We are entering a new year, and 2020 has been a volatile year for markets, be it equities or commodities. The COVID-19 pandemic pushed the major central banks and governments across the globe to take drastic measures to avoid the economy from sliding down the recession road.

The actions had a direct bearing on the global markets and commodities also saw a major share of price action, from a crash in crude oil prices to a rally in iron ore. Let us have a quick look at how the commodities market panned out in 2020 and the outlook for 2021.

The Oil Outlook

The COVID-19 outbreak had damped the market sentiments around many consumption-based commodities, including base metals, critical minerals, and many others. The oil industry was one of the hardest hit with prices of crude oil even slipping to the negative zone. The situation was so bleak that at one-point sellers were actually paying buyers to buy some of the oil.

The move was unprecedented while throwing light on how the demand and supply imbalance could cause the market to react sharply, and to an unimaginable extent.

The oil market remained in the dark for quite a while until the oil cartel - OPEC decided to curtail the global supply, which acted as a turning point for the plunging oil market, leading to a gradual increase in prices.

The recovery in the oil price was later supported by a slight uptick in demand following the travel ease and the removal of COVID-19 related cross border restrictions.

To Know More, Do Read: Crude Soars on Slightest Indication of Demand; Oil is not out of the Woods yet

The same demand and supply scenario should now dictate the oil market ahead, which has managed to recover to USD 50 a barrel due to less stringent travel restriction and a minor revival of the tourism industry.

Image Source: © Kalkine Group 2020

Furthermore, the OPEC and allies now plan to open the restricted supply chain a bit, showcasing confidence. Meanwhile, the demand sentiments and estimates have once again taken a hit from the new COVID-19 strain emerging across the United kingdom.

To Know More, Do Read: New COVID-19 Mutation Fears Hit Crude Oil Prices Once Again

However, oil prices are now anticipated by many industry experts to eventually recover ahead, but once again the understanding of the demand and supply equation would help the market participants to better gauge the direction this year.

To Know More, Do Read: Crude at Crossroads After Surpassing USD 50 Hurdle

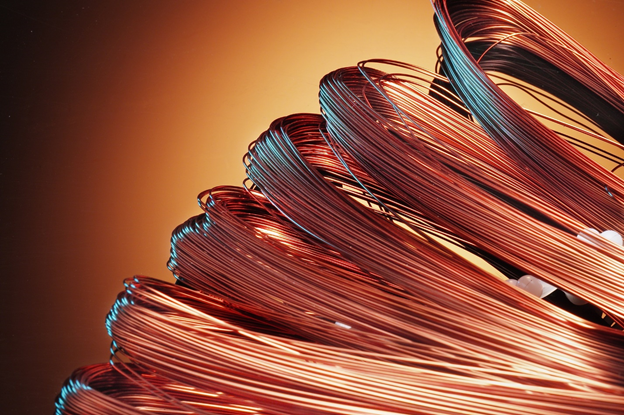

Base Metals Spree

Image Source: Megapixl

Coming to the second hardest-hit commodity of the year – base metals. They nosedived just like other consumption-based commodities at the beginning of the March 2020 quarter. However, as the mining activities gradually halted due to travel restrictions on a global front, base metals started recovering with some such as copper even reaching a record high over the supply shortage.

To Know More, Do Read: Copper Tops USD 8,000, Commodity Supercycle at Play?

Apart from that, the ongoing efforts to meet the Paris Accord plans are also shaping the base metals market and is expected to continue to do so in the future. And, until we see a major recovery in mining operations, the average price might remain high.

To Know More, Do Read: Before his White House departure, Trump has a spree of mining, energy project approvals

Precious Metals Front

While we discussed in detail about commodities reacting on the negative side over the COVID-19 outbreak, precious metals segment remained one of the superior performers of the year with gold reaching a record high and silver clinching a multi-period high.

The rally in gold was well supported by a massive capital influx in the safe haven through global gold-backed ETFs and large institutional and central banks purchases.

To Know More, Do Read: Australian Gold-Backed ETFs – Massive Capital Influx, Impeccable Performance, And Record Values

While the price rally in these commodities is taking a breather, many industry experts anticipate that the average price could increase amid low-interest rate environment and application of silver in solar panels.

Also Read: Gold Supply Disruptions and Paradigm Shift in Gold Miners’ Business Strategy

Commodity Crown Jewel for 2020 - Iron Ore

Image Source: © Kalkine Group 2020

Moving ahead, the year 2020 has been a wonderful period of some commodities like iron ore, which has rallied to record highs time-after-time in the wake of global supply deficit and increased demand from the Chinese steel industry, which aimed to capture a large tranche of the global steel market in the wake of diminishing competition amidst COVID-19.

To Know More, Do Read: China Poised to Grab the Global Steel Trade as Economies Open up for Trade

The rally in iron ore has further gained momentum over the supply shock delivered by the Brazilian giant – Vale and temporary suspension of exports from Port Hedland on account of disruptions caused by a tropical cyclone.

However, while this supply lag is anticipated to support the price near the short-term ahead, the supply is eventually anticipated to normalise, and much of the future move of the commodity would be dictated by the demand stemming from China.

To Know More, Do Read: Iron ore jolts another record high, is there more steam left in the rally?