The health care industry offers a range of services to help the health care demands of a community or individuals. The health care systems and hospitals continuously bringing the change in the service offerings and acting in response to various internal and external forces, including reimbursement issues, technology advancement, and shifts in the populations they work.

The essential sectors of the health care industry can be broadly classified into-

- Services and facilities for health care- Health care services and facilities are comprised of various subsectors. The broad classification includes- Hospitals, nursing and residential care facilities, ambulatory health care services and medical practitioners & healthcare professionals.

- Medical devices, equipment, and hospital supplies manufacturers- This segment comprises of medical device companies offering the latest medical technology for the medical & surgical equipment, in-vitro diagnostic substances, Irradiation apparatuses and many more.

- Medical insurance, medical services and managed care- This health care division deals with the players who are into offering health care insurance or different types of services to patients or other players in the medical sector. Managed care is used for defining several techniques which are for lowering the expense of providing health benefits and enhance the quality of care for organisations using the technologies.

- Pharmaceuticals, biotech & other related segments- The pharmaceutical and biotech industries are engaged in development and marketing of drugs or pharmaceutical products which are licensed for use as medicines. This sector also consists of many players, including OTC or over the counter drugs & drug Stores, pharmaceuticals packing & labeling services, prescription drugs, biopharmaceutical drugs, generic drugs etc.

Australian health care system-

Health care system in Australia is one of the best across the world which offers safe and reasonable health care for people residing in Australia. The health care system in Australia is combinedly operated by all levels of the Australian Government- federal, state and territory, and local.

Medicare is the foundation of the Australian health care sector, and it has been a universal health care scheme in Australia since 1984. Medicare is available to the residents of Australia and New Zealand, and for people from countries with reciprocal agreements.

The Medicare Benefits Schedule (MBS)

This is a list of all the health-related services that are provided by the Government, and there is a team of medical specialists to maintain the list up to date, safe and best practice. The MBS could come to aid by ensuring that people pay lesser amount for services once they reach a particular amount of money which is out of pocket costs. This might be the case if one has a year where the person spends a lot for medical care.

The Pharmaceutical Benefits Scheme (PBS)

With the Pharmaceutical Benefits Scheme, the patient could get medicines at a lower price which would be more expensive without PBS. In Pharmaceutical Benefits Scheme, the medicines are listed under the brand name, generic name, biologic and biosimilar drugs, and there are more than 5,200 products listed in this scheme. All the pharmaceutical products listed in PBS are proven to be safe and effective before they are available to sell in Australia. If one person has been enrolled in Medicare, they only have to pay some of the cost of most PBS listed medicines.

Australian health system challenges- The health care system in Australia faces few challenges, some of them are as-

- Ageing population

- Chronic diseases

- Health and medical research

- Technology advancement

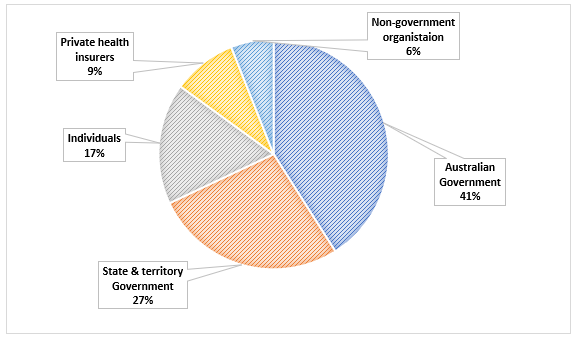

In the year 2016â17, Australia spent approximately $181 billion on health care sector-

The Government of Australia generally funds most of the spending for medical services and subsidised medicines, and in 2016-2017 the Government had provided a fund of approximately $5.5 billion for the health research in Australia.

Let us have a look who are the major players in the health care sector in Australia-

An ASX listed health care sector player CSL Limited (ASX:CSL) is engaged in providing vaccines for rare and serious diseases and influenza. The company is engaged in the R&D and marketing of products for the prevention and therapy of serious medical conditions. CSL is one of the biggest and fastest developing protein-based biotechnology businesses and a prominent supplier of in-licensed vaccines.

