The hottest commodity of the year 2020, i.e., iron ore is getting even hotter with prices climbing towards the all-time high. Iron ore future prices across China rose to RMB 993.00 per dry metric tonnes (as on 7 December 2020), just a unit down against the all-time high of RMB 994.00 per dry metric tonnes.

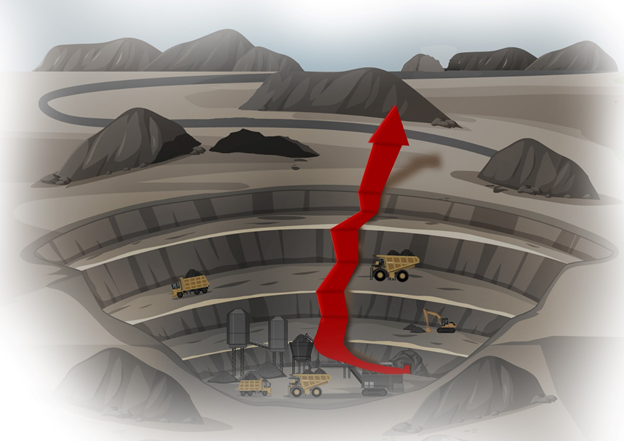

Image Source: © Kalkine Group 2020

Likewise, the price of the steelmaking commodity soared to a multi-period high and a fresh 52-week high with iron ore futures across the Chicago Mercantile Exchange (CME) soaring to USD 145.04 per dry metric tonnes.

However, iron ore prices slightly corrected with January 2021 futures settling RMB 958.50 per dry metric tonnes yesterday.

Vale Supply Shock Triggered The Rally

Boosted by the news that the Brazilian iron ore behemoth – Vale fell short of its production guidance for the year 2020, the commodity skyrocketed across the global front.

Recently, Vale announced that the Company is anticipating a production of 300 to 305 million tonnes in 2020, which was down against the previous estimation of at least 310 million tonnes of production. Apart from a reduced output for the current year, the estimation for the following year also helped to lift the iron ore bulls’ sentiment. In its announcement, Vale suggested that the iron ore production for 2021 is expected to fall in the range of 315 to 335 million tonnes, which was below the market estimation and further aided in firming up of the iron ore price.

Image Source: © Kalkine Group 2020

Along with the disappointing output numbers from Vale, a spike in demand from China also added further fuel to iron ore’s blistering rally in the recent past. In China, robust demand for the commodity coupled with supply shortage is lifting quotes on iron ore futures, keeping the price rally buoyant.

Supply Narrows Across China

The lower production estimates and ultimately the supply squeeze now finally unfolding with many major ports across China witnessing inventory shortfall.

As per the recent data disclosed by a China’s primary research house, a total of 82 vessels carrying 13.15 million metric tonnes of iron ore arrived across 35 significant Chinese ports entered between 29 November 2020 to 5 December 2020.

The shipment entered during the period remained 1.48 million metric tonnes lower against the previously reported period.

Opportunity Surfacing for Australian Miners

As a low-cost producer of the commodity, the domestic supply is anticipated by many industry experts to adjust for the Chinese demand, and a volume pullback is unlikely to emerge ahead.

Furthermore, considering the recent surge in the exploration expenditure across iron ore projects, it could be projected that the domestic supply might increase ahead, taking advantage of the high price scenario.

The iron ore exploration for 2019-20 reached $361.3 million, highest annual total since 2014-2015 while soaring 31 per cent on a quarterly basis in June 2020 quarter, which also remained 44 per cent up through the year.

Moreover, new domestic supply is soon anticipated to hit the market over increased exploration expenditure and reaching production timeline for many projects across the continent.

Image Source: © Kalkine Group 2020

For example, projects like South Flank and Eliwana by the ASX-listed iron ore giant BHP Group Limited (ASX:BHP) and the emerging hot shot – Fortescue Metals Group Limited (ASX:FMG), in the Pilbara region is anticipated to commence production from next year.

With many iron ore related projects going into production, the Australian export capacity is also estimated to surge ahead.

To Know More, Do Read: Iron Ore Resurgence and Improved Rating for ASX Miners, Goldman Upgrades BHP Shares