American-Canadian journalist, Vince Beiser has rightly stated in his book “The World in a Grain”: “Sand is the essential ingredient that makes modern life possible”.

It has been observed throughout history that silica sand has continued to support human progress, being a crucial raw material in the industrial development of the globe, particularly in the metal casting, glass and ceramics industries. From construction sand, glassmaking and metal casting/foundry industries to chemical production, filtration and agriculture industries, the usage of silica sand is widespread.

The extensive use of silica sand in various industries has resulted in an enormous growth in its demand across the world, with supplies being running out. Moreover, the shortage of silica sand supply across the world has hit the international market hard, leading to a global sand crisis.

Recognising the importance of silica sand across the globe, Australia-based silica sand player - VRX Silica Limited (ASX:VRX) is targeted at meeting the silica sand shortage via its three advanced silica sand projects in Western Australia - Arrowsmith North, Arrowsmith Central and Muchea projects.

The Company intends to produce silica sand for glassmaking and metal casting/foundry industries.

Silica Sand in a Growth Phase in Construction Market

The silica sand has been in a growth phase in the construction sector due to a buoyant demand for the product, with both value and volume having increased worldwide.

In its latest company presentation, VRX Silica reported that the global construction aggregates market value is expected to register a CAGR growth of 6.1 per cent between 2017 and 2025. The presentation highlighted that India and China will remain key markets for construction materials, primarily due to the growth of the building sector in these two countries.

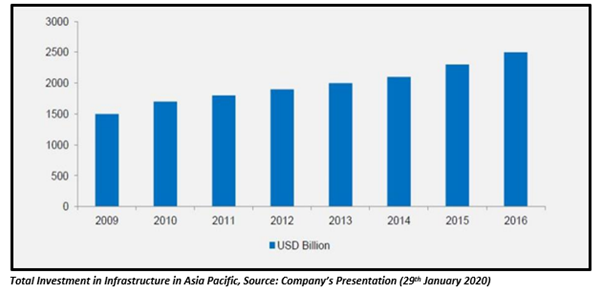

Moreover, sales of silica sand experienced a compound annual growth rate of approximately 8.7 per cent in value terms from 2009 to 2016, with a market value of USD 6.3 billion. Also, tremendous growth has been witnessed in total investment in infrastructure in the Asia Pacific between 2009 and 2016.

City construction Needs Glass!

The increased demand for silica sand in the construction market is particularly due to the application of product across a range of industries, especially glassmaking. As per the Company, the glass industry is a key driver for the international silica sand mining market.

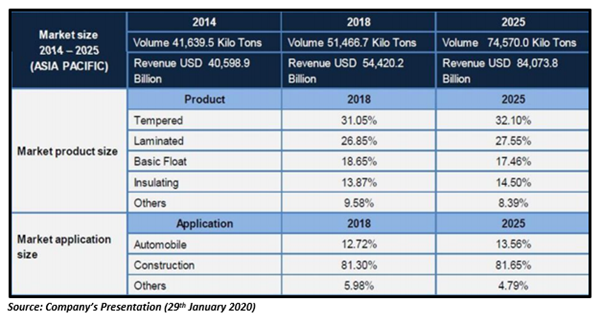

The Asia-Pacific flat glass market is witnessing high growth due to increased demand from the automotive and construction sectors. The flat glass market in the Asia-Pacific region is expected to deliver a revenue of USD 84,073.8 billion by 2025, a substantial increase from USD 40,598.9 billion observed in 2014 (see figure below).

The increased demand for flat glass is well supported by a growth in building and construction industry in the developing countries. Moreover, the solar energy sector, which is one of the most demanding markets for flat glass, is paving new opportunities for glass manufacturers, especially in China and India.

Positive Automotive Industry Outlook in Asia Pacific

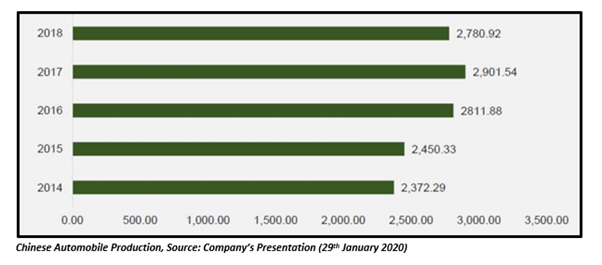

As discussed above, the growth in the flat glass market in Asia Pacific region is supported by an increased demand from the automotive sector. Moreover, progress in the sale of vehicles seen in China offers a potential growth opportunity for the flat glass market.

