For the first time since 2008 financial crisis, the Federal Reserve has reduced its key policy rate by 25 basis points, stating concerns over the global economy and subdued U.S. inflation. The US Federal Reserve has also signalled that it will?reduce the borrowing costs in future?if required. The rate cut was also characterized as an insurance move against the prolonged US-China trade war.

Key Highlights of FOMC statement

The decision over the federal funds rate target is taken by the governors at FOMC meetings in US. The FOMC members can either decrease, increase or make no movement in federal funds rate, depending on the economic conditions of the country and other factors.

On Wednesday, the Federal Reserve issued the Federal Open Market Committee (FOMC) statement, mentioning that the Committee has decided to reduce the target range of the federal funds rate by 25 basis points to 2 per cent to 2.25 per cent. The financial markets were already expecting this quarter-percentage-point rate cut but the US President, Mr Donald Trump, was hoping for a bigger rate cut. Mr Trump, who demanded a bigger cut in interest rates, was not satisfied with the Federal Reserve?s move. The Federal Reserve had also previously ignored Mr Trump?s demand to slash interest rates in May 2019 when it lowered the interest paid on excess reserves from 2.40 per cent to 2.3 per cent.

The statement highlighted that the US labour market has remained strong since FOMC?s June meeting, and the economic activities have been improving at a moderate pace. Also, the country has witnessed a lower unemployment rate, solid job gains on an average and an improvement in household spending during the last few months.

However, the overall inflation (on a 12-month basis) has stayed below 2 percent and there has been a soft growth of business fixed investment. In order to promote maximum employment and price stability, the Committee took the decision to lower the funds rate target range. It is expected that this move will support in strong labour market conditions, sustained expansion of economic activity and will keep inflation near the 2 per cent target. The Committee assured that it will evaluate realized and anticipated economic conditions for making future adjustments to the federal funds rate?s target range.

Major Decisions by Fed for Implementation of Monetary Policy

The Federal Reserve has also taken the following decisions in order to implement the changes in the federal funds rate with effect from 1st August 2019:

- To reduce the interest rate paid on necessary and excess reserve balances to 2.10 percent.

- FOMC directed the Open Market Desk of New York?s Federal Reserve Bank to conduct open market operations in System Open Market Account as required, to keep the federal funds rate in the modified target range, including overnight reverse repurchase operations at an offering rate of 2.00 percent.

- The Open Market Desk has also been asked to roll over all the principal payments from the Fed Reserve?s Treasury securities? holdings at auction, and reinvest the principal payments received during each calendar month from Fed?s holdings of agency mortgage-backed securities and agency debt.

- The Desk has also been ordered to involve in coupon swap and dollar roll transactions as required to support the settlement of the Fed?s transactions related to agency mortgage-backed securities.

- A 0.25 percentage point decrease to 2.75 per cent has also been approved in the primary credit rate.

Rate Cut - A Precautionary Step Against Recession

At the time of financial crisis in December 2008, the Federal Reserve took the interest rates to nearly zero and kept it there till 2015. It was the lowest such level of interest rates seen in the nation?s long history. The decision was taken by Fed to lift the economy out of the deepening recession as the economy experienced a gloomy outlook of jobs and a sharp drop in inflation at that time.

Fed began the series of increasing interest rates starting from December 2015. The current reduction in interest rates is a precautionary measure by Fed to prevent the US economy from recession and economic slowdown. Fed Chairman, Jerome Powell, has acknowledged the strength of the US economy where the unemployment level now stands at near a historic low level of 3.7 per cent. According to him, the US economy?s outlook still remains stable.

In recent months, many market experts have predicted that the US economy is heading towards recession. However, the recently recorded annual GDP (gross domestic product) growth of 3.2 per cent in the US during first quarter of 2019 has the changed the experts? projections. The growth rate indicated that the economy is still expanding at a healthy rate.

Will RBA Follow Fed?s Rate Cut Move?

According to several economists, the recent rate cut by the Federal Reserve has increased the chances of further rate cuts by the Reserve Bank of Australia. RBA has already reduced interest rates twice in the last two months consecutively in order to support employment growth and help inflation meet the target. Currently, the interest rate in the Australian economy stands at 1 per cent.

Economists believe that the impact of rate cut by Fed has far-reaching consequences as the major stock markets and global currencies often conduct trade over anticipations of the Fed Reserve?s moves. They think that the RBA may come under pressure to ease monetary policy, following the global central bank?s impulse to support economy.

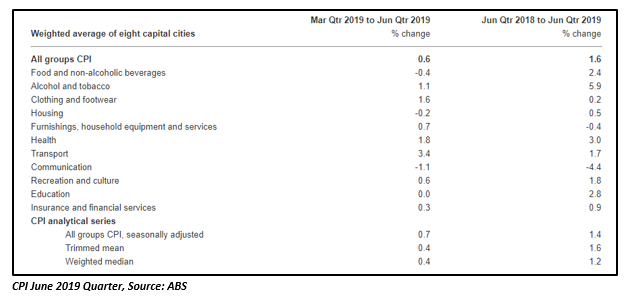

The rate cut announcement came just a day after the Australian Bureau of Statistics announced the inflation data for June 2019 quarter. The inflation in Australia improved by 0.6 per cent in June quarter, taking the annual consumer price index to 1.6 per cent. The annual CPI surpassed the expectations of market experts that were anticipating a 1.5 per cent increase during the quarter.

The experts are still expecting further rate cuts by the RBA before 2019 year-end. Recently, the RBA Governor Mr Philip Lowe, had also given an indication of additional rate cuts in the economy to lift inflation back to its target range of 2 to 3 per cent. According to him, the low level of interest rates will stay for an extended period of time in the economy.

Impact on Equity Market: The initial gains in the US stocks were wiped off by the hawkish statement of Mr Powell, not suggesting any further direction of the rate cut. The US stock market closed in the red territory. The Dow Jones Industrial Average Index closed 1.23 per cent lower at $26,864.27 and Nasdaq Composite index ended 1.19 per cent down at $8175.42 on 31st July 2019.

The Australian share market followed the losses of the Wall Street and closed in red zone. On 1st August 2019, the S&P/ASX 200 index settled at 688.9 points, down by 0.3 per cent or 18.2 points. The broader All Ordinaries Index closed 0.4 per cent down, at 6871.9 points on ASX.

The top five stocks that are currently trading in negative territory on S&P/ASX 200 Index includes JHG (down by 12.20%), NST (down by 7.23%), ABC (down by 3.33%), RSG (down by 5.35%) and CYB(down by 5.16%).

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.