Sirius Minerals PLC

Sirius Minerals PLC (SXX) is a United Kingdom based mineral development and fertilizer production company. It holds exploration rights over polyhalite mineral deposits located in Whitby, Yorkshire in United Kingdoms. This mineral combines six micronutrients potassium, magnesium, sulfur, calcium, nitrogen and phosphorus, which can be directly used as a fertilizer without need for further chemical treatment. The company intends to use this mineral to manufacture granulated NPK type blended fertilizer product called POLY4.

The company has not yet begun production of its principal product. The facilities of the company are in the construction and commissioning phase at the Whitby Yorkshire location. The companyâs shares are listed on the AIM segment of the London Stock Exchange where they trade with the ticker name SXX. The shares are also part of the FTSE 250 index.

Recent News update

The company on 17 September 2019 came out with an announcement that it will be redeeming $400 million worth of convertible bonds due to mature in 2027, to the bondholders along with interest which is lying in escrow since its issuance in May 2019.

The company on 6 August 2019 also announced the with-holding of $500 million worth of a bond sale.

The company has stated that the impending economic conditions at this stage are not conducive for the proposed debt fundraising and that it would postpone the issue for now and make a strategic review of the companyâs North Yorkshire Polyhalite Project during the next six months before it revisits the subject again.

The company also stated that its unrestricted cash reserves of £180 million held as on 31 August 2019 - provides comfortable liquidity to the company to explore all options during the strategic review process.

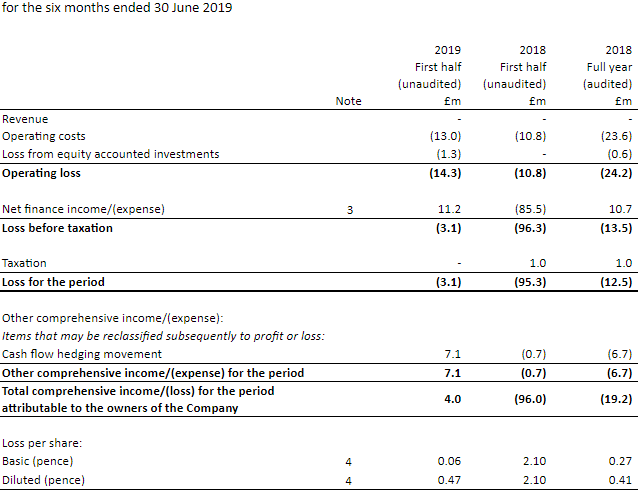

Insights from Financial Results published on 17 September 2019

- The operating loss of the company for the six month period ending 30 June 2019 was £14.3 million compared to £10.8 million in the six month corresponding period ending 30 June 2018, the increase in loss was on account of heightened level of corporate spending, sales expenditure and marketing costs associated with the company's Stage 2 Financing.

- The company for the financial period suffered a loss of £3.1 million compared to a loss of £95.3 million for the prior six-month corresponding period; this reduction was on account of fair value gains attributable to derivative instruments in contrast to the fair value losses incurred on this account in the corresponding prior six-month period.

- The company has deployed £240 million in the North Yorkshire Polyhalite Project during the six-month period for development activities there.

Source â Companyâs half-yearly report published on 17 September 2019

Stock Price performance at the London stock exchange over the past five daysÂ

Price Chart as on 18 September 2019, before the market close (Source: Thomson Reuters)

On 18 September 2019, at the time of writing the report (before the market close, GMT 02.25 PM), SXX shares were trading on the London Stock Exchange at GBX 4.348.

The stock has a 52-week High of GBX 30.81 and a 52-week low of GBX 2.10. The total market capitalization of the company was £326.91 million.

Outlook

The Board of the company is of the opinion that by reducing the pace of development at the project site and focusing only on the key aspects of the project would instead better serve to preserve the overall value for North Yorkshire Polyhalite Project and will provide the company with a period of up to six months to review and consider all available options for it to move forward. The Group would have to raise additional external financing to continue operations beyond 31 March 2020.

Primary Health Properties Plc

Primary Health Properties Plc is a United Kingdom domiciled company engaged in the real estate investment trust (REIT) business. The main business of this real estate investment trust (REIT) is to invest in the ownership of primary healthcare facilities within the United Kingdom and in the Ireland Republic. It is particularly interested in the ownership of freehold or long-term leasehold assets in purpose-built primary healthcare facilities, that are leased out to medical professionals, government medical facilities and other associated medical and healthcare entities. Its portfolio of assets consists of nearly 306 such primary healthcare properties. Among the company's facilities include Appleby Primary Care Centre, Wrexham; Allesley Park Medical Centre, Amesbury; Carnoustie Medical Group, Birkenhead; Hope Family Medical Centre, Carnoustie; Dinays Powys Medical Centre, St Catherine's Health Centre,  Dinas Powys; Appleby-in-Westmorland, Coventry; Barcroft Medical Centre and Cedars Surgery.

The companyâs shares trade with the ticker name PHP on the London Stock Exchange. The companyâs share form part of the FTSE 250 index.

PHP - Recent News update

The company on 17 September 2019 announced that one of its wholly-owned subsidiaries had issued new senior secured notes worth â¬70 million at 1.509 per cent fixed rate and a maturity period of 12 years. The notes have been guaranteed by the company and were placed for the United Kingdom and Ireland based institutional investors.