CSLâs stock closed the day at $281.47 on 20 December 2019, down by 0.386% from its last close. The stock has a market capitalisation of approximately $128.25 billion. It has 52 weeks low and high price at $173.330 and $287.900, respectively. The P/E ratio of the stock stands at 46.780x, with an annual dividend yield of 0.94%.

Ramsay Health Care Limited (ASX:RHC)

A global health care sector player Ramsay Health Care Limited (ASX:RHC) was established in Sydney, in 1964, involved in managing high-quality services and providing excellent patient care for more than 50 years. The company delivers a variety of primary healthcare services across 11 countries from 480 facilities and employs over 77,000 staff and caters 8.5 million patients in its primary care clinics and hospitals.

RHCâs stock closed the day at $73.970 on 20 December 2019, up by 0.312 per cent. The stock has a market capitalisation of approximately $14.9 billion. It has 52 weeks low and high price at $53.200 and $74.280, respectively. The P/E ratio of the stock stands at 27.840x, with an annual dividend yield of 2.05%.

Sonic Healthcare Limited (ASX:SHL)

Sydney headquartered, global healthcare player Sonic Healthcare Limited (ASX:SHL) is engaged in providing its services in laboratory medicine, radiology or diagnostic imaging etc. The company majorly operates in laboratory and imaging segment; the laboratory segment involves pathology and clinical services while the imaging segment is engaged with radiology and diagnostic imaging services.

SHLâs stock settled the day at $29.600 on 20 December 2019, up by 0.646% per cent. The stock has a market capitalisation of approximately $13.97 billion. It has 52 weeks low and high price at $21.280 and $30.620, respectively. The P/E ratio of the stock stands at 24.010x, with an annual dividend yield of 2.86%.

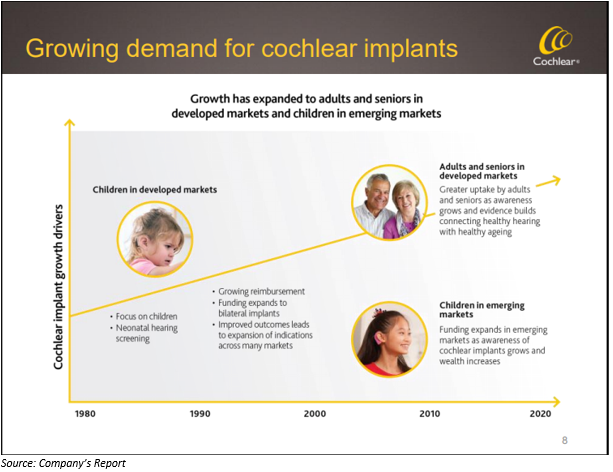

An ASX listed medical device company Cochlear Limited (ASX:COH) is engaged in providing implantable hearing solutions globally, the implants are - Acoustic implants, Cochlear implants and bone conduction implants. The company employs over 3,500 staff and provides its hearing solutions in more than 100 countries with over 550,000 devices. Cochlearâs annual investment in its R&D is approximate $160 million.

COHâs stock closed the day at $234.530 on 20 December 2019, up by 0.394 per cent. The stock has a market capitalisation of approximately $13.51 billion. It has 52 weeks low and high price at $164.000 and $238.540, respectively. The P/E ratio of the stock stands at 48.710x, with an annual dividend yield of 1.41%.

Fisher & Paykel Healthcare Corporation Limited (ASX:FPH)

New Zealand headquartered health care company Fisher & Paykel Healthcare Corporation Limited (ASX:FPH) entered the respiratory care market in 1971. The company is engaged in designing, development and marketing therapeutic products and techniques which are for use in respiratory and acute care, therapy and surgery of obstructive sleep apnea (OSA). Fisher & Paykel Healthcare manufacture, assemble and test its products and components in its New Zealand & Mexico. F&P provides its products in more than 120 countries globally and nearly 99% of the sales revenue is generated from outside New Zealand.

FPHâs stock closed the day at $21.300 on 20 December 2019, falling by 2.428 per cent from its last close. The stock has a market capitalisation of approximately $12.54 billion. It has 52 weeks low and high price at $11.320 and $21.990, respectively. The P/E ratio of the stock stands at 56.050x, with an annual dividend yield of 1.12%.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.