Iron ore prices are once again capturing the attention as the prices spike to another record high over supply concerns and robust demand from China. The commodity clinched RMB 1,194.00 per dry metric tonne on the Dalian Commodity Exchange (DCE) on 21 December 2020.

Image Source: © Kalkine Group 2020

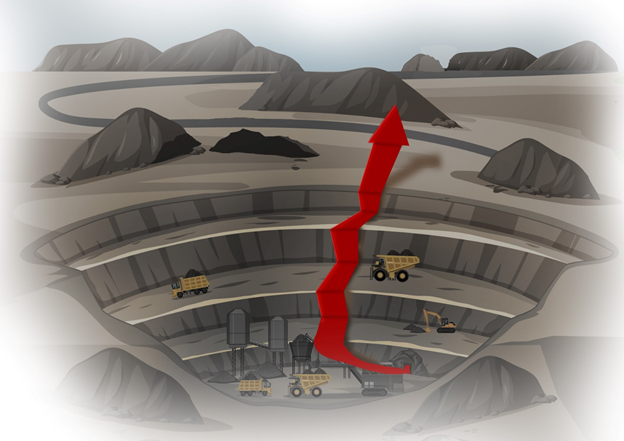

The surge in iron ore prices are well supported by the supply lag and increasing steel production across China. Two events which have considerably concerned steelmakers and investors are the Vale supply shock and cyclone warning around Pilbara region.

To Know More, Do Read: Vale Output Shock, Chinese Demand- Thrust Iron Ore Prices to New highs

The cyclone warning has further ignited the rally.

In the recent past, Ports Authorities at Pilbara started to clear large vessels out of Port Hedland over the tropical cyclone near Christmas island as it was expected to bring gale-force and swell, ultimately leading to the closure of exports from Port Hedland.

The dented supply from the Australian port and Brazil has reduced port stocks across China, pushing iron ore prices to record high.

Image Source: © Kalkine Group 2020

At present, the port stocks across China continues to decline, which coupled with a strong demand over rising steel product prices is ballooning the commodity to unprecedented levels across China.

For the week ended 18 December 2020, iron ore port stocks across China further declined by 0.34 million metric tonnes to stand at 115.94 million metric tonnes. Likewise, the steel inventory for the same period also shrank by 0.32 million tonnes to stand at 10.33 million tonnes.

The iron ore futures on DCE are gaining upside volatility after witnessing an accelerating uptrend over the supply shortage.

DCE Iron Ore Futures Continuation Daily Chart (Source: Refinitiv Eikon Thomson Reuters)

On following the daily price action, it could be seen that the commodity is currently trading above the 50- and 200-day exponential moving averages over extreme bullish sentiments. Furthermore, iron ore prices gave a volatility breakout with prices crossing the +2 Standard Deviation of the 20-day simple Bollinger Band®.

Post the volatility breakout, the commodity has been trading close to the upper band of the Bollinger Band®, suggesting that current sentiments are extremely bullish.

If the current rally sustains, it could further attract more bullish sentiments.

The primary support for the commodity is at the upper band, followed by the mean value of the Bollinger Band®, which is also overlapping with the horizontal support level (RMB 1,008.20); therefore, could be decisive in nature.

A majority of technical indicators are currently moving in tandem with the price action, confirming the prevailing bullish sentiments.

For example, OBV is spiking in tandem with price, reflecting large participation in terms of volume; and the ATR is also sloping up over increased volatility.

Furthermore, the plus DI is currently trading above minus DI, confirming that the major volatility over the past 14-day is towards upside; as expected, the commodity is trading close to the upper band for quite some time.

.jpg)