The notes issue is the companyâs second euro-currency offering in the private placement market and highlights its ability to secure funding from a wide range of alternative funding providers at favourable rates. The use of euro-currency debt instruments also provides a hedge against any adverse movements in exchange rates for its assets in Ireland.

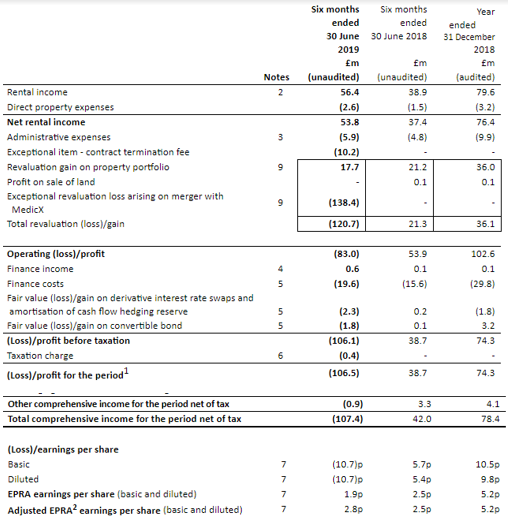

PHP - Insights from Financial Results published on 25 July 2019

- The Adjusted EPRA earnings per share of the company increased by 12.0 per cent to 2.8 pence for the six-month period ending 30 June 2019, while for the corresponding period ending 30 June 2018 Adjusted EPRA earnings per share were 2.5 pence.

- The Average cost of debt of the company has come down by 25 basis points to 3.75 per cent from 4.0 per cent applicable at the conclusion of the merger with MedicX (on 31 December 2018 it was 3.9 per cent) including after balance sheet date transactions.

Source â Companyâs half-yearly report published on 25 July 2019

PHP - Stock Price performance at the London stock exchange over the past five daysÂ

Price Chart as on 18 September 2019, before the market close (Source: Thomson Reuters)

On 18 September 2019, at the time of writing the report (before the market close, GMT 04.25 PM), PHP shares were trading on the London Stock Exchange at GBX 137.6.

The stock has a 52-week High of GBX 139.00 and a 52-week low of GBX 106.40. The total market capitalization of the company was £1.56 billion.

PHP - Outlook

The company has expressed its confidence that with the merger getting completed with MedicX it can create long term value for shareholders and other stakeholders.

CYBG Plc

CYBG Plc is a United Kingdom-domiciled holding company having three of United Kingdomâs banking and financial entities namely Clydesdale Bank Plc (Clydesdale Bank), Yorkshire Bank and Virgin Money Plc under its fold. The company through these entities provides banking and associated financial services to both retail and corporate clients through its retail banking outlets, business banking outlets, direct & online channels, and through dealers. Clydesdale Bank in England provides retail financial and banking services and SME banking services. Its products and services include among others, current account services, deposit services, personal loan services, term lending services, working capital solutions, mortgages services, overdraft facilities, credit cards and payment transaction services. The Bank operates out of nearly 160 branches.

The companyâs shares are listed on the London Stock Exchange where they trade with the ticker name CYBG. The shares also form part of the FTSE 250 index.

Recent News Update

The company on 17 September 2019, announced that Tim Wade would take up the position of a member of the Board's Governance and Nomination Committee of the company with effect from 20 September 2019.

Tim had joined the company in September 2016 and is holding the Chair of the companyâs Board Audit Committee and is also a member of the company Boardâs Risk Committee.

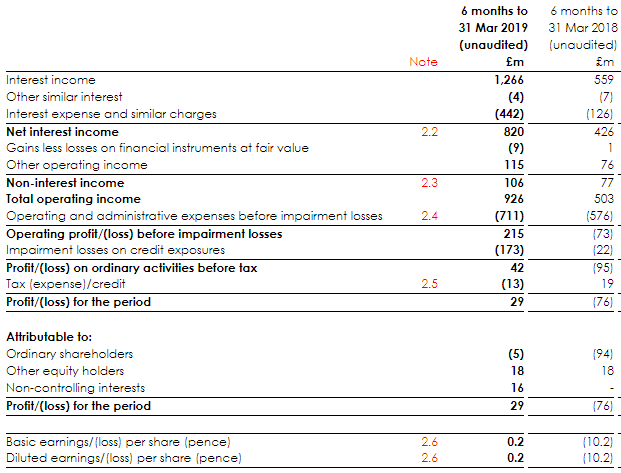

Insights from Financial Results for six months ended 31 March 2019

- The companyâs Pro forma underlying profit before tax stood at £286m which is 5 per cent lower year on year due to the anticipated rise in impairment costs, however, it is up by 2 per cent compared to H2 18. The underlying Return on Tangible Equity (RoTE) was 10.4 per cent.

- The Pro forma profit before tax of the company stood at £9 million, being impacted by heightened acquisition and integration expenditure, statutory profit after tax stood at £29 million on account of tax charge and acquisition timing effect.

Source â Companyâs half-yearly report published on 15 May 2019

Stock Price performance at the London stock exchange over the past five daysÂ

Price Chart as on 18 September 2019, before the market close (Source: Thomson Reuters)

On 18 September 2019, at the time of writing the report (before the market close, GMT 04.25 PM), CYBG shares were trading on the London Stock Exchange at GBX 119.45.

The stock has a 52-week High of GBX 336.0 and a 52-week low of GBX 108.30. The total market capitalization of the company was £1.77 billion.

The company is well on track to deliver full-year 2019 results in line with the boardâs expectations.