Highlights

- Low interest rates may have an impact on our daily lives and the economy at large.

- Low interest rates are both favourable and harmful for the economy.

- They promote economic recovery by increasing consumption, spending, borrowing, and growth. On the other hand, if demand surpasses supply, it could lead to inflation.

Interest rates heavily influence the overall economic activity of a country. Moreover, when interest rates vary, they significantly impact financial markets, asset markets, and investment markets.

We shall explore whether a low interest rate is good or destructive to the economy.

Related Article : China’s Economy Shrinks, Ending a Nearly Half-Century of Growth

What does the term "interest" mean?

The cost or return of borrowed money is referred to as interest. If you get a bank loan, for instance, interest is the cost of the loan. Likewise, the bank gives you interest if you deposit money in a savings account.

Related Article: Which Australian state has the strongest economy?

How low interest rates affect the economy?

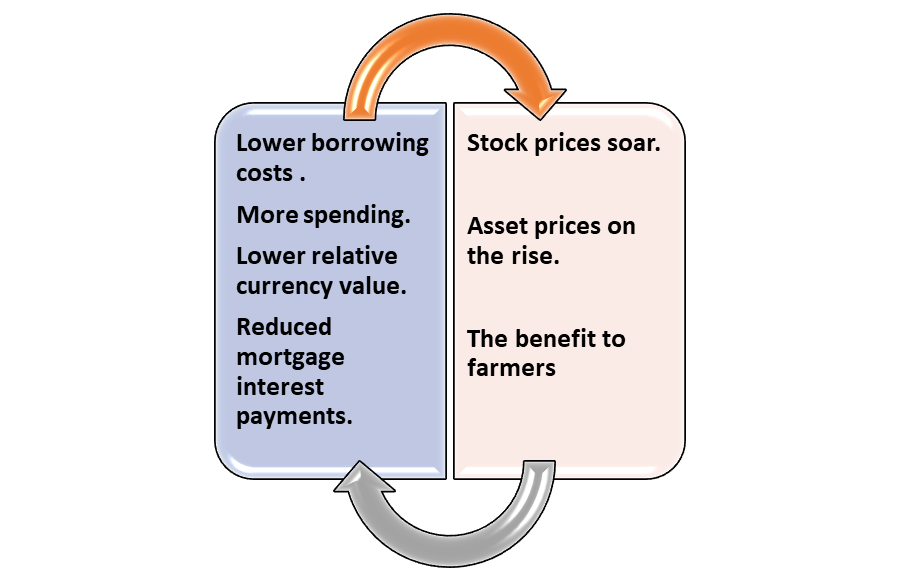

Lower borrowing costs and Increased spending: Why would interest rates not be kept low all the time? Borrowing becomes much more affordable when interest rates drop. It tends to boost spending and investment. As a result, aggregate demand (AD) rises, and the economy expands. However, this leads to inflation. When there is an excess of liquidity, demand outweighs supply, and prices go up.

Source: Copyright © 2021 Kalkine Media

Lower relative currency value – Decreased interest rates make foreign investors less interested, resulting in a lower relative currency value.

Reduced mortgage interest payments: A reduction in interest rates lowers the monthly cost of mortgage payments. As a result, households will have more disposable income, causing consumer spending to rise.

Stock prices soar: When savers realise that they receive less return on their savings, they may start spending more. They may also engage in slightly riskier but more profitable investments, causing stock values to rise.

Asset prices on the rise: Lower interest rates make purchasing assets like housing and vehicles more appealing. This will result in higher property prices and, as a result, an increase in wealth.

The benefit to farmers: Farmers gain from lower interest rates because the low cost of borrowing encourages them to make significant equipment purchases.

What happens when interest rates are high?

In case of high interest rates, it is vice versa as it increases the cost of borrowing, encouraging more individuals to save their hard-earned money.

If customers are unwilling to spend more money on goods, demand will diminish, and companies will sell fewer items. As a result, high interest rates may cause the economy to shrink. It may also turn into a recession if it goes too far.

Related Article: Australia's Tech Advantage: How is Technology Transforming Businesses and Economy?

Bottom line

Low interest rates are both favourable and harmful for the economy. They promote economic recovery by increasing consumption, spending, borrowing, and growth. On the other hand, if demand surpasses supply, it could lead to inflation.