Following the RBAâs consecutive cash rate cuts in June and July this year, many mortgage lenders passed down the cuts to their customers, which resulted in lower home loan repayments. Australiaâs top four leading banks are currently facing the heat from the small lenders and international banks that are giving tough competition in providing cheaper loans.

Many lenders are providing huge discounts on loans and are providing loans to its customers at much easier terms, creating a competitive disadvantage for the big four banks, namely- Westpac, ANZ, Commonwealth and NAB.

Recently, Australiaâs leading home loan platform Lendi released a report in which it disclosed that the big four banks are taking comparatively more time in approving loans than other lenders, which are present in the market. It has been analysed that in the first six months of 2019, median rate of big four banks had been comparatively higher than the other lenders median rates.

Comparative Analyses of Median Interest Rates from 1 January to 30 June 2019 (Source: Lendiâs Report)

In the current scenario, where many lenders are providing cheaper loans and at easier terms and borrowers are looking for convenience and certainty, these big four banks need to pull up their socks in order to maintain their leadership in the lending market.

How had big four banks responded to rate cuts?

On 2nd July 2019, when RBA slashed down its official cash rate to 1.00%, to decrease the variable interest home loan rates for Australian home and residential investment loans by 0.25% per annum, passing the reduction in the cash rate to its customers.

Australia and New Zealand Banking Group Limited

One of the Australiaâs leading banks, Australia and New Zealand Banking Group Limited (ASX: ANZ) reduced the Standard Variable Rate for Owner Occupiers paying principal and interest to 4.93% per annum and decreased variable interest home loan rates in Australia by 0.25% per annum.

Major Changes by ANZ Following RBAâs Cash rate cut

- Decrease all variable interest rates for Australian home and residential investment loans by 0.25 percent per year;

- For Standard Variable Rate Owner Occupiers paying interest only the Index Rate reduces to 5.48%pa, from 5.73 percent per year;

- For Standard Variable Rate Owner Occupiers paying principal and interest this reduces the Index Rate to 4.93 percent per year, from 5.18 percent per year;

- All variable rate reductions were effective Friday, 12 July 2019.

Commonwealth Bank of Australia

Likewise, Australiaâs another leading bank in terms of market capitalisation, Commonwealth Bank of Australia (ASX: CBA) also reduced interest rates for home owners following the RBAâs cuts.

CBA had announced the following Reductions for borrowers:

- Owner Occupied Principal and Interest Standard Variable Rate home loan reduced by 0.19% per annum (pa) to a new record low rate of 4.93% pa;

- Owner Occupied Interest Only Standard Variable Rate home loans reduced by 0.25 percent per year to 5.42 percent per year;

- Investor Principal and Interest Standard Variable Rate home loans reduced by 0.19 percent per year to 5.51 percent per year;

- Investor Interest Only Standard Variable Rate home loans reduced by 0.25 percent per year to 5.89 percent per year.

National Australia Bank Limited

Australiaâs leading business bank National Australia Bank Limited (ASX: NAB) also announced the reduction of 19-basis points in its variable home loan interest rates, following RBAâs cuts.

Westpac Banking Corporation

Further, one of the Australiaâs oldest and largest bank, Westpac Banking Corporation (ASX: WBC) reduced the rates by 0.20% per annum. The bank had announced the following changes which were effective 16 July 2019:

- Variable home loan (owner occupier) rate has been reduced by 0.20% per year to 4.98% per year for customers with principal and interest repayments;

- Variable home loan (owner occupier) rate reduced by 0.20% per year to 5.57% per year for customers with interest only repayments;

- Variable residential investment property loan reduced by 0.20% per year to 5.53% per year for customers with principal and interest repayments;

- Variable residential investment property loan rate reduced by 0.30% per year to 5.79% per year for customers with interest only repayments.

Recently, banks like CBA and ANZ had cut down their fixed interest rates on loans also.