China Association of Automobile Manufacturers reported a sale of more than 27 million vehicles in 2018, which includes a rise of 5.05 per cent in the sale of commercial vehicles which amounted to 4.38 million.

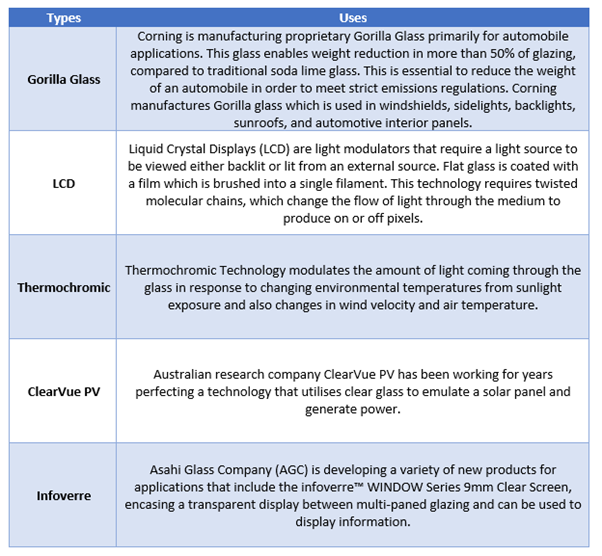

How Glass Industry is Innovating?

VRX Silica’s Projects Well-Positioned to Tap Market Opportunities

It has been seen that there are tremendous market opportunities available for the Company amidst growing demand and usage of silica sand product in different industries. The Company’s three advanced silica sand projects are well-positioned to tap these significant opportunities in the Asia-Pacific region.

Let’s scroll through some key attributes of the Company’s advanced projects:

Muchea

- Very high-grade product with outstanding financial metrics.

- Well located to key port and rail infrastructure.

- Specialist glass products.

- Potential 100+ year mine life:

- JORC Resource 208Mt @ 99.6% SiO2

- (Ind 29Mt @99.6% SiO2; Inf 179Mt @ 99.6% SiO2)

- Probable Ore Reserve of 18.7Mt @ 99.9% SiO2

- BFS completed in Oct 2019.

Arrowsmith North

- High-grade with exceptional financial metrics.

- Close proximity to port and rail infrastructure.

- Glass making, foundry and ceramic markets.

- Potential 100+ year mine life:

- JORC Resource of 771Mt @ 98% SiO2

- (Ind 248Mt @ 97.7% SiO2; Inf 523Mt @ 98.2% SiO2)

- Probable Ore Reserve of 223 Mt @ 99.7% SiO2

- BFS completed in Aug 2019.

Arrowsmith Central

- High grade with strong financial metrics.

- Adjacent to railway infrastructure to port.

- Container glass and foundry products.

- Significant resource base:

- JORC Resource of 76.5 Mt @ 96.8% SiO2

- (Ind 28.2Mt @ 96.6% SiO2; Inf 48.3Mt @ 96.9% SiO2)

- Probable Ore Reserve of 18.9 Mt @ 99.6% SiO2

- BFS completed in September 2019.

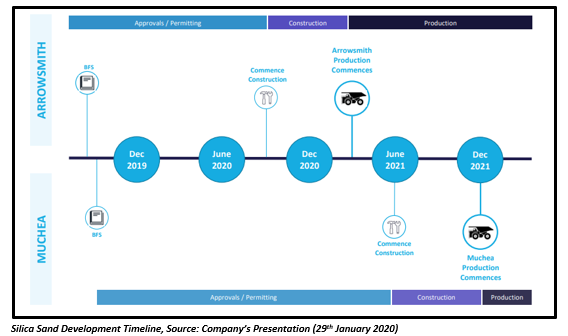

In a nutshell, VRX Silica is well on track to produce high-grade silica sand for the Asia-Pacific region, backed by outstanding project economics and logistics of its advanced projects. With a rapid pathway to production and financing, the Company is ideally positioned to tap on strong market

VRX settled the day’s trading at $0.093, up 2.2% on 29 January 2020.