.4 per cent in comparison to the FY18 revenue of $ 25.90 million. The stock of the company closed trading at a market price of AUD 0.032 on 29 August 2019, reporting no change on previous trading price.

Financial Summary (Source: Company Reports)

- Rhinomed Limited (ASX: RNO) is engaged in the research, development and commercialisation of consumer and medical devices. During the year ended 30 June 2019, the company generated revenue amounting to $ 3.29 million, up 51.5 per cent on prior corresponding year. Net loss for the period stood at $ 6.07 million. The stock of the company closed trading at a market price of AUD 0.250 on 29 August 2019, down 5.66 per cent from its previous close.

FY19 Financial Results (Source: Company Reports)

(c) Osprey Medical Inc (ASX: OSP) operates in the health care sector. During the half year ended 30 June 2019, the company reported strong sales growth. Net revenue for the period amounted to USD 1.8 million, up 54 per cent on prior corresponding period. The stock of the company closed trading at a market price of AUD 0.053 on 29 August 2019, down 3.636 per cent from its previous close.

Financial Highlights (Source: Company Reports)

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.