Healthcare System in Australia is one of the most comprehensive across the world and offers services from general as well as preventive health by treating the more complex disease conditions.

The growing aging population and increase in chronic diseases can directly impact the growth of the healthcare stocks, and it is anticipated that number of persons aged more than 65 would rise from 3.8 to 5.2 million by 2027.

On 17 January 2020, the S&P/ASX 200 Health Care (Sector) last traded higher at 44,022.2 points, with a rise of 0.11% compared to the last close. While the S&P/ASX 200 index last traded at 7,064.1 points, up by 0.3% from its previous close. A green upward trend for S&P/ASX 200 Health Care sector has been observed in the prior year-

Let us now discuss four ASX listed health care stocks- SHL, PNV, RMD, COH

Sonic Healthcare Limited (ASX:SHL)

Sydney Headquartered ASX listed health care company Sonic Healthcare Limited (ASX:SHL) is a global healthcare service provider. The company is focused on providing laboratory, imaging and primary medical care services to doctors, hospitals, community health services, and patients. Sonic Healthcare operates in New Zealand, Germany, Australia, the USA, Switzerland, Belgium, the UK and Ireland.

In its Annual General Meeting Presentation (AGM) Sonic Healthcare discussed the outlook and FY20 guidance and the highlights are-

Outlook

- Sonic Healthcare is well positioned for ongoing robust growth;

- The company has rich pipeline of joint venture, contract and acquisition opportunities;

- Sonic Healthcare has a strong balance sheet with headroom for expansion;

- Geographical diversification of the company offers growth opportunities as well as risk mitigation;

- Sonic’s global team consists of more than 1,000 pathologists, over 200 radiologists and thousands of qualified technical staff underpinning the company’s Medical Leadership culture.

FY 2020 Guidance

- For the financial year 2020, the company anticipates an EBITDA growth 6-8% on underlying EBITDA of FY2019.

- In the fiscal year 2020, the interest expense to reduce by approximately 5%.

- The capital expenditure of the company anticipated to be considerably lower in the fiscal year 2020.

Stock Information-

On 17 January 2020, the SHL stock closed the day’s trade at $30.970 up by 0.65% compared to its last close. The company’s market capitalisation stood at nearly $14.62 billion, with almost 475.02 million shares outstanding. SHL stocks 52 weeks high and low price was noted at $31.010 and $21.460, respectively.

PolyNovo Limited (ASX:PNV)

An ASX listed medical technology company PolyNovo Limited (ASX:PNV) is involved in the development of a dermal regeneration solution known as NovoSorb BTM. The company produces this solution by utilising its patented technology- NovoSorb biodegradable polymer technology. The developmental program of PolyNovo offers solutions for Breast Sling, Hernia, and Orthopaedic applications.

PolyNovo informed the market that December 2019 had been its first two-million-dollar month and provided information on ASX to its shareholders for the direction of sale-

- The company revealed that the unaudited revenue from the sale of NovoSorb BTM for the month of December 2019 was more than $2 million as compared with $890k noted from December 2018, up by 134%.

- In the first half of the fiscal year 2020, unaudited revenues from NovoSorb BTM were reported to be $8.57 as compared to $3.75 million for the H1 FY2019, which is increased by 129%.

The company mentioned that the audited financial results would be released to the market on Wednesday, 26 February 2020.

Moreover, the company anticipates providing a further announcement about the EU/UK prospects post CE authorisation shortly.

Outlook 2020-

The company highlighted that new manufacturing machines have been ordered and are projected to be delivered by circa February 2020. PolyNovo foresees filing for US FDA 510(k) late in the financial year 2020.

The CE Burn trial has been completed and PolyNovo projects to publish the results by the end of Feb/March 2020.

The study on NovoSorb BTM dermal implant is under development using stem cell derived islet cells versus cadaver donor cells and expected to start a human clinical trial in 2020.

Stock Information-

On 17 January 2020, the PNV stock closed the day’s trade at $2.450, up by 2.083%. The company’s market capitalisation stood at nearly $1.59 billion, with almost 661.09 million shares outstanding. PNV stocks 52 weeks high and low price was noted at $2.660 and $0.585, respectively.

