In this article, we would discuss four penny stocks trading at the ASX. Three out of the four stocks are engaged in mining and exploration industries, while one stock operates a capital goods business in the country. Penny stocks are called penny stocks due to the relatively small size of the business they operate in.

Letâs now look at these stocks:

Oldfields Holdings Limited (ASX: OLH)

Established in 1916, Oldfields Holdings Limited is engaged in the marketing, importing and manufacturing of scaffolding & painting accessories. It has manufacturing facilities in Sydney & China, focused on creating quality projects along with consumer centric growth strategies for the domestic and international markets.

On 6 June 2019, the company reported the appointment of Chief Financial Officer & Company Secretary, and the resignation of Director & Company Secretary. Accordingly, the company had appointed Mr Alan Lee as Chief Financial Officer & Company Secretary effective from 11 June 2019.

Subsequently, the company announced the resignation of Mr Greg Park as a CFO, Company Secretary and Director. It was reported that Mr Park spent five years with the company and possess great depth of knowledge in the companyâs business. Therefore, the Board intends to retain Mr Park for specific project work on a consulting basis.

In February 2019, the company reported half-year results for the period ended 31 December 2018. Accordingly, the company reported $12.30 million in revenues for HYFY19, against the revenue of $13.40 million in HYFY18. Consequently, the company had EBITDA of $588k in HYFY19 compared with $916k in HYFY18.

Besides, the company had seen lower revenues from primary operating segments, consumer products and scaffolding due to escalated competition and slowing Australian building industry. Further, it was said that the company had streamlined processes to lower operating costs, and the results would be seen during the second-half of the year.

Company Products (Source: Companyâs Website)

Reportedly, the company suffered a net loss after tax of $214k in HYFY19 against a profit of $1.3 million in HYFY18. Also, the profit of HYFY18 included a fair value adjustment to the companyâs DSLN of $1,161,000. Further, the company had cash and cash equivalents of $728k in HYFY19 against $720k in HYFY18.

The balance sheet of the company carried borrowings under both current & non-current terms. Under the current liabilities, the borrowings of the company increased to ~$1.7 million in HYFY19 against ~$1.48 million in HYFY18. Under the non-current liabilities, the borrowings of the company increased to ~$1.74 million in HYFY19 against ~$1.56 million in HYFY18.

OLHâs stock last traded at A$0.050, on 6 August 2019.

MetalsTech Limited (ASX: MTC)

MetalsTech Limited is developing a number of projects of lithium, and it is an Australian registered company. It is developing projects in Ontario & Quebec, Canada. These two places are known for the relative abundance of cobalt & lithium deposits, and well connected transportation along with supportive government.

Earlier this month, the company notified that it hs obtained final assessments from Revenue Quebec for the claims associated with the Resource Exploration Tax Credit refunds & Credits on Duties Refundable for Losses. Besides, the Revenue Quebec had made some adjustments following the audit, and the company along with its tax advisors had accepted those adjustments. Now, the company expects to receive refunds before 30 September 2019.

Reportedly, the Revenue Quebec had assessed and approved credits worth approximately CAD$1.8 million, which equates to approximately AUD$2 million. Importantly, the approved amount represents over 95% of the claimed amount by the company.

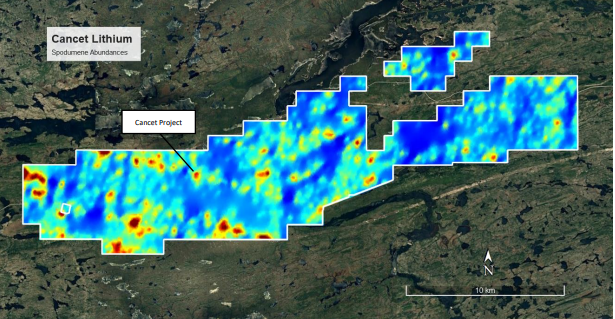

Spodumene Abundances (Source: Companyâs Quarterly Activities Report, July 2019)

Late last month, the company released the quarterly activities report for the period ended 30 June 2019. Accordingly, the company had appointed Dr Qingtao Zeng and Mr Noel OâBrien as Non-Executive Technical Directors. Besides, Dr Quinton Hills resigned from the capacity of Non-Executive Technical Director.

Reportedly, the company completed a remote sensing spectral survey at the Cancet Lithium Project, which unveiled multiple spodumene anomalous targets. Besides, it believes that the potential exists for the increase in the mineral resources on the project. Further, the company also tested the project for gold & cooper mineralisation through the remote sensing spectral survey. Subsequently, the evidence suggests the project has the potential to host cooper & gold mineralisation.

Other Projects

As per the release, the Board of the company has been assessing and evaluating acquisition opportunities for exploration, development globally across the commodity spectrum. Besides, the company had decided to suspend the cobalt projects in Canada, and the agreement with Tri Origin Exploration Ltd was also terminated.

Last year, the company was notified about a civil action related to certain claims at Cancet, Quebec. Now, it has not received any further notification related to the claim. Therefore, it had considered the claim as meritless and would be defended if necessary.

