Fevertree Drinks Plc

Fevertree Drinks plc (LON:FEVR) is the UK-based developer and supplier of premium mixer drinks. The company started its business in 2003. The co-founders of the company are Charles and Tim, who realised that premium spirits were multiplying. The company found three various varieties of ginger which together helped to produce a rich, crisp and genuine taste, which are used for selecting ginger ales and ginger beer. The company sells mixer drinks with the brand name of Premium Indian Tonic Water, Refreshingly Light Indian Tonic Water, Smoky Ginger Ale, Spiced Orange Ginger Ale, Elderflower Tonic Water, Sicilian Lemonade, Premium Lemonade, Mediterranean Tonic Water, Aromatic Tonic Water, Sicilian Lemon Tonic Water, Refreshingly Light Cucumber Tonic Water, Citrus Tonic Water, Ginger Beer, Ginger Ale, Madagascan Cola and Premium Soda Water.

Trading Updates

On 20th November 2019, the company announced that it was able to deliver growth throughout regions out of this the USA region performed well as per company expectations in the second half of FY2019. However, the performance of UK off-trade was not up to the expectations of the company. The company expects that the revenue margin was remaining unchanged with 12% to 13% revenue growth at the end of 31st December 2019.

Financial Highlights

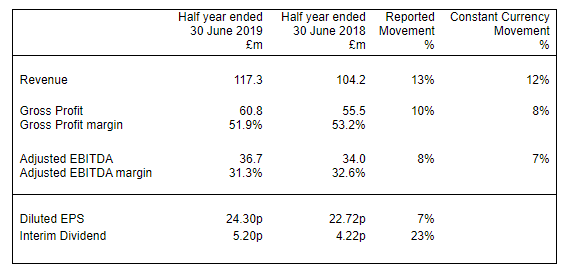

The reported income of the company stood at £117.3 million for the first half of the fiscal year 2019 as compared to £104.2 million in H1 FY2018, an increase of 12.6%. The gross profit of the company increased by 9.54% to £60.8 million for H1 FY2019 as against £55.5 million in H1 FY2018. However, the gross profit margin decreased to 51.9% in H1 FY2019 from 53.2% H1 FY2018.

The reported adjusted EBITDA of the company increased by 7.9% to £36.7 million for the first half of the fiscal year 2019 as compared to £34.0 million in H1 FY2018. In contrast, the adjusted EBITDA margin decreased to 31.3% in the first half of the fiscal year 2019 versus 32.6% in H1 FY2018. The company increased its interim dividend per share by 23.22% to 5.20p in H1 FY2019 from 4.22p in H1 FY2018.

(Source: LSE)

Share Price Performance

On 13th December 2019, at 10:25 AM GMT, while writing, FEVR share price was reported to be trading at GBX 2,122 per share on the LSE, an incline of 1.14 per cent or GBX 24 per share, as compared to the previous dayâs closing price, which was reported to be at GBX 2,098 per share.

On 02nd May 2019, the shares of FEVR was GBX 3,290 which was highest ever and reached to the GBX 1697.02 on 13th November 2019 which was lowest ever in the last 52 weeks range. Todayâs share price was down by 35.50 per cent from the 52-week highest price whereas the same share price was up by 25.04 per cent from 52-week lowest price.

The companyâs market capitalisation valued at GBP 2.44 billion concerning the shareâs current market price. The beta of the FEVR share was reported to be at 1.785, which shows that the movement is highly volatile in its trend, as compared to the benchmark market indexâs movement.

Ocado Group PLC

Ocado Group plc (LON:OCDO) is the UK-based worldâs largest dedicated online grocery retailer. The company was listed first time on LSE in 2010. The company has more than 580,000 active customers. It established an exceptional operating solution for online grocery retail which is based on proprietary technology which is also fit for operations business and commercial associates. The company has also introduced its mobile app, which helped the company to multiply business.

News Updates

On 9th December 2019, the company announced the successful completion of the convertible bond offering. It includes £600 million of senior unsecured Convertible Bonds which is due 2025.

On 29th November 2019, the company announced an agreement between Ocado Solutions and Aeon to further create Aeon's online grocery business with the use of the Ocado Smart Platform in Japan.

Trading Updates

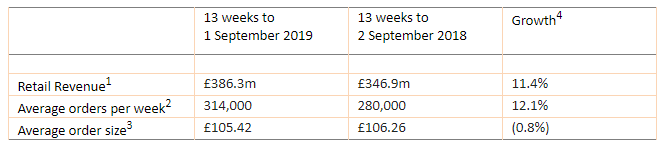

On 17th September 2019, Ocado Retail Ltd, a joint venture with Marks & Spencer Group plc which was completed in August, announced its trading statement for the 13 weeks to 1 September 2019.

