Highlights

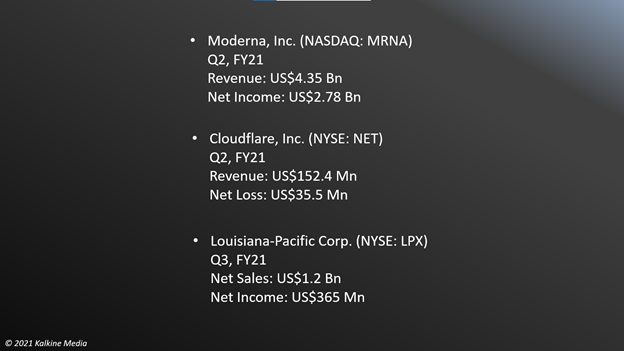

- Moderna, Inc’s (NASDAQ:MRNA) stock price jumped more than 212% YTD.

- The Cloudflare, Inc. (NYSE:NET) stock gained over 157% YTD.

- Louisiana-Pacific Corp’s (NYSE:LPX) net sales rose by 53% YoY in Q3, FY21.

As the third-quarter earnings season is gradually nearing its end, investors might consider topping up their portfolios with some growth stocks, given the improved economic outlook lately. Despite concerns over inflation, labor shortage, rising prices of raw materials, many retail traders are upbeat over the growth prospects of the companies.

Here explore five growth stocks that may benefit from the improving economy.

Also Read: Backblaze IPO: How to buy this cloud storage platform stock?

Moderna, Inc. (NASDAQ:MRNA)

Moderna, Inc. is a biotechnology company based in Massachusetts. It manufactures mRNA vaccines for Covid-19 and other diseases.

The shares of the company traded at US$339.51 at 1:11 pm ET on Nov 3, down 2.62% from their closing price of November 2. The stock value of MRNA surged over 212% YTD.

Explore five hot growth stocks with robust YTD returns

The firm has a market cap of US$136.96 billion, a P/E ratio of 42.31, and a forward P/E one year of 11.83. Its EPS is US$8.02.

Also Read: OLB Inc. (OLB) stock tanks 16% after robust gains on Mastercard deal

The 52-week highest and lowest stock prices were US$497.49 and US$66.59, respectively. Its trading volume was 5,259,391 on November 2. The company reported a revenue of US$4.35 billion in Q2, FY21, compared to US$67 million in the same quarter of the previous year. Its net income came in at US$2.78 billion, versus a loss of US$117 million in Q2, FY20.

Also Read: 10 upcoming IPOs to keep an eye on in November

Also Read: Elon Musk’s net worth now tops Jeff Bezos, Mark Zuckerberg’s combined

Cloudflare, Inc. (NYSE:NET)

Cloudflare, Inc. is an online infrastructure and web security company based in San Francisco, California. The stock of the company was priced at US$191.535 at 1:19 pm ET on November 3, down 0.43% from its previous closing price. The NET stock grew over 157% YTD. The market cap of the company is US$61.06 billion, and the forward P/E one year is -418.20. Its EPS is US$-0.45.

Also Read: Microsoft now joins the Metaverse craze, to launch Mesh for Teams

The stock saw the highest price of US$196.80 and the lowest price of US$51.60 in the last 52 weeks. Its share volume on November 2 was 2,122,903. In the second quarter of fiscal 2021, its total revenue increased by 53% YoY to US$152.4 million. On a GAAP basis, it reported a net loss of US$35.5 million against a loss of US$26.1 million in Q2, FY20.

Also Read: Estee Lauder (EL) posts net income of US$692 million in Q1

Avis Budget Group, Inc. (NASDAQ:CAR)

Avis Budget is a car rental company and is the parent company of Avis Car Rental, Zipcar, Budget Truck Rental, and Budget Car Rental. It is based in New Jersey.

The shares of the company traded at US$299.00 at 4:32 pm ET on November 3, up 0.31% in after-market trading. Its stock value increased by over 900% YTD.

The firm has a market cap of US$19.83 billion, a P/E ratio of 24.12, and a forward P/E one year of 24.43. Its EPS is US$12.36. The 52-week highest and lowest stock prices were US$545.11 and US$28.20, respectively. Its trading volume was 30,496,240 on November 2.

In the third quarter of fiscal 2021, the company's revenue surged 96% from the same quarter of the prior year to US$3.0 billion, while its net income came in at US$674 million compared to US$45 million in Q3, FY20.

Also Read: Five stocks to explore as more companies join metaverse madness

Palo Alto Networks, Inc. (NASDAQ:PANW)

Palo Alto is a cybersecurity company that offers a platform with advanced firewalls and cloud-based services. It is based in Santa Clara, California.

The stock of the company was priced at US$498.96 at 4:00 pm ET on November 3, down by 1.87% from its previous closing price. The stock rose about 44% YTD. The market cap of the company is US$48.90 billion, and the forward P/E one year is -1081.83. Its EPS is US$-5.18.

The stock saw the highest price of US$519.45 and the lowest price of US$223.00 in the last 52 weeks. Its share volume on November 2 was 684,965.

The company's revenue surged 28% YoY to US$1.2 billion in Q4, FY21, while its fiscal 2021 revenue was up 25% YoY to US$4.3 billion. For the quarter, its non-GAAP net income came in at US$161.9 million, or US$1.60 per diluted share, compared to US$144.9 million, or US$1.48 per diluted share in Q4, FY20.

Also Read: Marriott (MAR), Exelon (EXC) profits rise sharply in third quarter

Source: Pixabay

Louisiana-Pacific Corp. (NYSE:LPX)

Louisiana-Pacific Corp. is a building company based in Nashville, Tennessee. It primarily focuses on manufacturing building materials. The shares of the company traded at US$67.13 at 1:21 pm ET on November 3, up 4.52% from their closing price of November 2. The LPX stocks grew over 73% YTD. The firm has a market cap of US$6.42 billion, a P/E ratio of 4.78, and a forward P/E one year of 4.87. Its EPS and annualized dividend are US$14.11 and US$0.72, respectively.

Also Read: ConocoPhillips (COP), BP (BP) Q3 profits rise on high energy demand

The 52-week highest and lowest stock prices were US$76.35 and US$28.78, respectively. Its trading volume was 2,339,046 on November 2.

The net sales of the company were US$1.2 billion in Q3, FY21, up 53% from US$795 million in the comparable quarter of the prior year. Its attributable net income came in at US$365 million, or US$3.87 per diluted share, compared to US$177 million, or US$1.57 per diluted share in the second quarter of fiscal 2020.

Also Read: What is Burger King’s crypto reward program and how to join it?

Bottomline

The S&P 500 index increased by about 24% YTD. Likewise, stocks of all these companies have witnessed robust gains despite multiple concerns in the market. Investors, however, should evaluate the companies closely before investing in the stock market.

.jpg)