An ASX listed medical device company, ResMed Inc (ASX:RMD) is into developing high-quality medical devices for providing a superior and healthier life to patients with sleep apnea, COPD, and other chronic diseases. The Company has its software platform outside hospitals that helps health care practitioners and attendants to cater to patients. ResMed provides its services in over 140 countries.

Reporting date for Second Quarter Fiscal 2020 Earnings

On 9 January 2020, the company unveiled to release financial and operational results for the second quarter of FY2020 on Thursday, January 30, 2020, after the closing of the New York Stock Exchange.

First Quarter 2020 Highlights

On 25 October 2019, ResMed announced results for its first quarter of FY2020, the highlights are-

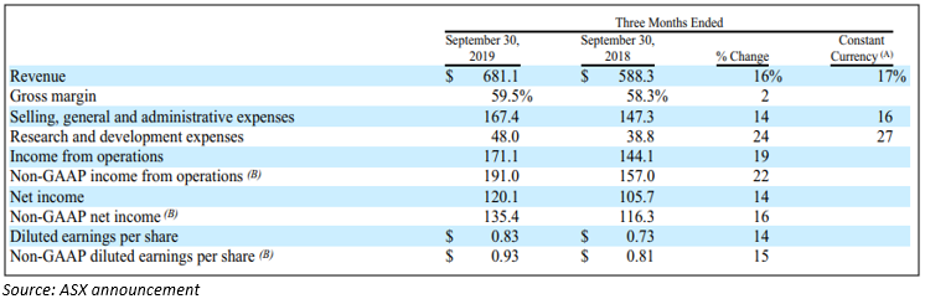

- Revenue for the quarter increased 16% to $681.1 million; up 17% on a constant currency basis;

- The gross margin of the company expanded 120 bps to 59.5%;

- The company’s net operating profit increased by 19% and non-GAAP operating profit up by 22%;

- ResMed has GAAP diluted earnings per share of $0.83 and non-GAAP diluted earnings per share of approximately $0.93.

- For the first quarter FY2020, the cash flow from operations was nearly $162.4 million, and during the quarter the company paid approximately $56.1 million in dividends.

Stock Information-

On 17 January 2020, the RMD stock closed the day’s trade at $23.260, up by 0.955%. The company’s market capitalisation stood at nearly $33.32 billion, with almost 1.45 billion shares outstanding. RMD stocks 52 weeks high and low price was noted at $23.360 and $12.650, respectively.

Sydney headquartered, an ASX listed medical device company Cochlear Limited (ASX:COH) is engaged in providing implantable hearing solutions for providing a lifetime of hearing outcomes. The Company offers Cochlear implants as well as acoustics, 88% of the revenue come from Cochlear implants, and the remaining 12% come from acoustics that includes bone conduction implants and acoustic implants.

Change in the company’s Board

On 10 December 2019, Cochlear revealed the appointment of Michael Daniell to the company’s Board. According to this announcement, Mr. Daniell was supposed to join Cochlear’s board from 1 January 2020.

Mr. Daniell has extensive executive leadership experience, and he has worked in the medical device industry for 40 years. Mr. Daniell’s expertise and deep experience in product innovation and leveraging new technologies would contribute to the continued growth and strategic development of the company.

FY2020 Financial outlook -

- The company expects to report net profit nearly in the range of $290-300 million in the fiscal year 2020, up by 9-13% on underlying net profit for FY2019.

- The new products launched late in the financial year 2019 would contribute to achieve robust growth in cochlear implant units of the company.

Key guidance considerations for FY2020-

- In the fiscal year 2020, the company is aiming to maintain the net profit margin and expecting a weighted average AUD/USD exchange rate of 70 cents for FY2020.

- From the continued development of the manufacturing facility in China and investment in IT platforms the capital expenditure to increase to nearly $180 million in the financial year 2020 and it is anticipated to decrease to about $100 million in FY2021.

- Cochlear is planning to expand the Acoustics product portfolio and expecting the release of its new osseointegrated steady-state implant product later in the FY2020.

Stock Information-

On 17 January 2020, the COH stock closed the day’s trade at $241.710, up by 0.623%. The company’s market capitalisation stood at nearly $13.83 billion, with almost 57.83 million shares outstanding. COH stocks 52 weeks high and low price was noted at $242.760 and $164.000, respectively.

_07_02_2025_07_09_20_593716.jpg)