The reported retail revenue of the company stood at £386.3 million in 13 weeks to 1 September 2019 as compared to £346.9 million 13 weeks to 2 September 2018, an increase of 11.4%. The reported average orders per week of the company stood at 314,000 in 13 weeks to 1 September 2019 as against 280,000 in 13 weeks to 2 September 2018, an increase of 12.1%. Additionally, the reported Average order size of the company stood at £105.42 million in 13 weeks to 1 September 2019 as against £106.26 million in 13 weeks to 2 September 2018, a decrease of 0.8%.

(Source: LSE)

Share Price Performance

On 13th December 2019, at 10:30 AM GMT, while writing, OCDO share price was reported to be trading at GBX 1,234 per share on the LSE, an incline of 1.98 per cent or GBX 24 per share, in contrasted to the previous dayâs closing price, which was reported to be at GBX 1,210 per share.

On 24th April 2019, the shares of OCDO was GBX 1,440.50 which was highest ever and reached to  GBX 739.70 on 27th December 2018 which was lowest ever in the last 52 weeks range. Todayâs share price was lower by 14.33 per cent from 52-week highest price whereas the same share price was higher by 66.82 per cent from the 52-week lowest price.

The companyâs market capitalisation (M-Cap) was reportedly valued to be at GBP 8.45 billion concerning the shareâs current market price. The share outstanding of the OCDO share has been reported to be at 698.38 million, and the average volume has been 2.40 million.

The beta of the OCDO share was reported to be at 1.17. This means that the companyâs share price movement is more volatile in its trend, as compared to the benchmark market indexâs movement.

Â

Sirius Minerals Plc

Sirius Minerals Plc (LON:SXX) is the UK based company and a world-leading producer of polyhalite, an exceptional multi-nutrient fertiliser containing sulphur, magnesium, potassium and calcium. The companyâs polyhalite fertiliser product (POLY4) can improve crops and quality in different variety of crops to fight with global challenges of food safety measures. The company operates from the headquarter at Resolution House in Scarborough, North Yorkshire.

Financial highlights

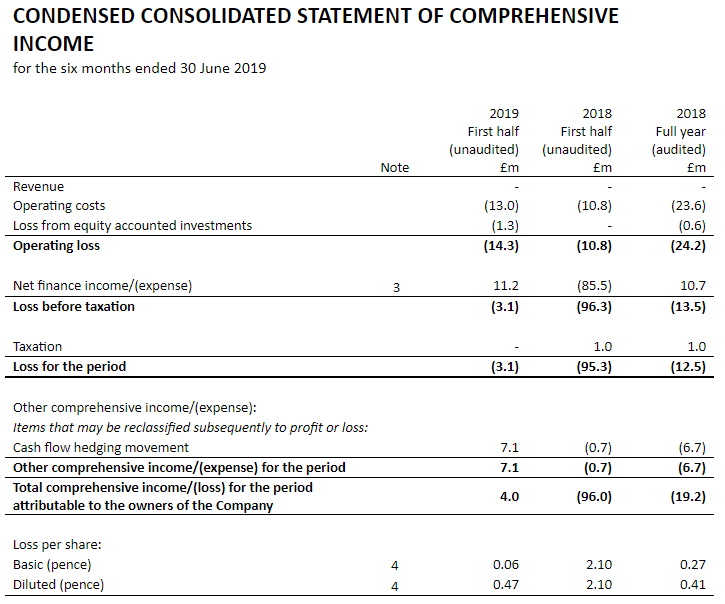

On 17th September 2019, the company released its interim results for the six months ended 30th June 2019. As per the report, the operating cost increased by 20.4% to £13.0 million in H1 FY2019 as compared to £10.8 million in H1 FY2018. The loss from equity-accounted investment was of £1.3 million in H1 FY2019. The loss for the period decreased by 96.7% to £3.1 million in H1 FY2019 as compared to £95.3 million in H1 FY2018.

The convertible loans increased to £504.7 million in H1 FY2019 as compared to £196.2 million as at 31st December 2018. The Share Capital increased to £17.5 million in H1 FY2019 as compared to £12.0 million in 12 months to 31st December 2018.

(Source: company website)

Share Price Performance

On 13th December 2019, at 10:25 PM GMT, while writing, SXX share price was reported to be trading at GBX 3.51 per share on the LSE, an increase of 3.24 per cent or GBX 0.11 per share, as compared to the previous dayâs closing price, which was reported to be at GBX 3.40 per share.

On 09th April 2019, the shares of SXX was GBX 26.84, which was highest ever and reached to GBX 2.10 on 17th September 2019 which was lowest ever in the last 52 weeks range. Todayâs share price was down by 86.92 per cent from 52-week highest price whereas the same share price was up by 67.14 per cent from the 52-week lowest price.

The companyâs market capitalisation (M-Cap) was reportedly valued to be at GBP 238.69 million concerning the shareâs current market price. The share outstanding of the SXX share has been reported to be at 7.02 billion, and the average volume has been 17.79 million.

The beta of the SXX share was reported to be at 1.98. This means that the companyâs share price movement is more volatile in its trend, as compared to the benchmark market indexâs movement.