Highlights

- Marriott International (NASDAQ:MAR) revenue rose 75% YoY in Q3, FY21.

- Marriott’s adjusted diluted EPS jumped 662% YoY in Q3, FY21.

- Exelon Corporation (NASDAQ:EXC) narrowed its adjusted EPS guidance to between US$2.70 and US$2.90 per share.

Marriott International (NASDAQ:MAR) and Exelon Corporation (NASDAQ:EXC) on Wednesday reported strong third-quarter revenue growth, helped by the reopening of markets.

MAR stock was priced at US$161.245, up 0.74%, and the EXC stock traded at US$54.57, up 1.54%, at 10:10 am ET from their previous close.

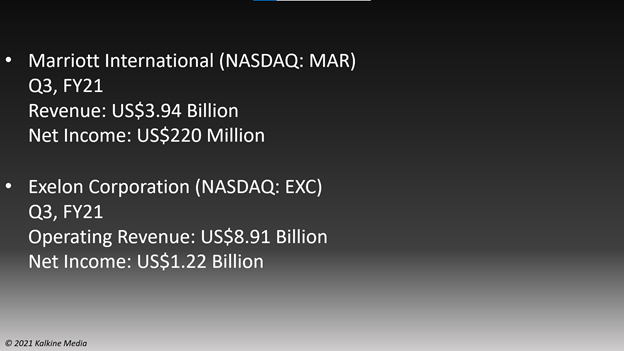

Quarterly earnings highlights:

Also Read: 10 upcoming IPOs to keep an eye on in November

Marriott International (NASDAQ:MAR)

Marriott International is a Bethesda, Maryland-based company and operates, franchises, and owns hotels and other properties.

The company's revenue surged 75% YoY to US$3.94 billion in Q3, FY21. Its operating income was US$545 million, up 116%, from US$252 million in the year-ago quarter.

Also Read: Elon Musk’s net worth now tops Jeff Bezos, Mark Zuckerberg’s combined

The company's net income came in at US$220 million, or US$0.67 per diluted share, compared to US$100 million, or US$0.31 per diluted share, in Q3, FY20.

Its adjusted earnings surged 662% YoY to US$0.99 per diluted share in Q3, FY21.

Marriott International has a market cap of US$52.53 billion, a P/E ratio of 152.18, and a forward P/E one year of 55.38. Its EPS is US$1.06.

The 52-week highest and lowest stock prices were US$162.31 and US$93.89, respectively. Its trading volume was 2,616,123 on Nov 2.

Also Read: Microsoft now joins the Metaverse craze, to launch Mesh for Teams

Also Read: Estee Lauder (EL) posts net income of US$692 million in Q1

Exelon Corporation (NASDAQ:EXC)

Exelon Corporation is a utility holding company based in Chicago, Illinois, and has interests in energy generation.

On a GAAP basis, the firm's operating revenue was US$8.91 billion in Q3, FY21, compared to US$8.85 billion in the same quarter of the previous year. Its operating income came in at US$1.85 billion in the period compared to US$769 million in the third quarter of fiscal 2020.

Exelon's net income was US$1.22 billion, or US$1.23 per diluted share, compared to US$569 million, or US$0.51 per diluted share, in Q3, FY20.

Also Read: ConocoPhillips (COP), BP (BP) Q3 profits rise on high energy demand

Meanwhile, the company has narrowed its adjusted operating earnings guidance for fiscal 2021. It now expects its non-GAAP operating earnings to be between US$2.70 and US$2.90 per share from its previous forecast of US$2.60 and US$3.00 per share.

The market cap of the company is US$53.37 billion, the P/E ratio is 55.14, and the forward P/E one year is 19.47. Its EPS is US$0.99. The stock saw the highest price of US$54.18 and the lowest price of US$38.35 in the last 52 weeks. Its share volume on Nov 2 was 5,872,938.

Also Read: What is Burger King’s crypto reward program and how to join it?

Bottomline

Both the stocks skyrocketed in the recent quarters due to strong demand for services. The MAR stock rose 28.28% YTD, while the EXC stock jumped 30.53% YTD. Investors, however, should evaluate the companies carefully before investing in the stock market.

.jpg)