Stock Performance of the four Banks

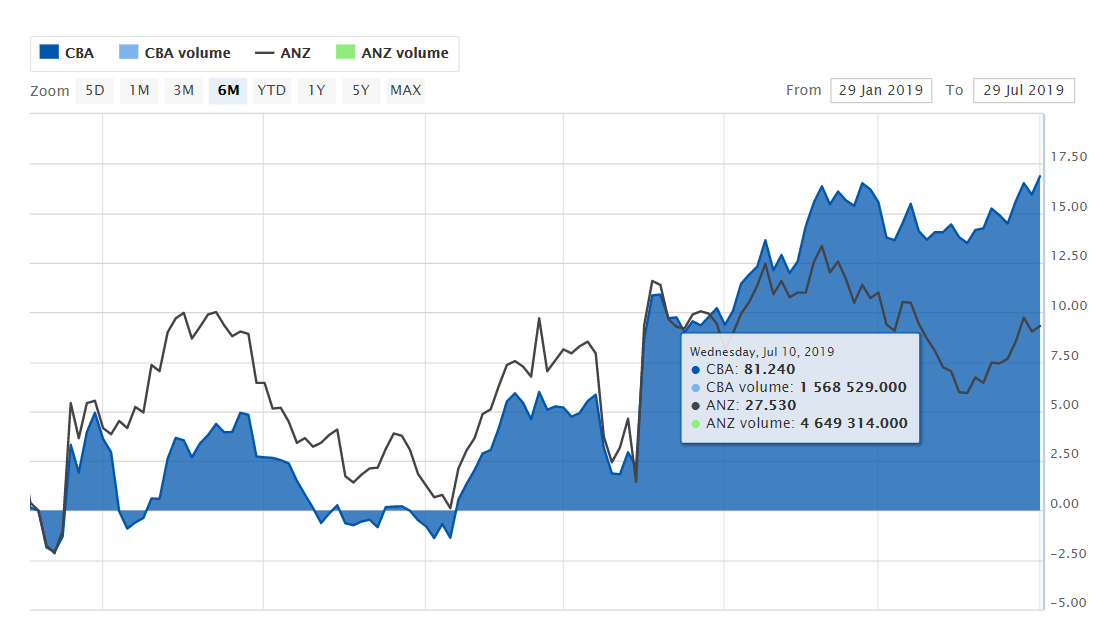

Now let us look at the recent stock performances of these four banks mentioned above.

The shares of CBA were up 0.18% during 30 July 2019âs intraday trade. On the stock performance front, the shares of CBA gave a return of 16.68% during the past six months as on 29 July 2019. CBAâs stock has a PE multiple of 16.220x and an annual dividend yield of 5.18%. At the market close on 30 July 2019, CBAâs stock was at a price of A$83.400 with a market capitalisation of circa $147.37 billion. The stockâs 52 weeks high price stands at A$83.990 and 52 weeks low price at A$65.230 with a yearly average volume of ~3,087,162.

The shares of ANZ were up 0.539% during 30 July 2019âs intraday trade. On the stock performance front, the shares of ANZ generated a return of 8.87% during the past six months as on 29 July 2019. ANZâs stock has a PE multiple of 12.710x and an annual dividend yield of 5.75%. At the market close on 30 July 2019, ANZâs stock was at a price of A$28.000 with a market capitalisation of circa $78.94 billion. The stockâs 52 weeks high price stands at A$30.390 and 52 weeks low price at A$22.980 with a yearly average volume of ~5,708,275.

Six Months Comparative analysis of CBA and ANZ (Source: Companyâs Report)

The shares of WBC were up 1.01% during 30 July 2019âs intraday trade. On the stock performance front, the shares of WBC gave a return of 13.52% during the past six months as on 29 July 2019. WBCâs stock has a PE multiple of 13.930x and an annual dividend yield of 6.55%. At the market close on 30 July 2019, WBCâs stock was at a price of $29.000 with a market capitalisation of circa $100.2 billion. The stockâs 52 weeks high price stands at A$30.440- and 52-weeks low price at A$23.300 with a yearly average volume of ~ 7,134,923.

The shares of NAB were up 0.245% during 30 July 2019âs intraday trade. On the stock performance front, the shares of NAB posted a return of 17.81t% during the past six months as on 29 July 2019. NABâs stock has a PE multiple of 13.930x and an annual dividend yield of 6.37%. At the market close on 30 July 2019, NABâs stock was at a price of A$28.650 with a market capitalisation of circa $82.4 billion. The stockâs 52 weeks high price stands at A$29.000- and 52-weeks low price at $22.520 with a yearly average volume of ~7,298,742.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.