On 9 August 2019, MTCâs stock last traded at A$0.017, up by 6.25 percent from the previous close.

Azumah Resources Limited (ASX: AZM)

Perth-based, Azumah Resources Limited operates in Ghana, West Africa. The company explores & develops the extremely prospective gold province of Ghanaâs Upper West Region.

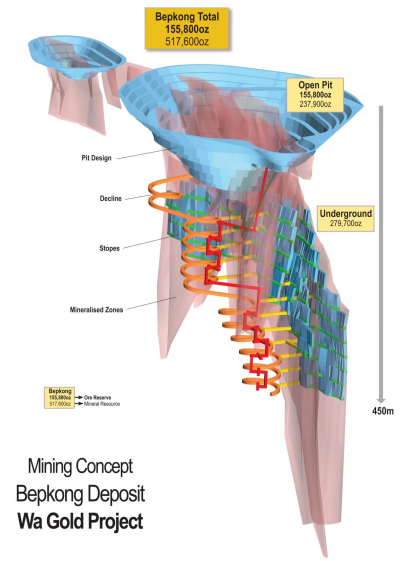

Recently, the company had announced results from the scoping study conducted at its Bepkong deposit within the Wa Gold Project (Project), Ghana. Accordingly, the results had suggested that an underground mining program could provide the additional potential to the Project. Besides, the study has increased the scope by ~154,000oz, which equates to US$32 million in cash flows at a price of US$1,300 per ounce.

Reportedly, the feasibility study of the Bepkong deposit is being managed by the joint venture partner, Ibaera Capital which is nearing completion. Presently, the project is anticipated to have a pre-tax NPV5% of US$177 million, and an IRR of 35% to return the establishment capital of US$117 million in 1.6 years. Besides, the projections based on open-pit optimisation and revenue estimates using US$1,300 gold price.

As per the release, some notable costs associated with the Bepkong deposit involves infrastructure development for ventilation, dewatering, portal and decline, initial lateral but not limited to the drilling costs. Also, the provisional capitals cost are composed of US$36 million for development and diamond drilling, US$78 million for underground mining and processing cost for US$29 million.

Reportedly, the underground mining opportunity would be financed through a project establishment capital finance package along with subsequent surplus cash flows. Presently, the finances have not been decided as of now, and the development decision, strategic plan to advance the gold mining operation is subject to completion of the feasibility study and other factors.

Besides, the company is evaluating the given options to finance the project, and any source of finance to review the concluded feasibility study, undertake due diligence and analysis of risk prior to any investment. Further, the overall financing package might include project/corporate level debt finance equity finance, a quasi-debt convertible note etc.

Open Pit Design & Scoping Study Concept (source: Companyâs Announcement)

Reportedly, the mining of Bepkong deposit depends upon the decisions taken by the Joint Venture to develop the project. Besides, the availability of finance, the other commercial factors also weigh in before any decision is finalised. Further, the JV has been advancing to complete the feasibility study for a detailed assessment of mining at the Bepkong deposit.

On 9 August 2019, AZMâs stock last traded at A$0.017, down by 5.556% from the previous close.

Dampier Gold Limited (ASX: DAU)

DAU is an Australian registered entity which operates with three major projects, which are presently under the development and exploration phase.

On 7 August 2019, the company issued 11,585,711 fully paid ordinary shares at an issue price of $0.028 per share. Subsequently, the company raised $324,400 in working capital. Additionally, it issued 2,260,143 fully paid ordinary shares at an issue price of $0.028 per share to pay $63,284 in liabilities.

Recently, the company released the activities for the June Quarter. Accordingly, the company has been pursuing its rights to earn up to the extent of 50% of the K2 Gold Project in line with its Binding Terms Sheet.

Besides, the underground mining operation at the K2 project has the potential for the company to earn returns from the expected initial production of 49,000 ounces of gold, and the expected production has anticipated an all in sustaining cost of $1,100/ounce along with start-up CAPEX of ~$6.4 million.

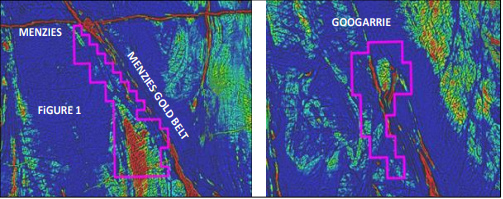

Menzies and Goongarrie Projects (Source: Companyâs Announcement)

Reportedly, the company was engaged in desk top studies of the Zuleika shear zone, and it has applied for the tenements covering 1,263 ha of a highly prospective structure. Besides, the companyâs Menzies and Goongarrie projects completed early reconnaissance, which had depicted greenstone lithologies inside the project areas. Additionally, the company has completed further desk top studies magnetic data analysis at Ruby Plains, and it is now selecting target area for the proposed drilling programme at the project.

DAUâs stock last traded on 8 August 2019, at a price of A$0.03.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.