Fisher & Paykel Healthcare Corporation Limited (ASX: FPH) is primarily involved in designing innovative products for respiratory care. The company help patients transition to less acute care settings, help them recover more quickly and provide solutions that can assist them to avoid more acute conditions. The companyâs product range has grown to include over 1,400 products and sales have grown from just $20,000 in 1972 to be over $1 billion now.

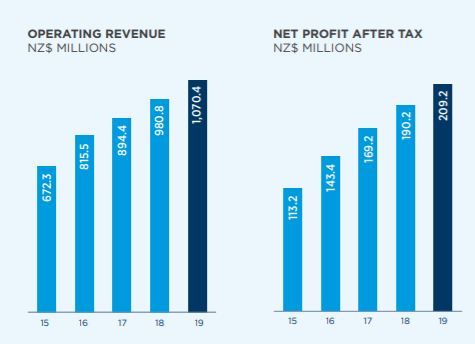

The financial year 2019 has been another successful year for the company with net profit after tax up 10% to $209.2 million and with operating revenue of $1.07 billion.

Operating Revenue and Net Profit Figures (Source: Company Reports)

During the year, the operating revenue for the Hospital product group increased by 12% to a record NZ$642.3 million and its Operating revenue for the Homecare product group rose 6% to NZ$421.5 million. Besides this, the companyâs gross margin increased by 56 basis points to 66.9 percent. In February 2019, the company announced that along with ResMed it has agreed to settle all outstanding infringement disputes related to patents between them in all venues across the globe and all current legal proceedings against the named products of the companies will be dismissed.

Recently, the company launched its new F&P ViteraTM OSA full face mask which incorporates its new VentiCoolTM technology.

The companyâs Board has declared a final dividend of 13.5 cents per share (cps) which will be paid on 5th July 2019. This takes the total dividend for FY19 to 23.25 cents per share (cps) and equates to a dividend payout ratio of approximately 64% of net profit after tax for the year.

The company is expecting its capital expenditure for the FY2020 to be around NZ$150 million. For FY20, the company is expecting its full year operating revenue to be around NZ$1.15 bn and net profit after tax to be in the range of NZ$240 mn to NZ$250 mn.

Historically, the companyâs growth has come from its expertise in respiratory humidification and, in the last two decades, from CPAP therapy and products to treat OSA. These areas remain the foundation of the companyâs business, however, the company is now using the expertise it has developed over the last 50 years to build its presence in new segments in the healthcare market where it can add value. The company is seeing growing demand in China and India, both of which offer significant future potential for the company with large populations and increasing spend on healthcare.

Now, letâs have a glance at the companyâs share performance and the return it has posted over the past few months. The stock traded at a price of $15.300, down by 3.165% during the dayâs trade with a market capitalisation of ~$9.07 billion as on 27 May 2019. The counter opened the day at $15.240 and reached the dayâs high of $15.310 and touched a dayâs low of $15.010 with a daily volume of ~ 428,217. The stock has provided a year till date return of 30.47% & also posted returns of 26.40%, -14.16% & 5.12% over the past six months, three & one-month period respectively. It had a 52-week high price of $15.830 and touched 52 weeks low of $11.280, with an average volume of ~ 358,715

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.